Interview with Libby Bernick – Managing Director and Global Head of Trucost Corporate Business, S&P Global

In support of ACORE’s 1Tx2030 campaign, ACORE policy staffer Max Almono has begun to assess the role of “ESG” (Environment, Sustainability and Governance) scoring in driving renewable energy investment and procurement. To better understand the impact of ESG scoring on the renewable sector, Almono recently sat down with Libby Bernick, Managing Director and Global Head of Trucost Corporate Business for S&P Global to discuss how corporates, utilities, investors and project developers are utilizing ESG to foster renewable energy deployment and hedge against climate change risk.

In support of ACORE’s 1Tx2030 campaign, ACORE policy staffer Max Almono has begun to assess the role of “ESG” (Environment, Sustainability and Governance) scoring in driving renewable energy investment and procurement. To better understand the impact of ESG scoring on the renewable sector, Almono recently sat down with Libby Bernick, Managing Director and Global Head of Trucost Corporate Business for S&P Global to discuss how corporates, utilities, investors and project developers are utilizing ESG to foster renewable energy deployment and hedge against climate change risk.

Over the last decade, ESG investment has seen a remarkable rise. According to The Forum for Sustainable and Responsible Investment (SRI), more than 1 out of every 4 dollars under professional management in the United States in 2017 (approximately $12 trillion dollars) was invested in ESG-related funds. Why has the industry seen such a dramatic increase in investment?

Libby: Socially responsible portfolios and ESG investing are not new concepts for investors. The idea of aligning personal values with financial investments emerged years ago by screening companies based on certain values, like tobacco, weapons or gambling. Most recently, key divestment campaigns have focused on the fossil fuel-free movement. However, within the last three to five years in the United States, the underlying function of ESG investing has transitioned from personal values to financial value. There is increasing evidence that companies with a high ESG rating on material issues tend to demonstrate stronger financial performance than their sector peers.

We are witnessing an uptick in ESG investments due to growing client demands and key indicators that show a correlation between sustainability and financial performance. In fact, over the last few years, the market average annual growth rate has been 5%, while the average annual growth rate for ESG investing has been 12%. Investors see this as a tremendous opportunity and one that is not going away, given that $24 trillion will transfer from the baby boomers to the Gen X and millennial generations by 2020.

What advice would you give to investors and corporations who are just beginning their journey in ESG compliance and investing?

Libby: There are two criteria which every company and investor should address early on. The first is that each company should tell its own sustainability story – and not have a third party do it on its behalf. Every organization is unique and should outwardly define its principles and values. This is crucial. Second, companies should identify the type of information that is most material to their respective business. There are hundreds of ESG metrics that a company can disclose. However, this may dilute financial performance indicators. Instead, companies should focus on the most material metrics within their sector. For most stakeholders across the energy industry, this means analyzing things like energy use intensity, water use intensity, and GHG intensity. A few leading organizations such as SASB, Edison Electric Institute, and the Sustainable Stock Exchange Initiative have done an excellent job of identifying material indicators by sector. A company should also look at its own investors and understand the particular ESG issues that inform their investment strategy.

One of the most pressing issues in ESG investing is the lack of standardized reporting. Private scoring companies, credit rating agencies, stock indexes, and NGO initiatives all present different variations of ESG scoring methodologies. Do you see the industry eventually unifying under one generally accepted taxonomy?

Libby: I think in 2019 we’ll see an even greater convergence of the Three T’s: Terminology, Taxonomy, and Transparency. Currently, there are several regulatory and NGO efforts which focus on aligning stakeholder interests and methodologies. For instance, the EU’s Non-Financial Disclosure Directive helped accelerate market development and narrowed ESG disclosure methodology. The World Federation of Exchanges has also made significant contributions towards creating a standard taxonomy with its guidance for companies that are listed on global exchanges. Finally, at the non-profit level, organizations like GRI, SASB, CDP, and IIRC are beginning to harmonize their ESG terminology.

However, it’s not unreasonable to assume that ESG scoring will never fully converge. In the financial services industry, there are hundreds of metrics which help investors gauge financial performance (e.g. EBITDA, P/E ratios, Revenue Growth, etc). There will always be different lenses that different stakeholders use to assess ESG performance. Therefore, we shouldn’t assume that ESG investing will have one generally accepted practice.

Does the Task Force on Climate-related Financial Disclosure (TCFD) help address the convergence of the Three Ts?

Libby: S&P Global supports the TCFD framework, and we were part of the original task force to develop TCFD guidelines. The disclosure methodology has done an excellent job of linking environmental risk with financial performance. This is crucial because it allows different divisions of a company (e.g. procurement group, product strategy, data center engineers) to speak the same language. TCFD connects physical risk (e.g. vulnerability to hurricanes, floods, etc.) and transition risk (e.g. carbon tax, technology shifts) to financial performance. This is an important step in standardizing terminology, taxonomy and transparency.

There is a collective frustration within the renewable energy community that the nature of the E valuations within ESG will, at best, only calculate the operational carbon footprint of a company and therefore ignores other important aspects. For example, if your company builds or finances renewable energy, there is a perception that you will not necessarily get credit for the positive downstream impact of your business activities. This problem could be especially acute if your business activities happen to take the form of a non-controlling investment. What is the most appropriate way to reflect the positive downstream impacts of a company’s business activities, and how can that impact be properly reflected if a company’s activities sometimes take the form of a non-controlling investment? Will this lead to new disclosure methodologies?

