- Energy Storage & Decarbonization Pathways

- Grid Infrastructure

- Project Finance

- Tax Incentives & Appropriations

- Blog

How Power Market Structures are Driving Demand for Energy Storage Investment

[vc_row][vc_column][vc_empty_space height=”30px”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]On March 19, ACORE hosted an invite-only, executive meeting in Washington, D.C. to discuss evolving business models for energy storage and hybrid projects. Participants in the event, Aligning Market Incentives to Facilitate Financing and Deployment of Energy Storage, ranged from senior-level financiers to corporate offtakers, utilities, developers and wholesale markets.

MISO, ERCOT, PJM and Grid Strategies kicked off the meeting with a first panel discussion on the development of new battery storage incentives through power market structures. The second panel, with representatives from Starwood Energy, GE, Engie and Covington & Burling, took an in-depth look at how market approaches are catalyzing financial innovation in energy storage. This blog details key takeaways from these discussions.

Power Markets are Adapting

The battery storage industry is poised to see tremendous growth due to its declining cost and its ability to tap into several revenue streams. In response to investor demand, Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs) are assessing new market proposals to allow battery storage assets to participate in power markets. Pressure from the Federal Energy Regulatory Commission (FERC) has accelerated this process through Order No. 841, which was issued on Feb. 15, 2018, and aims to remove participation barriers in wholesale and retail markets for energy storage resources. In Q1 of 2019, all six grid operators submitted proposals to FERC shedding light on current market developments. A recent report from RTO Insider reveals key FERC revisions to the ISO/RTO proposals. Some of these revisions include:

- MISO – Redefine Phased Participation: FERC has asked MISO to clarify how it will handle the participation of a large number of small battery units (100 kilowatts) via a phased approach.

- ISO-NE – Energy vs Reserve Pricing: In 2018, FERC reviewed an ISO-NE request to incorporate energy storage into its energy, capacity and ancillary services markets. Under Order 841 revisions, FERC requested ISO-NE to define the pricing mechanisms and lost opportunity costs for storage units switching from energy to reverse markets.

- CAISO -The grid operator has currently developed three different participation models – demand response, non-generator resources and pumped hydro. FERC questioned compliance orders with all three models and inquired about the integration of storage into the ISO’s backstop capacity procurement mechanism.

- NYISO – Last year, New York set a battery storage goal of 3,000 MW by 2025. The commission has asked NYISO to elaborate on order compliance with its Dispatch-Only Model.

- PJM – FERC addressed several issues around PJM’s pump-storage compliance and its ten-hour energy supply requirements.

- SPP – Clarify Continuous Run Time Requirements for Load Serving Entities: The commission wants SPP to pursue a clear definition of “continuous run time requirements” before allowing battery storage to function as a capacity/resource adequacy unit.

Grid operators will have until the end of 2019 to comply with FERC Order No. 841.

Despite FERC’s initiative to further develop the market, the panelists agreed that Order No. 841 lacks the authority for a broader conversation. For example, ERCOT and vertically integrated utilities outside of regulated markets are not required to comply with FERC regulations. However, this doesn’t mean non-FERC entities are falling behind the curve. ERCOT, a leader in U.S. wind capacity, is actively exploring new market participation models. This has attracted the interest of investors looking to develop solar + storage projects. Yet, overarching questions still remain on how developers can couple storage with renewable energy projects without losing their place in interconnection queues.

Financial Innovation will Lead to Greater Deployment

According to the U.S. Energy Storage Monitor Q4 2018, battery storage will grow from 338 MW in 2018 to 3.9 GW by 2023. Strong forecasts, combined with a growing list of state and local incentives, have galvanized investors and developers to seek new forms of battery storage financing. Unfortunately, as the panelists at our executive meeting adeptly pointed out, what makes energy storage so complicated is a direct function of what makes the asset so useful. Energy storage is incredibly versatile. It can be coupled with renewables, provide grid management services, serve as behind-the-meter Virtual Power Plants, and used as a backup generator. But the relative value of these revenue streams is determined by the structure of the market in which it is deployed.

In America’s organized markets, battery storage can generate revenue in three different ways: reliability upgrades, service fees and arbitrage.

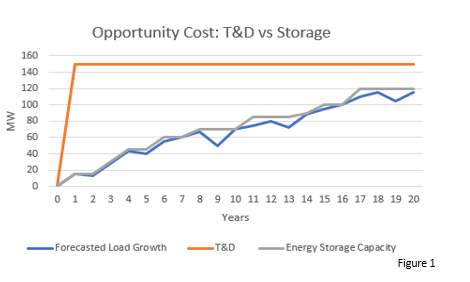

Reliability upgrades are essentially battery storage units that improve system reliability without the need for additional transmission investment. Traditionally, utilities have built large capital-intensive T&D projects with an oversupply of capacity. Battery storage can identify the marginal increase of electricity for a higher ROI than T&D investments (as seen in Figure 1). This can help utilities both maintain reliability and save

money.

Energy storage service fees refer to capacity and frequency response markets. Although there is tremendous potential in this area, these markets were developed to incentivize more traditional energy assets. Therefore, market rules are often unable to capture the full value of battery storage.

Finally, arbitrage pricing can benefit developers who are looking to enter directly into the energy market and profit from day-ahead and real-time prices. Unfortunately, in many situations, revenue streams from energy markets are unsuitable for in-front or behind-the-meter projects.

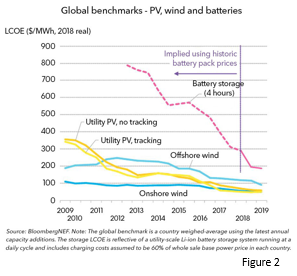

Despite these drawbacks, investors are moving forward. Similar to wind and solar, the cost of battery storage has plummeted in the last few years (see Figure 2). The record-low prices set by Xcel and NV Energy are indicative of where the market is headed. There is also movement on the legislative front. ACORE is part of a broad coalition urging Congress to enact an Energy Storage Tax Credit.

ACORE will continue to convene key stakeholders as part of our ongoing effort to catalyze greater deployment of energy storage technologies. Going forward, declining costs – along with smart federal policy and a clear power market structure – can help developers and investors bring the myriad benefits of energy storage technology to electricity markets as soon as possible.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)