Bridging Demand and Financing: Voluntary Offtake in Clean Energy

Introduction

The voluntary procurement of clean energy is critical for mitigating risks for project development and attracting investment. By providing a stable revenue source for solar, wind, energy storage, and other clean energy projects over a defined period, offtake agreements from corporations and other entities help to enable the financing required to construct new projects – expanding affordable, reliable, and clean power across the U.S. power grid.

Clean energy is advancing at its fastest pace in history, and corporate buyers are helping to drive that momentum. As the U.S. faces growing electricity needs and advances its global leadership in advanced technologies, corporate players have centered clean energy use as an important part of their operational growth.

This white paper explains how voluntary offtake agreements, particularly those signed by large corporations, enable clean energy projects to secure financing and addresses common misconceptions about their value. To understand how stakeholders view the role of voluntary offtake agreements in the market, ACORE conducted interviews with companies that are investing in, developing, and operating clean energy projects. The results of these interviews are presented in this paper.

OverviewOverview of Clean Energy Project Finance Structures

Like many large infrastructure projects, wind, solar, energy storage, and other clean energy projects rely on project financing for construction. Such projects tend to have higher upfront capital costs but limited operating costs.

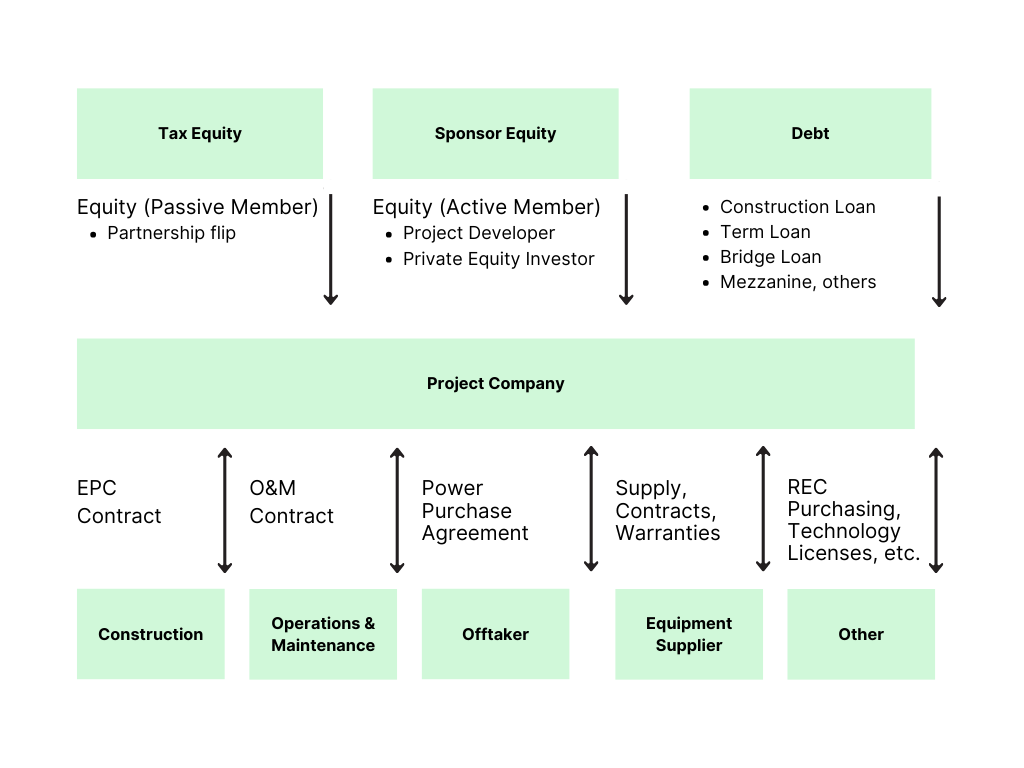

Project developers (or “project sponsors”) typically finance wind, solar, and energy storage projects by raising a combination of financing sources. Tax equity provides funding to take advantage of the tax benefits and receive cash flows from the project. Debt financing involves loans raised by the project sponsor during the development period, construction period, and/or after the project is placed in service. The project sponsor can also raise additional cash equity from other institutional investors.

