The Risk Profile of Renewable Energy Tax Equity Investments

Executive Summary

Tax equity, largely provided by domestic banks, has been a critical financing source for clean energy projects. The Inflation Reduction Act (IRA) extended and expanded the use of federal tax incentives to various renewable and carbon emission reduction technologies as well as the domestic manufacturing of advanced energy equipment. To meet the goals of the IRA, many forecasters estimate that tax equity will need to increase from a $20 billion annual market today to over $50 billion.

Domestic banks have been major providers of tax equity, representing over 80% of the roughly $20 billion annual market, and are poised to increase their tax equity investments to meet this demand. While the IRA provides new tax credit monetization options through transferable tax credits and direct pay, tax equity is expected to remain the most common and preferred option for project developers because it monetizes both the tax credits and other tax benefits, such as tax depreciation.

Renewable energy projects typically have a high level of contracted revenue, limited variable operating costs, and relatively predictable cash flows. Projects are often held in a limited liability company (LLC). In most cases, the project sponsors do not have sufficient tax liabilities to efficiently use the tax benefits that may be available for these projects. Thus, the sponsor sells non-controlling passive interests in the LLC to a tax equity investor in a structured tax equity transaction. This structure is designed to allow the tax equity investor to fund a large portion of the capital cost of the project and to receive a pre-negotiated rate of return, which consists primarily of the value of tax credits and other tax benefits.

The tax equity investor has limited downside exposure as the investment will receive most of its return from more predictable tax credits and accelerated depreciation deductions, and it has other protective features, such as no senior debt in the project and its priority over a sponsor’s return. In many ways, tax equity has more loan-like characteristics compared to typical equity exposures. In fact, in a recognition of the importance of tax equity financing coupled with its conclusion that tax equity is the functional equivalent of a loan,1 the Office of the Comptroller of the Currency (OCC) codified and streamlined the process for the banks to participate in tax equity financing under the general lending authority.

According to a recently conducted survey of banks that represent 70% of the overall renewable tax equity market in the past five years, the historical performance of exited renewable tax equity investments and projections for current investments demonstrate overwhelmingly positive yields. The risks from recapture, foreclosure, and bankruptcy have had no or very limited impacts on investors’ overall portfolios. Absent new policy impediments, the low-risk profile of renewable tax equity will continue to attract considerable capital from bank investors seeking stable returns.

II. IntroductionI. Introduction to Renewable Energy Tax Credits

a. The federal renewable energy tax credit program has a proven track record, serving as a vital driver of the energy transition.

Federal tax credits have played an indispensable role in the development and expansion of the U.S. renewable energy sector. They provide crucial financial incentives for utility-scale, community, and distributed renewable energy projects, driving adoption across states, industries, and customers.

Tax credits work by reducing the tax liability of project developers and investors, effectively lowering the overall costs of developing renewable energy projects. This reduction in costs has been a key driver in the rapid scaling of renewable energy technologies over the past two decades. The availability of tax credits helped facilitate over $695 billion of private investments into the renewable sector between 2004-20222 and currently supports the employment of over half a million Americans.3 The availability of tax credits has also helped lead to significant technology improvements, increased system efficiencies and reliability, and cost reductions across all renewable energy technologies.

The most significant tax credits for the clean energy transition in the U.S. are the Production Tax Credit (PTC) and the Investment Tax Credit (ITC). The PTC is a per-kilowatt hour (kWh) tax credit for electricity generated by renewable energy and other qualifying technologies, paid over a 10-year period. The ITC is a tax credit that is based on a percentage of the project’s cost as a one-time credit in the year in which the project is placed in service.

b. The IRA extends and expands the role of tax credits in fueling renewable infrastructure.

Enacted in August 2022, the IRA extended and expanded the use of federal tax incentives to various renewable and carbon emission reduction technologies as well as the domestic manufacturing of advanced energy equipment.4

It ensures continued support for wind and solar power by extending the ITC of 30% and PTC of $0.0275/kWh to 2025, provided projects meet prevailing wage and apprenticeship requirements.1 After 2025, the credits will transition to a technology-neutral approach until the later of 2032 or the point at which carbon emissions are reduced to 25% of their 2022 levels. The IRA also introduced a new ITC for standalone energy storage and new PTC provisions through 2025 for offshore wind, geothermal, hydropower, and clean hydrogen.

The IRA introduces “prevailing wage” and “apprenticeship” requirements for entities to receive the full value of the credits, increasing the base credit (6% of the available ITC credit and 20% of the available PTC credit) by a multiple of five if the project pays prevailing wages and adheres to registered apprenticeship requirements.

In addition to the baseline credits, the IRA introduces a suite of bonus credits,5 including incentives for:

- Domestic Content: Base and bonus credits are increased by 10% if the project uses a certain percentage of steel, iron, and manufactured products that are mined, produced, or manufactured in the U.S.

- Energy Communities: Base and bonus credits are increased by 10% if the project is located within a defined energy community or interconnected to a substation within an energy community for offshore wind projects. Energy communities are defined as brownfield sites or areas that are economically dependent on fossil fuel activities according to certain metrics.

- Low-Income Communities: For wind and solar projects that are eligible for the ITC and have a maximum output of 5 megawatts (MW) or less, base and bonus credits are increased by 10% if the project is located in a low-income community or on tribal land. The credit increases by 20% for projects that are part of certain federally subsidized housing programs or offer at least 50% of the financial benefits of the electricity produced to low-income households.

To enhance the accessibility and effectiveness of these tax incentives, the IRA introduces provisions for transferability and direct pay, offering greater flexibility for investors for financing renewable energy projects. Transferability enables project owners to monetize tax credits by transferring them to other taxpayers with sufficient tax liabilities, such as corporate buyers. Direct pay allows tax-exempt and governmental entities to invest in clean energy projects and claim the equivalent amount of the tax credit in the form of a direct payment from the Internal Revenue Service (IRS). Direct pay is also available for taxable entities who would receive credits for carbon capture, clean hydrogen, and the manufacturing of renewable energy components.

