How Southwest Power Pool Sets Renewable Records Daily

By: Tyler Stoff

April 8, 2021

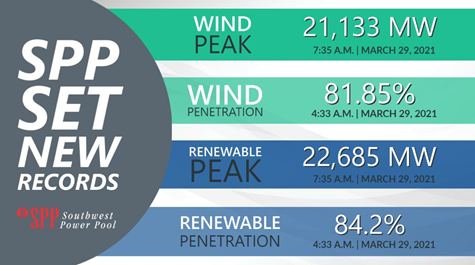

On March 9, 2021, the Southwest Power Pool (SPP) – a wholesale power market that manages a real-time energy market in 14 states across the Central U.S. – set a new record for renewable penetration, with 80.3% of its electricity coming from renewables. Five days later, SPP broke that record and reached 81.4% renewable penetration. Before the month was out, SPP bested itself yet again with 84.2% renewable penetration on March 29.

What makes SPP so successful at integrating renewable energy? To find out, the American Council on Renewable Energy (ACORE) hosted SPP President and CEO Barbara Sugg on March 26 for a member webinar moderated by ACORE President and CEO Greg Wetstone. In her remarks, Sugg identified four key factors in SPP’s recent success.

First, with 104 members and a market that clears $20 billion in transactions a year, SPP’s large consolidated balancing authority takes advantage of its scale to match the many sellers of renewable power with a broad footprint of buyers.

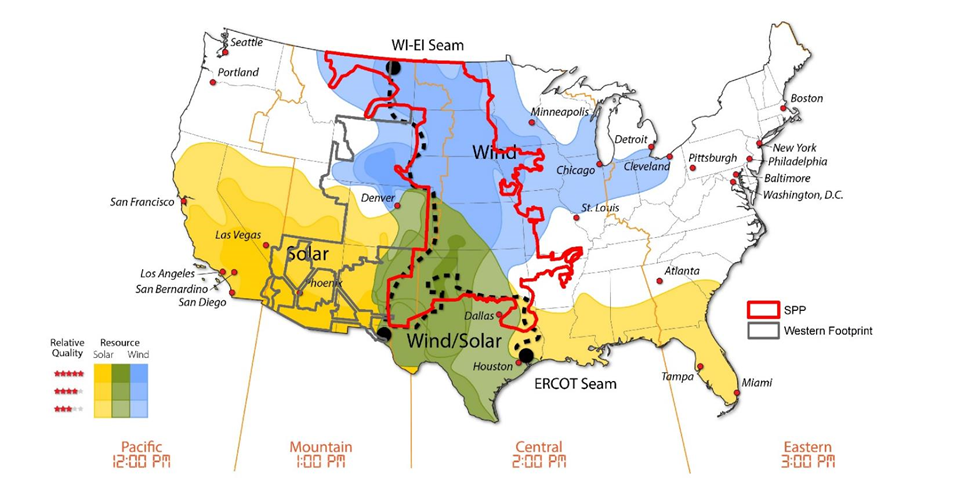

Second, SPP sits at the crossroads of the nation’s highest wind and solar resources. There are few better geographic configurations for a power market, with consistently high wind resources across the plains in SPP’s north and reliable solar resources in SPP’s south. “Pictures tell a thousand words,” said Sugg in pointing to the region’s blessings.

Third, SPP has a robust transmission infrastructure that allows renewable energy to be sent long distances, from wherever the wind is blowing or the sun is shining to consumers that may be more than a thousand miles away.

Fourth, SPP enjoys a robust day-ahead and real-time energy market. The real-time energy market sets the price of electricity through transactions that occur every five minutes, while the day-ahead market allows participants to secure financially binding prices the day before delivery to hedge against price volatility. In what is sure to make any economist happy, Sugg noted that SPP’s prices have declined as its footprint has grown, and it has offered new market products.

SPP began during World War II, when the electricity needed for Arkansas steel production suddenly exceeded the state’s supply and regional power providers needed to band together to “pool” their resources. SPP has since grown from an informal power pool to one of the nation’s six federally regulated wholesale power markets. Its latest expansion made it the first market operator to bridge the Eastern and Western Interconnections, the two largest grid units in the U.S. This tremendous growth created the irony that “Southwest Power Pool” is technically speaking neither in the Southwest nor a power pool ― but that hasn’t stopped its renewable progress.

However, challenges lie ahead for SPP because 80% renewable is not 100% renewable ― and even those ever-more-frequent periods of high renewable penetration continue to rely on some degree of fossil generation. Wind and solar projects are sitting in SPP’s interconnection queue, waiting to connect to a system originally designed for fossil power. Sugg acknowledged the need to reduce the interconnection backlog and highlighted a new effort to overhaul the process with stakeholder recommendations expected in the coming months. More connections are definitely needed ― both physically through new transmission capacity, and administratively through further cooperation with wholesale power market Midcontinent Independent System Operator (MISO) to the east and non-market states to the west.

Transmission optimizes the market, and Sugg looks to a growing relationship with MISO as a key to smoothing seams issues on SPP’s eastern border. Noting the challenges in building interregional transmission, Sugg highlighted how MISO was able to use its existing capacity to help SPP during the February 2021 cold weather event, as power flowed across SPP’s lines from the Mid-Atlantic power market PJM to keep the lights on in SPP’s plains. SPP covers some of the coldest parts of the continental U.S. Still, its broad geographic reach, diverse mix of renewable energy and connections to its neighbors enabled SPP to better serve customers during the cold weather event than its isolated power market neighbor to the south, the Electric Reliability Council of Texas (ERCOT). Similarly, interregional transmission has enabled SPP’s electrons to flow into MISO during recent hurricane seasons.

Sugg also discussed SPP’s recent launch of the Western Energy Imbalance Services (WEIS) market, wherein SPP runs a kind of proto-wholesale power market in parts of the Mountain West and desert Southwest that enables local load-serving entities to trade excess power. Occasionally, it has been so windy in SPP that the market operator has had to curtail wind resources absent ready buyers. As more and more states in the SPP footprint look to renewable energy to meet their environmental goals, transmission is key to moving SPP’s low-cost wind and solar bounty toward new demand. ACORE has highlighted interregional transmission’s role in delivering America’s clean energy future through its Macro Grid Initiative.

California wholesale power market CAISO recently set its own records for 80+% renewable energy penetration, giving SPP some healthy competition. Yet in this race of renewable record-breakers, there are no losers. Consumers win as zero-marginal-cost generators drive down the price of electricity. Wholesale power markets win as free-market principles are validated. And the environment wins as carbon-free electricity reduces air pollution and supports a healthy climate.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)