Long-term offtake agreements drive demand for clean energy and are a key ingredient enabling project financing and development, as noted by the investors interviewed for this paper.1 Clean energy projects do not typically secure critical sources of project financing, like tax equity, until a power purchase agreement (PPA) with a creditworthy offtaker is signed. As discussed in the next section, corporate offtakers, in particular, help projects clear this substantial financing hurdle in the project development process.

Figure 1: Typical Project Finance Structure

The Role of Corporate Power Purchase Agreements:

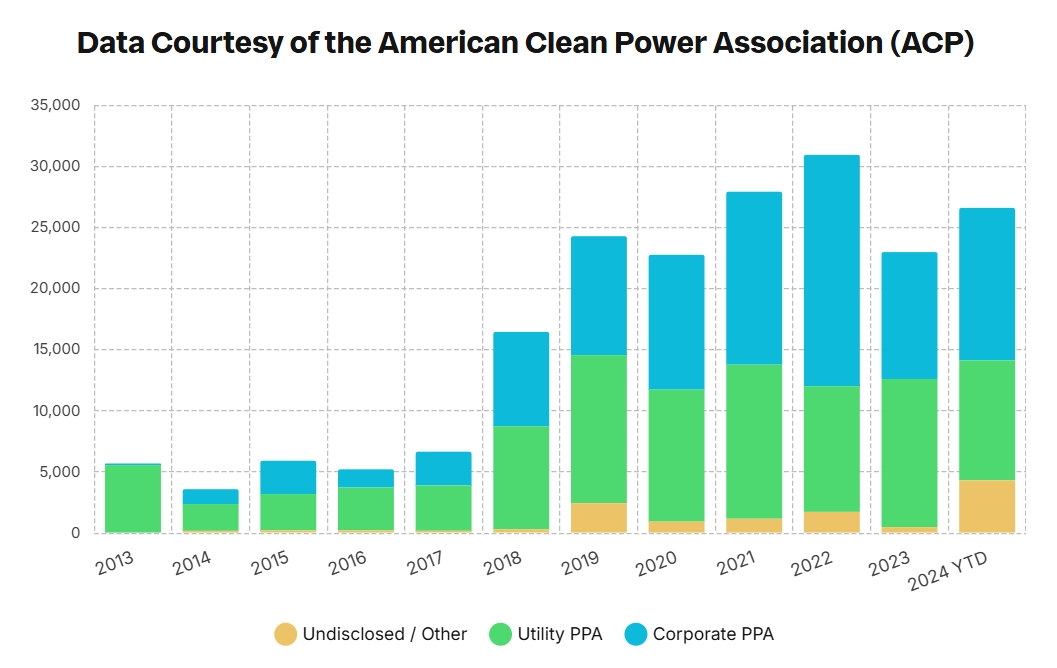

Power purchase agreements (PPAs) are long-term contracts that involve payment from a buyer (or “offtaker”) to the operator of a clean energy project (or “power generator”) and typically range from 10-20 years. Offtakers enter into PPAs for either compliance or voluntary purposes: most electric utilities and other load serving entities that sign PPAs do so to comply with state clean energy standards or procurement requirements, whereas many corporates enter PPAs voluntarily to meet their internal sustainability goals. Since the beginning of 2021, corporates have procured over 55 gigawatts (GW) of clean energy through PPAs, which represents approximately half of the overall demand for utility-scale wind, solar, and energy storage projects (see Figure 2).2

Within the voluntary PPA landscape, contracts come in different varieties, and each option plays a role in the overall advancement of the clean energy sector. Physical PPAs, also known as busbar PPAs, are associated with clean electricity that is physically delivered to the buyer and priced at a certain location within the energy market. In this case, the energy itself is bundled with renewable energy credits (RECs), which substantiate the non-power attributes of renewable electricity use.