III. Key StakeholdersIII. Key Stakeholders in Renewable Energy Project Development

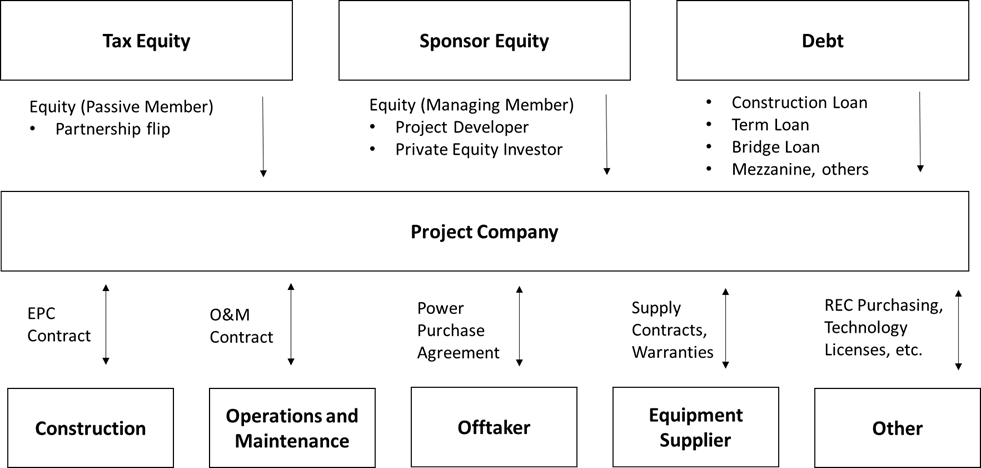

There are multiple stakeholders involved in the development of a renewable energy project, including project sponsors, financiers, offtakers, equipment suppliers, and construction, operations, and maintenance contractors, each playing a critical role in the lifecycle of a renewable energy project.

- Project Sponsors: The project sponsor oversees the development, construction, and operation of a renewable energy project. Project sponsors typically act as a partial owner of a special purpose project company set up to own and operate the project and contribute and raise capital to fund equipment purchases and the project’s construction6 Project sponsors analyze and mitigate potential risks, ensuring their projects adhere to planned timelines, budgets, and quality standards. Furthermore, they play a central role in coordinating activities among various stakeholders to ensure the construction and operation of the project.

- Financing Parties: Renewable energy projects are typically financed through cash equity, tax equity, and debt financing. Tax equity investors provide funding to take advantage of the tax benefits and receive cash flows from the project, partnering with the project sponsor to become a partial owner of the project company (see Section IV). The project sponsor can also raise additional cash equity from other institutional investors. Debt financing involves loans raised by the project sponsor during the development period, construction period, and/or after the project is placed in service.

- Offtakers: Renewable energy projects often rely on offtakers to enter into multi-year contracts, known as power purchase agreements (PPAs), to purchase the electricity and renewable energy certificates (RECs) produced by the project, often at a fixed price. PPAs provide a steady revenue stream for the project and make it more attractive to investors and lenders. Projects do not typically receive financing until a PPA with a creditworthy offtaker is signed. PPA tenors typically range between 10-20 years. Offtakers include electric utilities who may procure renewable energy to comply with state clean energy standards and meet load requirements, and with the growth in standalone storage, meet adequacy requirements and other ancillary services. In addition, corporations enter into renewable energy PPAs to reduce their greenhouse gas (GHG) emissions and hedge their power costs. Finally, corporates, municipalities, government agencies, school districts, and residential homeowners purchase renewable energy to save on energy costs and reduce GHG emissions.

- Engineering, Procurement, and Construction (EPC) Contractors: EPC contractors are responsible for the engineering design of the project, managing the procurement of all necessary materials and equipment, and overseeing the construction work. Their expertise ensures that the renewable energy facility is built to the required specifications, adheres to safety and quality standards, and is completed within the set timeframe and budget.

- Equipment Suppliers: Equipment suppliers manufacture and deliver the components and systems needed for the project. They also assist project developers in selecting the appropriate technology and equipment for the project’s needs. The equipment supplier helps to manage technology risk, with their ability to provide reliable and proven equipment directly impacting the project’s risk profile, financeability, and overall success.

- Operations and Maintenance (O&M) Contractors: Once the project is operational, O&M contractors handle the day-to-day operations, carrying out regular maintenance, and repairs as needed, to ensure the facility operates at optimal performance. They contribute to the overall reliability and efficiency of the renewable energy project, ensuring that it continues to produce energy effectively over its operational life.

Figure 1: Typical Project Finance Structure

IV. The Role of Tax Equity Investments in Renewable Project Finance

Renewable energy projects typically have a high level of contracted revenue, limited variable operating costs, and relatively predictable cash flows. Projects are often held in an LLC and taxed as partnerships. In most cases, the project sponsors do not have sufficient tax liabilities to efficiently use the ITC, PTC, or other tax benefits available for these projects. Thus, sponsors sell non-controlling passive interests in the LLCs to tax equity investors in structured tax equity transactions. These structures are designed to allow tax equity investors to fund a large portion of the capital cost of the project and to receive a pre-negotiated rate of return, which consists primarily of the value of available tax credits and other tax benefits. Tax equity is responsible for approximately one-third to two-thirds of a renewable energy project’s overall financing (or “capital stack”).

a. The demand for tax equity already exceeds supply and will more than double by mid-decade. Banks will continue to predominate the tax equity market.

Over the past three years, the U.S. renewable energy industry has attracted $18-20 billion in tax equity investment annually. Demand for tax equity will accelerate as the IRA leads to unprecedented levels of clean energy growth, more than doubling to $50 billion annually by mid-decade.7 New investors must enter the market to increase supply, and existing investors need to expand their level of participation. However, the complexity of tax equity arrangements limits the quantity of participants in the market.

Tax equity structures are complex, and transactions can be expensive to structure. Domestic banks are responsible for providing a majority of tax equity investment, representing over 80% of the annual market. Banks view tax equity as a low-risk asset class with attractive risk-adjusted returns. Other tax equity investors in the market include insurance companies and other large tax-paying corporations. Passive activity and other legal limitations restrict the entities that can invest in tax equity to corporations, excluding other entities with large tax capacities, such as retail investors and individuals, or other pools of capital.

b. Emerging financing options will play a complementary role but will not replace tax equity.

While the IRA provides new tax credit monetization options through transferable tax credits and direct pay, tax equity is expected to remain the most common and preferred option for project sponsors because it monetizes both the tax credits and other tax benefits, such as tax depreciation. Tax equity also provides additional value to sponsors in the form of long-term commitments to fund projects, which the sponsors can use to raise construction finance, and it can help facilitate the entrance of large buyers into the still-developing tax credit transfer market by providing underwriting and project diligence expertise. Thus, the important services that banks provide in creating liquidity in the market will continue to be a crucial aspect of market growth.

Transferability is expected to supplement traditional tax equity and attract an estimated $4 billion in 2023 and $10 billion in 2024, and much of this will be deployed through hybrid structures (described below) that continue to utilize tax equity8 In cases without a tax equity structure, transferability does not allow for the monetization of the significant accelerated depreciation benefits available to renewable energy. In a typical tax equity transaction, the depreciation provides an additional value equal to 10-20% of the project value.