Libby: This is an issue we’ve been grappling with for some time. S&P Global (Trucost) believes the ESG industry needs to focus on financially material and forward-looking data which aligns with a two degrees scenario and the U.N. Sustainable Development Goals. Traditional ESG scoring can be subjective and opaque. One way Trucost attempts to cut through this is by quantifying companies’ performance based on their climate impact. For instance, our Green-Brown Revenue Share Charts analyze extractive and utility companies by allocating their revenue into two categories – climate solutions and climate aggravators (see sample Green-Brown Revenue Share Charts below).

ESG data and analytics should focus on future-oriented information, which is most correlated with financial performance. Therefore, companies who own or finance low-carbon solutions should be recognized for this.

Sample Green-Brown Revenue Share Charts:

As ESG evolves and becomes more sophisticated, what role will S&P Global (Trucost) play in advancing the market?

Libby: Trucost has been providing cutting-edge ESG data and analytics since 1999. Now, as part of S&P Global, we collectively view ESG as critical to long-term value creation for companies, investors, and other stakeholders in the market. Our customers have expressed an increased interest in and need for ESG information. They want data and benchmarks to run their own analyses and scenarios and to inform their capital allocation decisions. In fact, earlier this year, we launched a cross-divisional ESG Design Team to identify further strategic ESG opportunities, and coordinate market and product development across our divisions. We know that ESG insights are considered crucial to mitigating risk, uncovering a competitive edge and activating innovation. This approach will help solidify S&P Global’s position as a trusted provider.

In 2018, corporate offtakers procured over 8 GW of renewable energy, shattering the previous record. More companies than ever before have established 100% renewable energy commitments and are working with suppliers to decarbonize their value chains. Can you explain how this will impact their ESG scores?

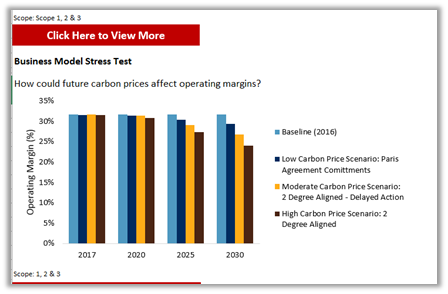

Libby: According to the World Bank, roughly 20% of global carbon emissions are priced. Some investors view this as an opportunity to invest in companies looking to reduce their Scope 1-3 emissions. For example, in July 2018, S&P Dow Jones Indices launched an index based off the S&P 500 related to carbon pricing earnings at risk – meaning the index favors companies with lower carbon emissions, for example, those that directly purchase renewable energy to manufacture goods and services. Simultaneously, GPIF, the world’s largest pension fund, launched a $10 billion index which favors companies with lower GHG emissions and better disclosure on energy use.

Banks are looking to invest in companies hedging against climate change risk throughout their supply chains. At Trucost, we calculate the elasticity of a product based off its carbon exposure. Therefore, companies who procure renewable energy and reduce carbon emissions across their supply chains can lower their carbon risk exposure, and subsequently increase their ESG score. We hope this will drive further demand for renewable energy (see sample Carbon Earnings at Risk Chart below).

Sample Trucost Carbon Earnings at Risk Chart:

ESG investing is most typically associated with the performance of public equity markets. How are debt markets and credit rating agencies shifting to incorporate ESG into their own valuations?

Libby: Mainstream adoption of ESG investing is still in its infancy. However, there is a strong parallel between the renewable energy industry and ESG investing. In 2018, corporate green bond issuances topped $247 billion, and sustainability-linked loans reached $36 billion globally. We estimate that corporate green bonds, most of which were for renewable energy, avoided roughly 1 billion metric tons of CO2 emissions.

Investors are increasingly aware of the potential impacts of ESG issues affecting lending. Over the past two years, S&P Global Ratings found environmental and climate concerns affected corporate ratings in 717 cases (10% of corporate credit ratings), resulting in a credit impact in 106 cases. Additionally, S&P Global Ratings found social rating criteria affected 346 cases, resulting in an impact in 42 cases. As new reports continue to emerge, investors are increasingly aware of the impacts of ESG within the debt markets.

Climate change poses systematic risks and opportunities to the global economy. If governments and institutions hope to achieve the Paris Agreement, renewable energy will remain a primary driver of economic decarbonization. Therefore, ACORE believes lenders, investors, developers, corporate offtakers, and utilities who invest in renewable energy should receive an appropriately weighted value in their ESG scores. Are there any specific scoring metrics which can help stakeholders align interests in the renewable energy industry?

Libby: In order to align interests between stakeholders in the renewable energy community, there needs to be a shift in ESG scoring. S&P Global believes there is a need for forward-looking data that can transparently and systematically align with global initiatives like the Paris Agreement. ESG scoring is often too subjective and lacks a general taxonomy where investors, lenders, and corporations can compare ratings in an apples-to-apples way. We believe that objective, science-based analysis around climate risk will provide better information that’s correlated to financial performance.

Join leaders from across the renewable energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)