Figure 2: Clean Energy Purchase Agreement Announcements3

An alternative pathway for corporate offtake is a virtual power purchase agreement (vPPA), a financial contract under which the electricity is not physically delivered to the offtaker’s facilities. vPPAs are especially valuable tools for companies that operate in regions where clean energy development is limited due to resource availability or by local barriers, or if they have geographically dispersed facilities.4

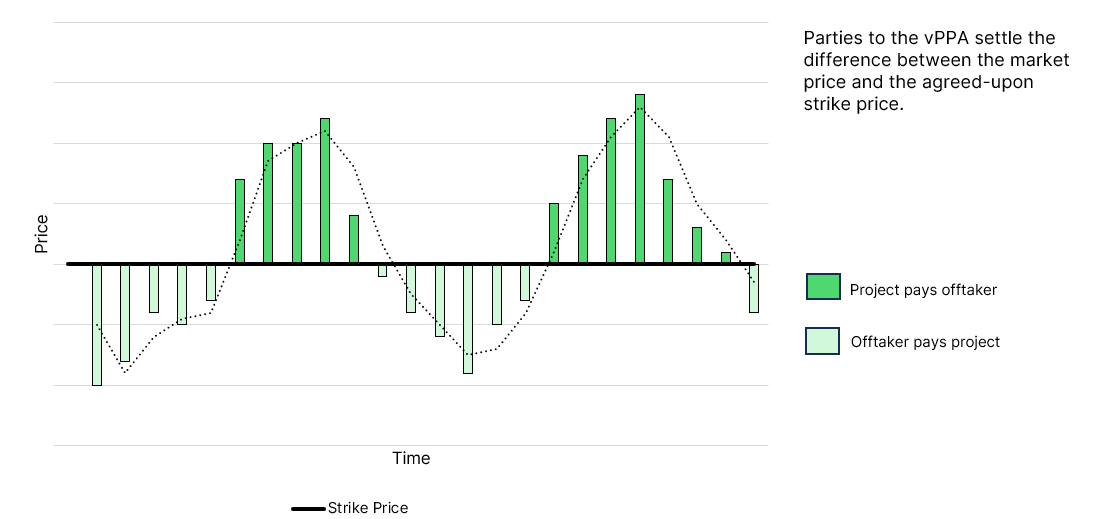

Although contracts can be structured in different ways, vPPAs can in part function as a hedge against wholesale electricity prices.5 Generally, projects continue to sell electricity directly into the power markets in which they are located, where prices fluctuate. As with a physical PPA, under a vPPA, the power generator and the offtaker typically agree on a fixed strike price per megawatt hour (MWh) of electricity generation. The vPPA pricing functions like a contract for difference (CFD), whereby the power generator is guaranteed to receive the strike price for the power they produce over the life of the contract, avoiding the risks of selling electricity into the market at times of low power prices. If the market price is lower than the strike price, the offtaker owes the difference to the power generator. If the electricity price is above the strike price, the power generator makes a payment to the offtaker for the excess amount (see Figure 3).

The corporate buyer also receives the associated RECs for the power produced, which they use to calculate their company’s Scope 2 greenhouse gas (GHG) emissions (i.e., indirect emissions from the generation of purchased energy). Corporate PPAs would not occur without RECs, and demand for RECs directly drives demand for PPAs. Corporate buyers are not traditionally in the business of power procurement and would not enter long-term contracts without receiving RECs.6

Figure 3: vPPA Settlement with Strike Price

This dynamic has sparked criticism from some commentators, who state that vPPAs are ineffective for stimulating demand for new clean energy. However, many arguments against vPPAs understate the realities that project sponsors face when attracting investment and selling electricity, and thus the role such contracts play bringing clean energy projects online across the country. The next section explores three claims that underpin criticisms of vPPAs and provides a different perspective on how vPPAs advance clean energy in the U.S.

Fact Checking ClaimsFact Checking Claims about Corporate Offtake

Claim: Now that wind and solar are often the least expensive forms of new energy generation, PPAs are unnecessary to drive additional deployment to the grid.