Tax equity transactions are also structured with long-term commitments from banks that developers rely on to raise construction debt (in some cases from the same bank providing the tax equity). Furthermore, for PTC transactions in particular, the tax equity investor is providing capital for 10 years-worth of the PTCs, whereas the still-developing transfer market is mostly focused on current-year tax credits. Tax equity’s more comprehensive approach to the long-term capital needs of a project means that renewable energy developers get more overall economic value from a tax equity structure than transferability. Even with transferability now available, developers still prefer to raise traditional tax equity for projects rather than rely on the burgeoning transfer market.

Furthermore, traditional tax equity players will serve an important role in providing due diligence and syndication services for large corporate players interested in exploring transferability. A significant portion of the transfer market is expected to develop in a hybrid structure where there is a tax equity investment provided by a bank with a portion of those tax credits sold to corporates. The transferable tax credit market will be able to grow more quickly, and ultimately to a larger total size, if corporate taxpayers feel confident that they are investing alongside banks who have expertise in the asset class and are putting their own capital at risk in the transaction.

A functioning tax equity market is needed to optimize the benefits of transferability and must be considered additive to realize the market success.

V. RisksV. Renewable Tax Equity Structures Protect Investors from Risks

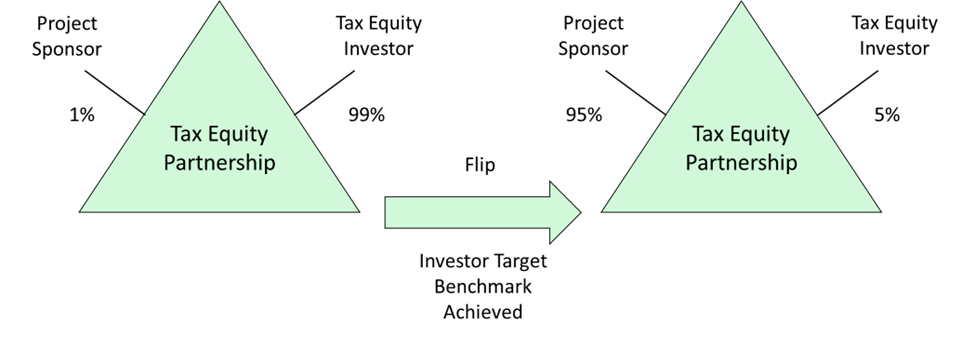

a. Partnership flip structures offer well-defined benefits for tax equity investors.

Partnership flips are the predominant tax equity structure in the U.S. renewable energy market for both PTC and ITC investments, which generally follow the safe harbor structures described in IRS Revenue Procedures 2007-65 and 2014-12. In a typical transaction, the project sponsor will form a partnership with a tax equity investor to jointly own the renewable energy project LLC, which the sponsor has developed or acquired from other developers. The tax equity investor provides between one-third to two-thirds of the total capital, injecting essential upfront capital into the project, and in exchange, typically receives 99% of the tax attributes and a minority share of the cash, typically between 5% and 30%. The sponsor finances the equipment purchase and project construction with balance sheet equity or a construction loan, which is then paid off by the tax equity proceeds when the project reaches commercial operations.

The initial allocation of benefits is sustained until a specific predetermined benchmark is reached. In a yield-based flip, the benchmark is a specific internal rate of return (IRR) target; in a time-based flip, the benchmark is a fixed date. For a time-based flip, the fixed date can be no earlier than five years after the project’s placed-in-service date. Once the yield or fixed date benchmark is reached, the tax allocations and cash distributions received by the tax equity investor decrease, usually to about 5%. The developer then inherits most of the remaining financial and tax benefits and has the option to buy the investor’s remaining interest at its fair market value.

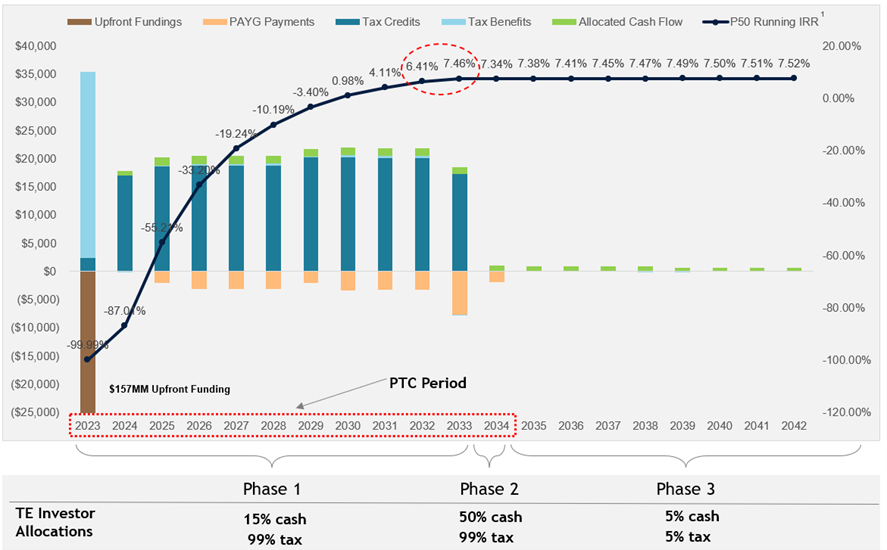

PTC investors make their capital contribution after construction completion and the commencement of commercial operation. PTC projects can include “pay-go” structures, in which the investor makes 75% of its investment at inception and the remainder on a contingent basis as the PTCs are produced over time, based on project performance. PTC projects have an expected flip term of 9-10 years.

ITC investors will make their first capital contribution, typically 20% of the total, around mechanical completion of a project to meet IRS guidelines established in IRS Rev. Proc. 2014-12 and be a “good partner” in the partnership before the project is placed in service. The second capital contribution, the remaining 80%, occurs after substantial completion. ITC projects have an expected flip term of 6-8 years.

The tax equity investor in a partnership-flip structure receives tax credits, cash flows from the project, and accelerated depreciation on the project’s qualified assets. These benefits generated by the project – in the form of ITCs or PTCs (as well as any other pre-negotiated state and local tax incentives), and a portion of the project’s revenue – are distributed between the sponsor and tax equity investor according to the pre-negotiated terms of the transaction. The depreciation of renewable energy systems can be claimed by the tax equity investor using a five-year schedule, allowing the investor to claim 100% of the depreciation of the project’s qualified assets in the first five years of the project. Tax benefits generally represent over 80% of the total return for the tax equity investor.

Figure 2: Basic Partnership Flip Transaction

b. Tax equity has a senior equity position and is not subordinated to debt.

Tax equity is senior equity ahead of the project sponsor’s junior equity, meaning that the tax equity investor has a priority in earning its return, is senior to the project sponsor in terms of distribution, and the sponsor takes the first dollar loss. Projects typically do not allow for senior debt that is secured by the project’s assets.