Fact: Most new wind, solar, and other clean energy projects require a PPA in place with a creditworthy offtaker to advance through development and would not be placed in service without one. Notably, only 6% of new renewable energy capacity built in 2023 had no offtake agreement in place.7

Onshore wind and utility-scale solar are now, on average, the cheapest forms of new electricity generation on an unsubsidized, levelized cost of electricity (LCOE) basis.8 These low costs could lead to the conclusion that project economics for solar and wind projects are sufficiently strong that having a PPA does not provide an “additionality” benefit, i.e., long-term contracts are not required for new projects to be developed because wind and solar are inexpensive. However, while the average cost to operate an onshore wind or utility-scale solar project over its lifetime is lower than that of other sources of electricity generation,9 project sponsors are typically unable to fund their upfront construction costs without external financing sources (debt, tax equity, and cash equity). As described earlier, projects that fail to secure an offtake contract often do not obtain financing on the terms needed to bring the project to fruition.

Furthermore, energy market revenues for clean energy projects tend to trend downward as wind and solar energy sources increase penetration on the grid.10 For instance, as more solar comes online in one region, each merchant solar project will on average receive a lower payment for its electricity generation when the sun is shining, as the plethora of competing solar projects drive the price down. In such markets, increasing wind and solar penetration will lead to depressed prices, making projects riskier for investors in the absence of long-term offtake.11 Corporate offtake agreements secure a stable contracted price, insulating the project from the effects of decreased market revenues, thereby lowering risks, and enhancing bankability. Financiers understand this dynamic well and are hesitant to provide debt or tax equity financing if the project is likely to earn decreasing revenues while the investment is still active.

Beyond long-term offtake, secondary REC markets that exist alongside vPPAs serve an important role in the economics of clean energy projects. One clean energy company commented on the importance of this market, saying that “it is very important that unbundled REC markets remain liquid because they are fundamental for all transactions, including new and existing projects.”12 These markets play a variety of roles for clean energy projects, including as hedges and gap-fillers after PPAs expire, enabling projects to stay online. As one project finance expert put it, “we don’t want to just build these plants, we want them to operate for as long as possible.”13 For more information on the importance of REC markets, please see ACORE’s blog post from January 2024.

Additionality is not a binary topic. It’s not just ‘is it additional?’ or ‘is it not additional?’ because it’s really hard to tell. We think it’s important to look at, but it’s something that should be [considered] on a gradient scale.

– Private Equity Investor

Claim: Corporate vPPAs primarily function as an additional revenue source for project developers by monetizing RECs.

Fact: vPPAs are critical for attracting external investors in clean energy projects, which is necessary for their development. In particular, the risk mitigation that vPPAs provide is an important enabler for tax equity, cash equity, and debt.15

Financiers evaluate the risks of the projects they underwrite and incorporate those risks into the rates and terms they offer to projects. If a project is fully merchant, meaning that the project will sell all its energy into the market at the locational marginal clearing price, financiers will demand a higher return on average to compensate for the risk of fluctuating market clearing prices. Wind and solar projects are “price takers” in wholesale electricity markets, where the clearing price is set by the last marginal unit needed to match supply – typically a higher fuel cost generator, such as a natural gas plant. Units set their bid price at their marginal costs, and as wind and solar projects have negligible marginal costs, which means in practice that the revenues or resources without a contract can be volatile. During periods where all or most of the energy in the market is supplied by wind and solar energy, the project could earn close to $0/MWh, whereas when the price is set by natural gas, nuclear, or coal, the project will earn higher revenue.

One industry player that both develops and finances clean energy projects commented on this dynamic, stating that “financing markets still generally follow the concept that volatility presents risk, and higher risk has a higher cost. With a long-term PPA, you’re able to mitigate the risk of volatile power prices, and banks will offer you lower overall interest rates as a result.” This is critical for most projects to attain the financing that they need, and this company shared that fully merchant projects are uncommon and only possible under specific circumstances.

Many wind and solar-rich states in the U.S. are in regions where there is no capacity market, making corporate offtake a critical pathway for projects to achieve compensation that reflects the full resource adequacy value they bring. Where capacity markets do exist, they are also subject to frequent rule changes and price volatility.16 As with energy markets, corporate offtake helps mitigate the uncertainty in how much revenue a project will earn in capacity auctions, making financing cheaper and more attainable.

Long-term PPAs, whether physical or virtual, play a key role in de-risking projects, enabling financing at lower rates. By obtaining a long-term agreement, a project becomes significantly more likely to get the financing it needs and begin producing clean power for the grid. Lenders and investors are typically risk-averse and price in the costs of the volatility of merchant projects, negotiating rates that make many projects uneconomical. Corporate offtake agreements help mitigate the uncertainty inherent in these market dynamics by providing a stable price for the generated electricity, making them much more attractive to risk-averse lenders. This allows for a lower rate from investors, lowering the break-even threshold for projects, allowing more to proceed past the Final Investment Decision (FID).

We value the presence of long-term offtake agreements from creditworthy counterparties for project financings, given that project finance markets don’t adequately price in the potential risks associated with merchant price volatility. It is also critical in any underwriting to analyze potential swings in cash flow available for debt service (CFADS) from other aspects of a transaction for example, annual property and casualty (P&C) insurance expense, basis risk for financially settled contracts or simply energy generation risk be it from weather or technology. Removing one potential element for reduction to CFADS by mitigating the volatility of energy revenues via long-term credit worthy offtake is crucial in our underwriting thesis.

– Equity and Debt Capital Provider

Prior to the passage of the Inflation Reduction Act of 2022, the only method for projects to monetize the tax credits they generated was through traditional tax equity. Tax equity investments have been historically low risk, allowing for cheap financing of wind and solar projects that enabled the technologies to grow rapidly and become pillars of the U.S. energy system. A key factor in making any tax equity investment low risk is the presence of a long-term offtaker. While the IRA established transferability as a new method of monetizing tax credits and opened the door for hybrid transferability-tax equity deals, the importance of tax equity and long-term offtake agreements has not diminished. For more information about tax equity, please see ACORE’s white paper from December 2023.

Claim: Due to higher clean energy deployment to comply with state requirements, voluntary corporate procurement is no longer necessary to achieve the benefits of additional clean energy.

Fact: While compliance with state-level renewable portfolio standard (RPS) and clean energy standard (CES) policies are important drivers of new clean energy projects, they are insufficient to drive growth at the speed required to meet rapidly increasing electricity demand and achieve power sector decarbonization.

Utilities and corporates both serve as critical long-term offtakers for clean energy projects. Having both options available vastly expands the market for clean energy development. State RPS and CES policies – which specify a minimum percentage of power sold by electric service providers that must come from a specified list of clean energy sources – have spurred utilities and retail providers to procure more clean power in the regions in which they operate. However, clean energy growth has far outpaced the levels specified in state-level RPSs and CESs. Only 35% of all new renewable capacity additions in 2023 were associated with these standards, leaving a critical role for voluntary procurement in advancing deployment.18 Demand from corporates has helped accelerate the growth of clean energy beyond these legal requirements and represents approximately half of the demand for PPAs.

While 29 states and the District of Columbia have CES or RPS policies in place, varying in stringency, 21 states have no binding requirements for clean energy procurement, and many of these states are home to rich renewable resources. In these markets, vPPAs from corporates with facilities in other regions are helping the U.S. spur economic activity in regions that would be slower in the uptake of clean energy technologies.

Voluntary offtake complements state-level RPSs and CESs. One U.S. developer discussed the role that corporates have in expanding deployment beyond the state-level requirements, stating that:

Corporate decarbonization goals are driving multi-gigawatt growth of vPPAs across the U.S. in deregulated markets, including areas with some of the most carbon-intensive grids. Corporates are also driving green tariffs and sleeved-utility PPAs in regulated markets, enabling more renewable power to come online beyond what’s driven by state-mandated RPS goals. These trends are expected to accelerate through 2030 as corporations seek to achieve clean energy goals and as demand from tech companies continues to ramp up with unprecedented data center load growth.