The project sponsor can secure other forms of cash equity, but typically as a direct equity investment in the project sponsor’s company or in a holding company that holds the sponsor’s interest. Even when there is a third-party cash equity investor involved, the principal sponsor typically provides 100% of the sponsor guaranty standing behind any indemnities or covenants in the tax equity partnership. The tax equity investor thus has limited exposure to the arrangement, and the other cash equity investors the sponsor attracts typically are not investors in the project LLC itself.

Sponsors can also attract “back-leveraged” debt financing after the project’s construction is complete, for which the sponsor or a holding company is the borrower, where the sponsor’s cash equity interest is collateral for the back-leverage borrowing. Under this structure, the lenders do not have a lien on, nor do they receive cash flows directly from the tax equity partnership. Instead, their collateral and source of repayment comes from the sponsor’s interest in the tax equity partnership, which is junior to the tax equity investor’s interest. The tax equity provider is protected from the risk of default under the loan agreement. If the back-leverage lenders were to foreclose, they would be stepping into the sponsor’s interest in the partnership and would not have recourse to the project-level assets.

c. Tax equity structures limit risks and downside for investors.

The tax equity investor has limited downside exposure because the tax equity investment will receive the vast majority of its return from tax credits and other tax benefits, which are more certain than cash flows from project operating income. The tax equity investor is passive and only gets involved in management of the asset or project for certain major decisions over which it has a consent right as a passive investor. Tax equity investors also have limited exposure to development and construction risks, with limited exceptions. Tax equity has other protective features, such as the absence of senior debt in the project and a structural priority over the project sponsor’s return. The partnership flip structure also helps protect against project risks, including resource variability, equipment performance issues, and power price declines that are not otherwise covered by PPA contracts. These investments are underwritten to be robust and are structured to perform well under various stress scenarios.

Tax equity investors typically view the investment horizon or life of the investment as being the period over which the substantial majority of the tax benefits are being received, typically 6-10 years, which is much less than the useful life of the underlying asset, 25-30 years. Under the Hypothetical Liquidation at Book Value (HLBV) or the Proportional Amortization Method (PAM) of accounting, tax equity investments amortize quickly over the first 10 years.Once this investment period has passed, the investor will likely exit the investment via a sponsor’s exercise of a fair market value purchase option or a negotiated sales process, which typically results in an investment return incrementally above the contractual target return.

Structures mitigating performance risks: Similar to “community development” tax credit investments, renewable energy tax credit investments are subject to performance risks. However, given the generally long-term contracted cash flows from creditworthy offtakers, the lack of senior debt, priority cash distributions to the tax investor, and predominately tax benefit return, the bank’s exposure to performance risk is mitigated.

Most projects are well-insulated from power price risks due to the contracted cash flow profile. However, certain projects may have exposure to some power price risk. To mitigate power price risks, investors will get independent studies and factor in portfolio experiences, rely less on cash distribution to achieve returns, and introduce structural enhancements or sponsor working capital obligations, if necessary. Where the risks do exist inside the partnership, they are often allocated to the sponsor through a preferred return or cash sweep mechanism that provides priority for tax equity cash distributions ahead of sponsor distributions.

To reduce operational risks, investors will run modeling to evaluate their returns under multiple production scenarios and use stress case scenarios to help structure terms. Production risk is also absorbed by structural features, such as pay-go contributions in PTC deals, which also provide material protection from project underperformance. With pay-go, up to 25% of the investor’s expected contributions are deferred at the initial funding date. Those deferred contributions are funded over time, contingent on the actual performance of the project. If the project underperforms, pay-go payments are reduced, or completely eliminated in cases of severe underperformance, to ensure the tax equity investor achieves its flip IRR (or preferred return) within the PTC period. With or without a pay-go structure, in the event the tax equity investor has not achieved its flip IRR by the anticipated flip date, there is an acceleration of cash to the tax equity investor (“cash step-up”) in almost all partnerships, whereby the tax equity is distributed in higher amounts of cash, usually 50-100% of project cash, until the flip IRR is achieved. In a time-based flip, any cash shortfall to the priority return will accrue and be paid in subsequent periods – including any at call or withdrawal option – which mitigates the risk that the investor experiences a reduction in return or delay in flip.

Exposure to fluctuations in the cash flow of the project – due to power prices and operational risks – is well mitigated because of the contracted nature of the cash flows and the priority cash position of the tax equity investor. The seniority of tax equity not only protects the tax investor’s cash benefits but also mitigates the risk of loss of the fixed tax benefits.

Furthermore, renewable tax equity investors have limited exposure to construction risks. While ITC investments require the investor to enter a tax equity partnership prior to the placed-in-service date (paying 20% of the purchase price at mechanical completion), the exposure is mitigated as the project is mostly built and generally only awaiting testing and evaluation for the commercial operation date. In either an ITC or PTC investment, by the time the tax equity investor makes an investment, the project is fully permitted, contracted, and developed. Tax equity partnerships may also have a “put” in which the developer must buy back the project from the tax equity investor under certain circumstances if the project fails to reach being placed in service.

Tax credit risks: In addition to performance risks, tax equity investors may also face tax credit risks related to ITC recapture, but the risks are minimal. ITCs are subject to recapture if a project is removed from service within the first five years after it is placed in service or if there is a change in ownership. Actions that can trigger recapture include the project suffering a casualty loss or the project being sold to a third party after placement in service. If the ITC is recaptured, the investor loses a portion of their previously claimed tax credits. Given the lack of senior secured debt, the risk of change of ownership is well mitigated. Property and casualty insurance coverage protects investors against losses from recapture or disallowance, and the historical impacts of recapture on investors’ overall portfolios are limited (see Section VI).

There is also a risk that the IRS could audit and challenge the amount of ITC that was claimed on a project. However, tax equity investments include appraisals by valuation experts supporting the fair market value of the asset. In addition to the risk mitigations above, tax equity investors require the project sponsor to fully indemnify them in the event of a recapture event or ITC adjustment. The credit support of that indemnity is provided via parent guaranties and project cash sweeps in the event the parent defaults on its guaranty obligations, and often tax insurance is procured.

Diligence and risk assessment: Furthermore, tax equity investors will conservatively assess risks in their underwriting and upfront due diligence processes. These strategies help investors understand a project’s viability and structure their investments to minimize their exposure to downside risks and push certain risks back to the sponsor. Prior to closing a tax equity investment, the bank performs due diligence similar to a loan closing. The tax equity investor will review and comment on project contracts – including the PPA, interconnection agreements, EPC contracts, site lease agreements, O&M agreements, and other key project documents. The tax equity investor engages outside legal counsel, who will provide a tax opinion to the investor that the tax benefits “should” or “will” be respected by the IRS. In addition, the tax equity investor and project engage an independent engineer and, in the case of an ITC, an appraiser to assess the value of the property. An insurance consultant will also opine on the level of property and casualty insurance to ensure the investor has adequate protection against any casualty risk. Finally, other experts (such as transmission consultants) will be engaged to assess other risks that may be unique to the underlying investment.