– Clean Energy Developer

Conclusion

Corporate offtake helps to mitigate market volatility and reduce the cost of clean energy project financing by stabilizing cash flows and driving the deployment of affordable, reliable, and clean power. As the debate over how to harness corporate investment most effectively into community and climate benefits continues, the role that corporate PPAs play in driving additional projects onto the grid should not be overlooked.

Having clear, consistent standards that allow corporates to commit to renewable projects in advance of construction through vPPAs, green tariffs, sleeved PPAs, and REC agreements will allow renewable project developers to have certainty that our development projects will be valued by corporates, who represent a significant and growing segment of the market.

– Clean Energy Developer

Fostering an environment that enables long-term corporate offtake agreements will provide developers and financiers the certainty they need to get more clean energy onto our grid, thereby making the U.S. more energy independent and accelerating job creation. With electricity demand on the rise, as data centers and manufacturing facilities require more power, it is more important than ever to maintain offtake options for corporates to allocate their capital to clean energy projects.

Authors

ACORE Team Member

ACORE Team Member

Additional Reading

Beiter, Philipp, et. al. “The enduring role of contracts for difference in risk management and market creation for renewables.” December 5, 2023. https://www.nature.com/articles/s41560-023-01401-w.

Energy and Environmental Economics (E3). Consequential Impacts of Voluntary Clean Energy Procurement. July 2024. https://www.ethree.com/wp-content/uploads/2024/07/E3_VoluntaryCorporateProcurement_HourlyEmissions_June-2024.pdf.

O’Shaughnessy, Eric. “A more comprehensive view of the impacts of voluntary demand for renewable energy.” Clean Kilowatts, LLC. September 23, 2024. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4953515.

Center for Resource Solutions. “Making Voluntary Markets for Clean Electricity Work.” September 5, 2024. https://resource-solutions.org/document/090524/.

Endnotes

1 Private interviews.

2 American Clean Power, “Clean Power Quarterly Market Report | Q3 2024,” December 3, 2024, https://cleanpower.org/resources/clean-power-quarterly-market-report-q3-2024/.

3 Ibid.

4 Enel North America, “VPPA 101: everything you need to know,” August 30, 2023, https://www.enelnorthamerica.com/insights/blogs/vppa-101-everything-you-need-to-know.

5 Philipp Beiter, Jérôme Guillet, Malte Jansen, Elizabeth Wilson, and Lena Kitzing, “The enduring role of contracts for difference in risk management and market creation for renewables,” December 5, 2023, https://www.nature.com/articles/s41560-023-01401-w.

6 Eric O’Shaughnessy, “A more comprehensive view of the impacts of voluntary demand for renewable energy,” Clean Kilowatts, LLC, September 23, 2024, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4953515.

7 Barbose, U.S. State Renewables Portfolio & Clean Electricity Standards: 2024 Status Update.

8 Lazard, Levelized Cost of Energy+, June 2024, https://www.lazard.com/research-insights/levelized-cost-of-energyplus/.

9 Ibid.

10 Energy and Environmental Economics (E3), Consequential Impacts of Voluntary Clean Energy Procurement, July 2024, https://www.ethree.com/wp-content/uploads/2024/07/E3_VoluntaryCorporateProcurement_HourlyEmissions_June-2024.pdf.

11 Ibid.

12 Private interview.

13 Private interview.

14 Private interview.

15 O’Shaughnessy, “A more comprehensive view of the impacts of voluntary demand for renewable energy.”

16 Claire Lang-Ree, “PJM’s Capacity Auction: The Real Story,” Natural Resources Defense Council, August 22, 2024, https://www.nrdc.org/bio/claire-lang-ree/pjms-capacity-auction-real-story.

17 Private interview.

18 Barbose, U.S. State Renewables Portfolio & Clean Electricity Standards: 2024 Status Update.

19 Private quote submitted for use in this paper.

20 Private quote submitted for use in this paper.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)