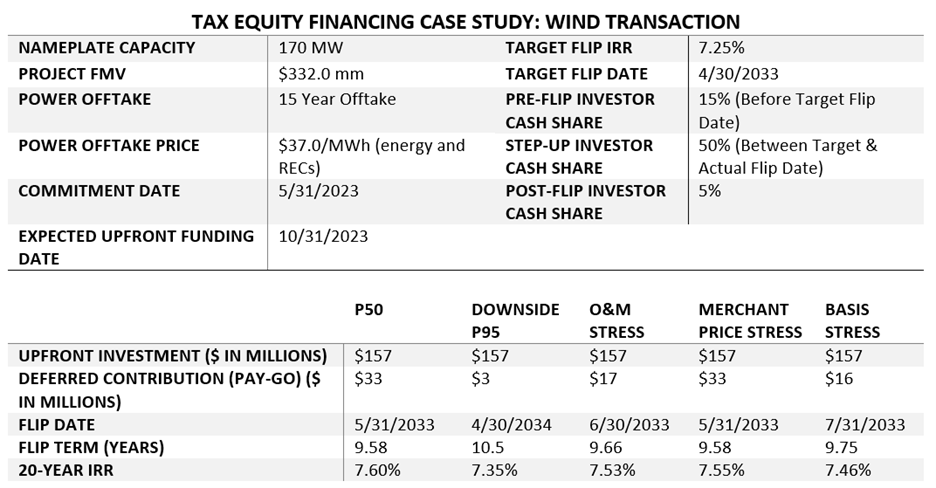

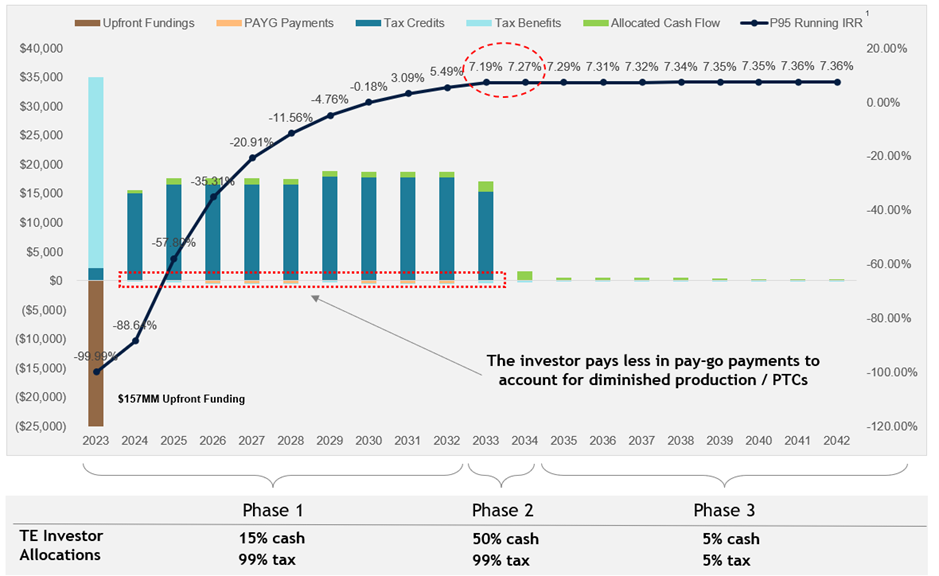

Case study: The below case study further illustrates how partnership flip structures provide strong downside protection for tax equity investors. As shown in the chart, the tax equity investor in a yield-based flip achieves a flip in less than 10.5 years under various stress scenarios, which is well within the project’s useful life. The small reliance on cash distributions and the pay-go features provide the investor robust protection.

Figure 3: Tax Equity Case Study: Key Base Case and Stress Case Metrics

Figure 4: Investor After-Tax Cash Flows – P50 Case (‘000)

Figure 5: Investor After-Tax Cash Flows – P95 Downside Case (‘000)

d. The OCC has established criteria that designates renewable tax equity investments as loan equivalent.

In a recognition of the importance of tax equity financing and its loan equivalent nature, in 2021, the Office of the Comptroller of the Currency codified and streamlined the process for the banks to participate in tax equity financing under the general lending authority. Prior to this notice, most banks made their tax equity investments out of their bank holding company. Many institutions have moved their tax equity investments into their banks and increased their tax equity financing since the OCC rulemaking.

Section 12 CFR § 7.10259 allows National Banks to engage in tax equity finance transactions and defines the criteria that make these investments the “functional equivalent of a loan.”

- The structure of the transaction is necessary for making the tax credits or other tax benefits available to the national bank or Federal savings association;

- The transaction is of limited tenure and is not indefinite, including retaining a limited investment interest that is required by law to obtain continuing tax benefits or needed to obtain the expected rate of return;

- The tax benefits and other payments received by the national bank or Federal savings association from the transaction repay the investment and provide the expected rate of return at the time of underwriting;

- Consistent with paragraph (c)(3) of this section, the national bank or Federal savings association does not rely on appreciation of value in the project or property rights underlying the project for repayment;

- The national bank or Federal savings association uses underwriting and credit approval criteria and standards that are substantially equivalent to the underwriting and credit approval criteria and standards used for a traditional commercial loan;

- The national bank or Federal savings association is a passive investor in the transaction and is unable to direct the affairs of the project company; and

- The national bank or Federal savings association appropriately accounts for the transaction initially and on an ongoing basis and has documented contemporaneously its accounting assessment and conclusion.

VI. Historical Performance of Renewable Energy Investments

ACORE conducted a survey of active bank tax equity investors in October 2023 to collect information about the performance of their clean energy investments. Between January 2018 and October 2023, these banking institutions have collectively invested roughly $70 billion in tax equity for clean energy projects,10 which represents over 70% of the overall market. The results show that investments in both PTC and ITC projects overwhelmingly yield positive returns and demonstrate resilience to key financing risks (recapture, foreclosure, and bankruptcy).

a. Renewable energy investments overwhelmingly result in positive yields.

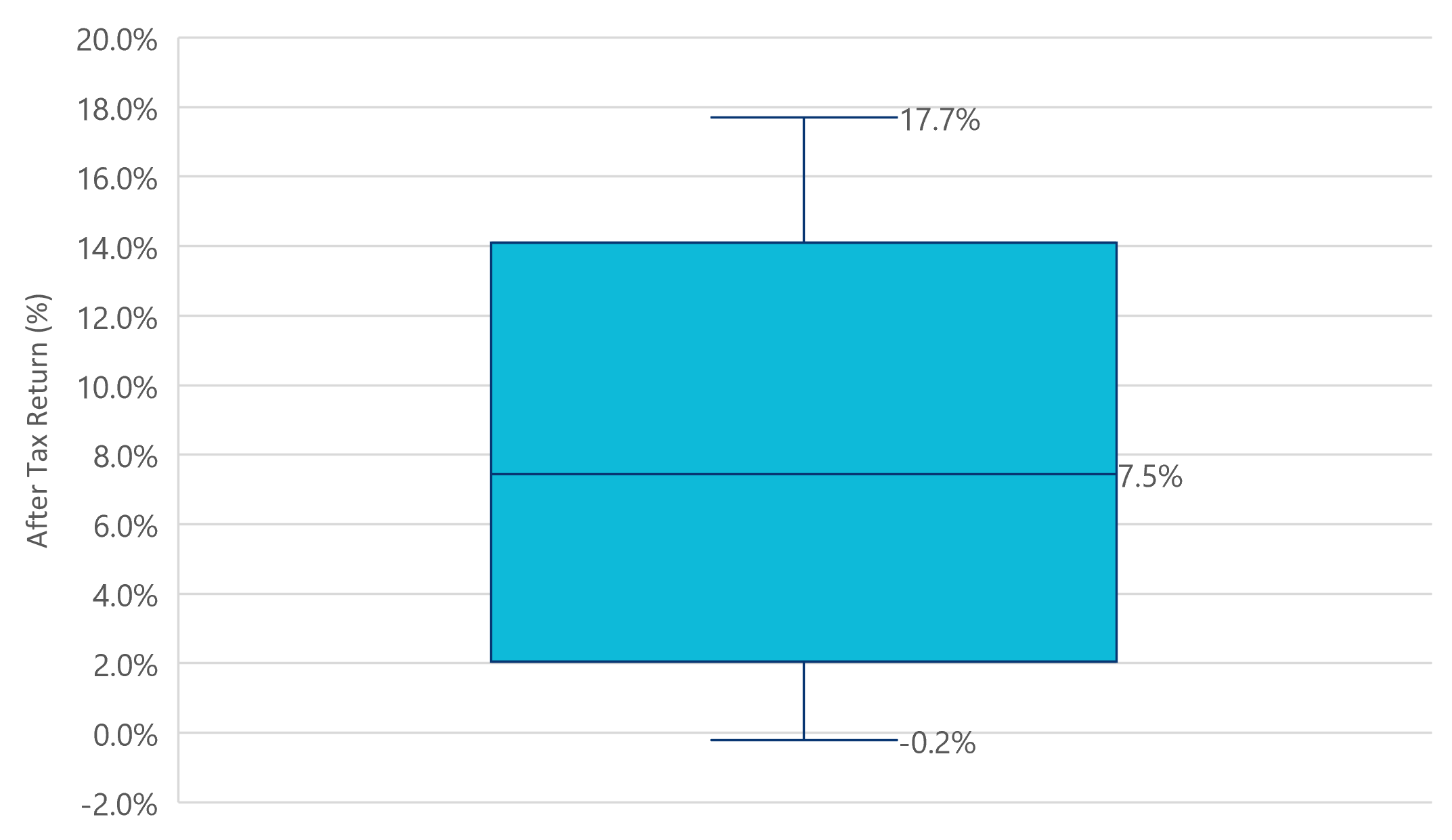

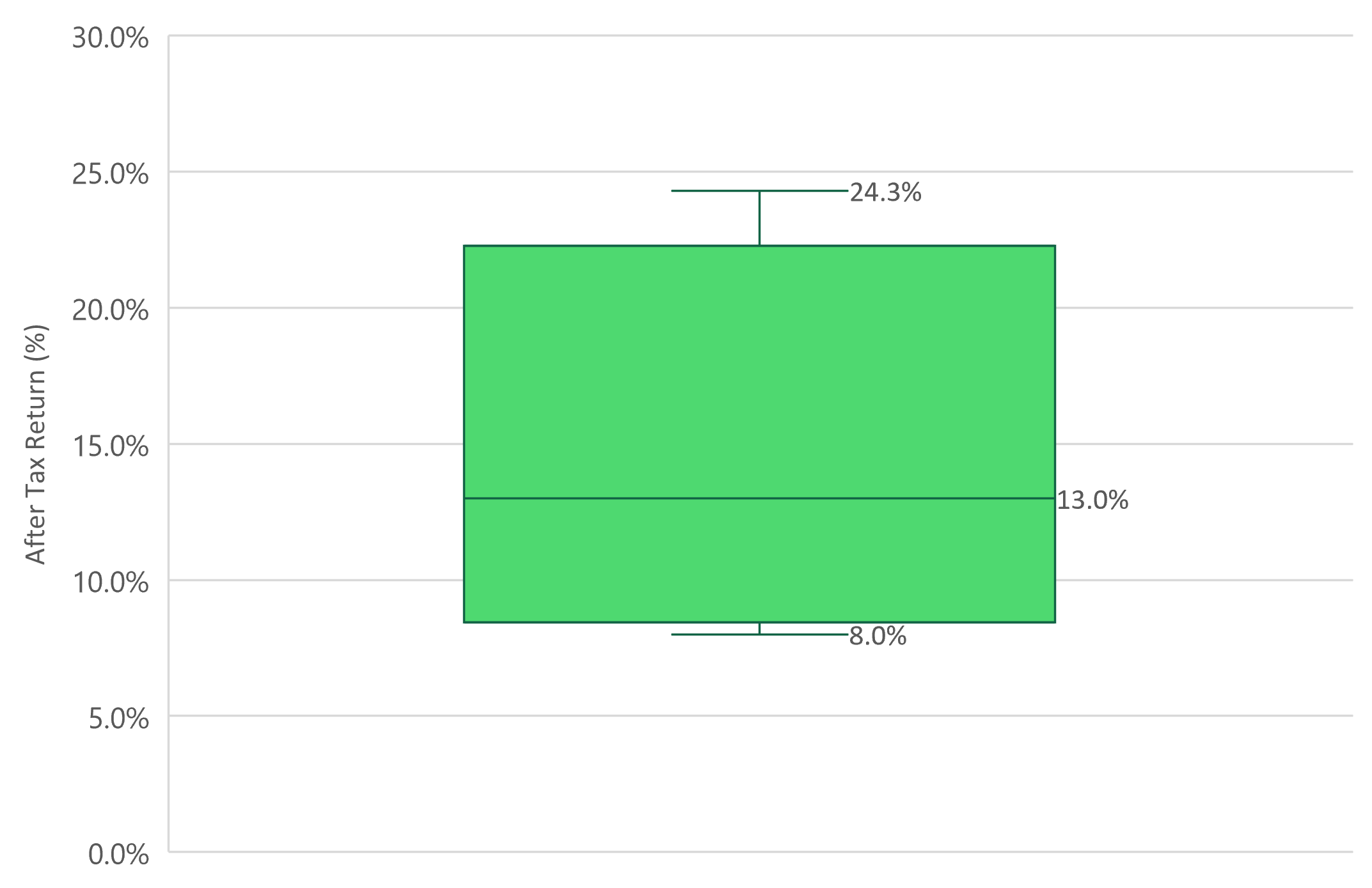

Surveyed participants reported positive after-tax returns for both PTC and ITC investments that have exited between 2018 and present. While two investors report exiting deals with small negative after-tax returns, those deals represent less than 1% of their banks’ total portfolio values.

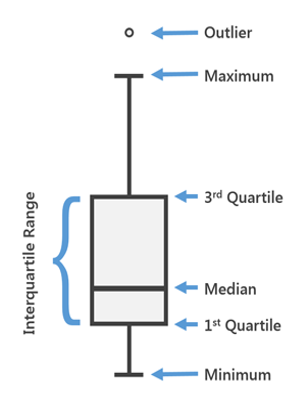

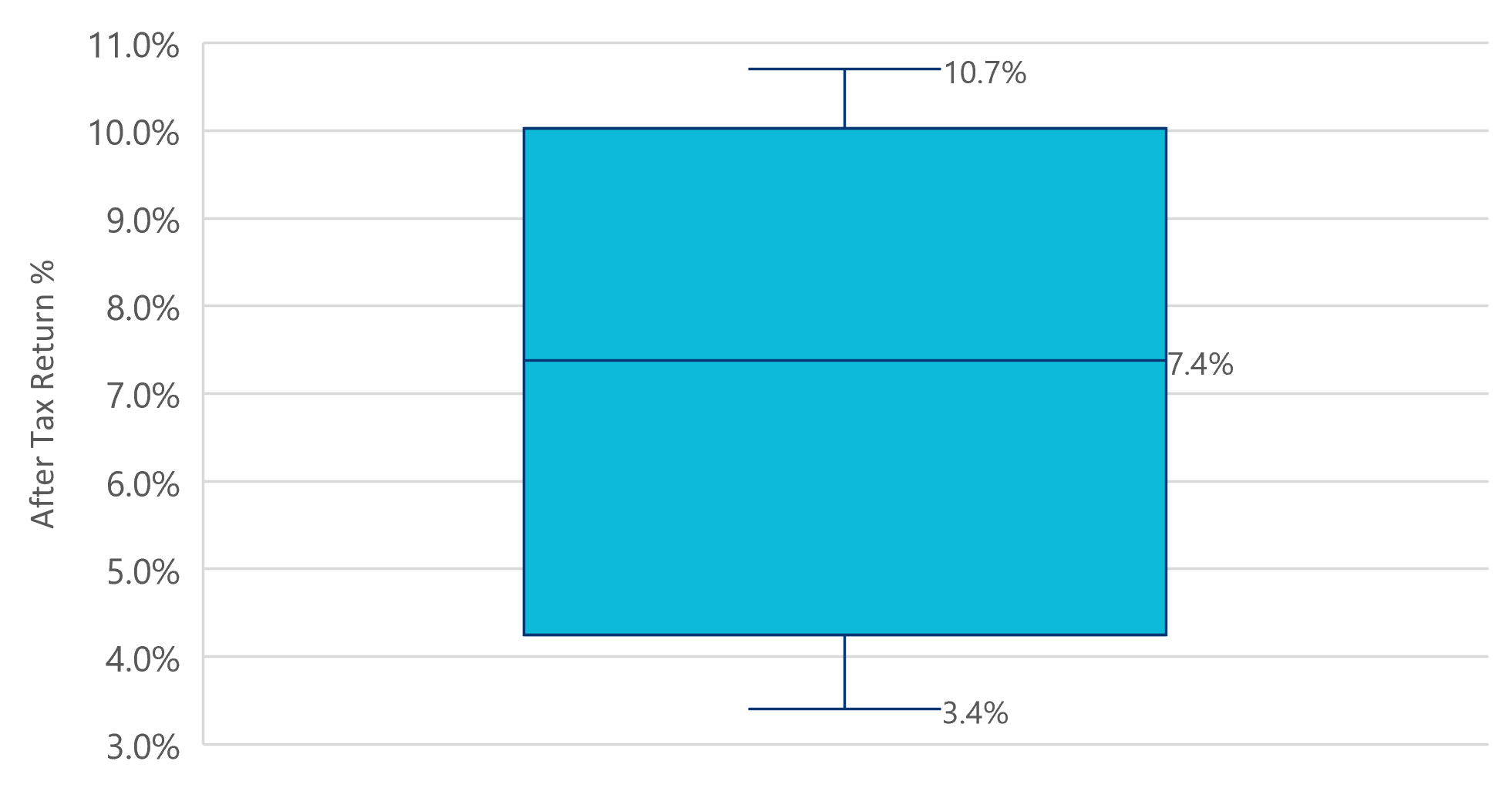

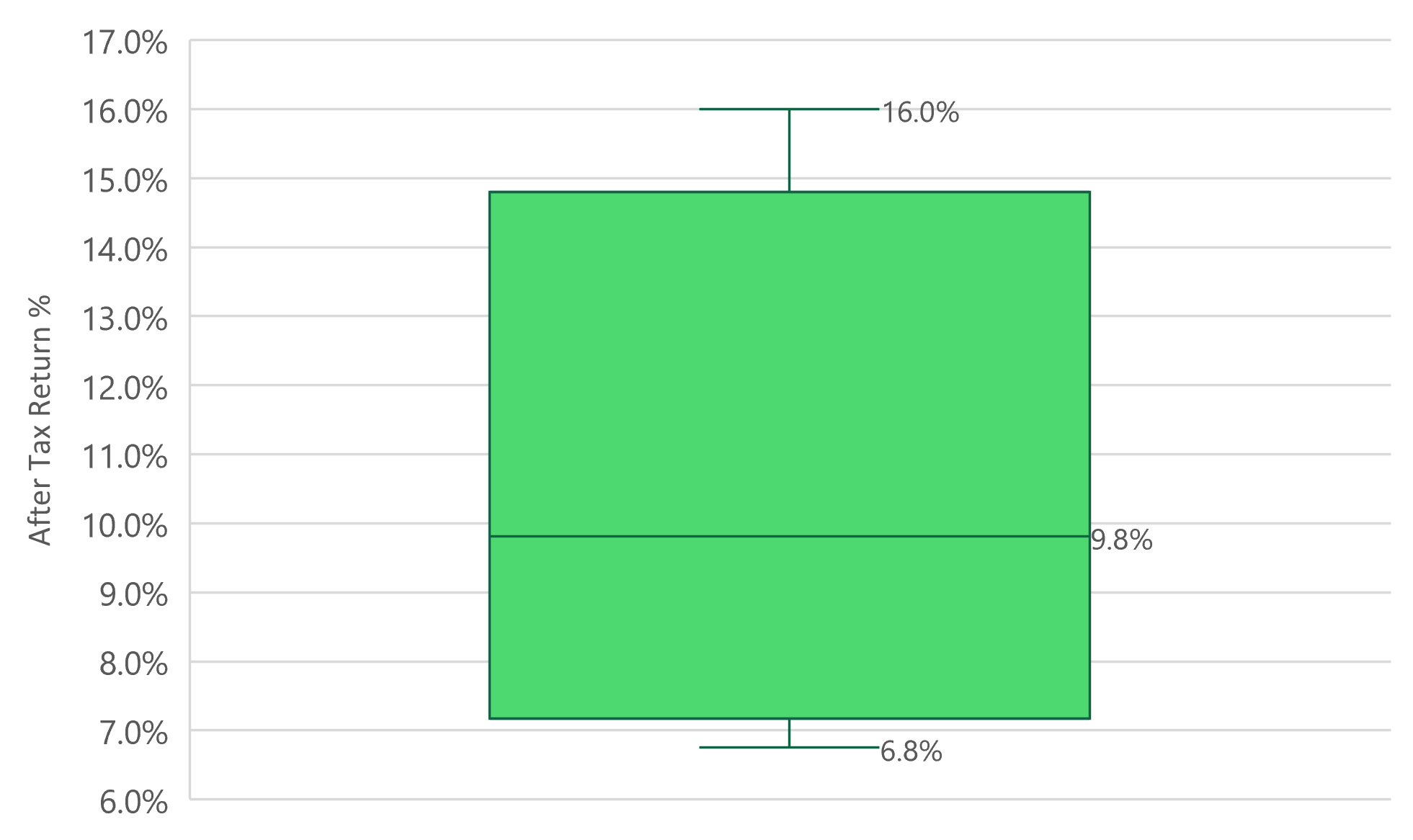

Figure 6: Vertical Box Plot Schematic

The distribution of the surveyed results for both the PTC and ITC exited and current investments are shown below in Figures 7-10. For all cases, box plots were used to capture the distribution of the numerical data submitted and their associated skewness. Each plot displays the data quartiles (or percentiles) and averages, with the lower and upper bounds representing the minimum and maximum values, the center area (box) bounded by the lower (25%) and upper (75%) quartile, and the median, which is represented by the line within the box plot, see Figure 6.

For all the PTC and ITC data surveyed, there were no statistical outliers, which is determined by subtracting the boundary quartile by a weighted interquartile range (Qn – 1.5*IQR). Finally, the results for both the exited and current PTC deals can be analytically deemed to have a symmetric normal distribution, while the ITC data tends to be more skewed to the right, suggesting more of the performance results residing amongst the higher values.

Figure 7: After-Tax Returns on PTC Investments, Exited 2018-Present (avg.)

Figure 8: After-Tax Returns on ITC Investments, Exited 2018-Present (avg.)

For active tax equity deals that have not yet exited, investors report positive actual and forecasted after-tax returns over the planned holding period for all PTC and ITC investments.

Figure 9: Expected After-Tax Returns on Current PTC Investments (avg.)

Figure 10: Expected After-Tax Returns on Current ITC Investments (avg.)

b. Investment risks associated with recapture, foreclosure, and bankruptcy are minimal.

Overall, losses associated with investments to date are extremely rare, and results from the survey highlight the low-risk nature of tax equity across the U.S. renewable energy sector. The survey responses indicate that recapture events for ITC investments are infrequent, with less than half of the respondents experiencing recapture events. For those who have experienced recapture, the affected investments constitute less than 1% of their total portfolio investments, and the recapture did not cause negative after-tax returns for those investments.11 The survey also found that occurrences of project bankruptcies or foreclosures within ITC or PTC investments have been extremely rare, with no surveyed investors reporting such events.

Regarding their underwriting criteria and approach post-IRA relative to the prior period, 75% of respondents report that they do not plan to make notable changes to their criteria, while 25% report that they have developed more stringent standards to further manage the risk aspects of tax equity investments.

ConclusionVII. Conclusion

The federal renewable energy tax credit program, with its proven track record, continues to be a driving force behind the ongoing energy transition. Through tax equity investments, banks will continue to play a pivotal role in monetizing these tax credits and creating significant liquidity in the market.

Renewable energy tax equity structures have protective features that shield investors from project risks and protect their returns even in downside cases. Tax equity investments are not speculative in nature and have a different risk profile than traditional equity investments, with their value driven primarily by tax benefits. The tax equity investor’s position is senior to the project sponsor’s junior equity, providing a priority in earning returns and avoiding structural subordination to long-term debt. These investments are underwritten to be robust and are structured to perform well under various stress scenarios. As recognized by the OCC, tax equity has more loan-like characteristics than true equity investments.

Moreover, the historical performance of exited renewable tax equity investments, as well as projections for current investments, demonstrate overwhelmingly positive yields. The risks from recapture, foreclosure, and bankruptcy have had no or significantly limited impacts on investors’ overall portfolios. Absent new policy impediments, the low-risk profile of renewable tax equity will continue to attract considerable capital from banking investors seeking stable returns.

For a fact sheet on the findings of this report, click here.

Glossary

EPC: Engineering, Procurement, and Construction

GHG: Greenhouse gas

HLBV: Hypothetical Liquidation at Book Value

IRA: Inflation Reduction Act

IRR: Internal Rate of Return

IRS: Internal Revenue Service

ITC: Investment Tax Credit

kWh: Kilowatt hour

LLC: Limited Liability Company

MW: Megawatt

O&M: Operations and Maintenance

OCC: Office of the Comptroller of the Currency

PAM: Proportional Amortization Method

PPA: Power Purchase Agreement

PTC: Production Tax Credit

REC: Renewable Energy Certificate

Authors

ACORE Team Member

ACORE Team Member

1 https://www.occ.gov/news-issuances/bulletins/2021/bulletin-2021-15.html

2 https://www.bnef.com/flagships/clean-energy-investment

3 https://www.energy.gov/policy/us-energy-employment-jobs-report-useer

5 https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses

6 The sponsor can self-develop the project or acquire it from other developers.

8 ACORE discussions with tax equity investors.

9 https://www.occ.gov/news-issuances/bulletins/2021/bulletin-2021-15.html

10 Including all funded investments and committed/to-be funded investments (including pay-go)

11 As discussed in Section V, tax equity investors require the project sponsor to fully indemnify them in the event of a recapture event or ITC adjustment.