- Project Finance

- Sustainable Investing & ESG

- Fact Sheets

ACORE Summary of SEC Climate Rule Treatment of Renewable Energy

The U.S. Securities and Exchange Commission’s (SEC) rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors, finalized on March 6, 2024, is a historic and unprecedented step in the country’s regulation of corporate climate information.1 This document summarizes the major elements of the final rules related to renewable energy use, generation, provision, and investment, which certain public companies will now be required to disclose in their SEC filings.

Climate-Related Targets, Goals, and REC DisclosuresI. Climate-Related Targets and Goals and REC Disclosures

a. Regulation S-K (Item 1504(a), (b), and (c)): The Overall Disclosure Requirement for Climate-Related Targets and Goals

Under Regulation S-K, SEC registrants are required to disclose any climate-related target or goal that has “materially affected or is reasonably likely to materially affect the registrant’s business, results of operations, or financial condition.” This disclosure requirement includes both publicly announced goals and internal, non-public goals, regardless of the specific climate-related issues they address, if they are determined to be material. While not specifically stated, low-carbon financing targets and goals are considered climate-related and are required disclosures if they are deemed material to the business. Similarly, renewable energy goals and targets are likely climate-related if they are deemed material to the business.

The registrant must disclose its progress in meeting the target or goal and how it has been achieved. Each year, the registrant must update its disclosure by describing the actions taken during the year to achieve its target or goal, but does not need to disclose interim targets. The required climate and goal disclosures include:2

- The scope of activities included in the target;

- The unit of measurement;

- The defined time horizon by which the target is intended to be achieved, and whether the time horizon is based on one or more goals established by a climate-related treaty, law, regulation, policy, or organization;

- If the registrant has established a baseline for the target or goal, the defined baseline time period and the means by which progress will be tracked; and

- A qualitative description of how the registrant intends to meet its climate-related targets or goals.

b. Regulation S-K (Item 1504(d)): The Carbon Offsets and RECs Disclosure Requirement

The final rules require a registrant to disclose certain information about carbon offsets and RECs if they are used as a material component of a registrant’s plans to achieve its climate-related targets or goals. The specific REC disclosures include:

- The amount of generated renewable energy represented by the RECs;

- The nature and source of the RECs (i.e., whether it is bundled or unbundled, and the party that has issued the REC);

- A description and location of the underlying projects;

- Any registries or other authentication of the RECs; and

- The costs of the RECs.

c. Regulation S-X (Rule 14-02(e)): Carbon Offset and REC Disclosures in Financial Statements

Amendments to Regulation S-X also require disclosures of carbon offsets and RECs in registrants’ financial statements if they have been used as a material component of their plan to achieve climate-related targets or goals. In the SEC’s determination, the required REC disclosures in Regulation S-X will also “anchor” the disclosures required by the amendments to Regulation S-K. The specific REC disclosures include:

- The aggregate amount of RECs expensed;

- The aggregate amount of RECs recognized;

- The aggregate amount of losses incurred on the capitalized RECs;3

- The beginning and ending balances of capitalized RECs on the balance sheet for the fiscal year;4

- Where on the income statement or balance sheet the capitalized costs, expenditures expensed, and losses related to RECs are presented; and

- The registrants’ accounting policy around RECs.

II. GHG Emission Disclosures

a. Regulation S-K (Item 1505): GHG Emissions Disclosure

Scope 1 and Scope 2 emissions disclosures are required for large-accelerated filers (LAF) and accelerated filers (AFs), if their GHG emissions are determined to be material. For those required to disclose GHG emissions, a third-party provided assurance report will be required at the “limited assurance” level beginning for FYB 2029 reports, increasing to a “reasonable assurance” level for LAFs after a transition period. Smaller reporting companies and emerging growth companies are not required to disclose GHG emissions. Reasonable estimates of GHG emissions with a discussion of their underlying assumptions and the reason for using them are permitted.

In a departure from the Proposed Rule, there are no Scope 3 disclosure requirements in the final rule. Emerging growth companies (EGCs) and smaller reporting companies (SRCs) have no GHG emissions reporting requirements at all.5

The required GHG disclosures include:

- Scope 1 and Scope 2 emissions disclosed separately, each in aggregate, and in gross terms without purchased or generated offsets (see more information about the treatment of RECs below); and

- The methodology, significant inputs, and significant assumptions used to calculate the GHG emissions, including:

- The organizational boundaries, and the method to determine the boundaries. The registrant must describe the method used to determine those boundaries, and provide a brief explanation if the boundaries materially differ from the registrant’s consolidated financial statements’ discussion of its scope of entities and operations.6

- A discussion of the operational boundaries used and the approach to categorizing emissions and emissions sources; and

- The protocol or standard used to report GHG emissions, including the calculation approach, the type and source of any emissions factors used, and any calculation tools used to calculate the GHG emissions.7

Entities required to disclose Scope 1 and 2 emissions must report their emissions by the second fiscal quarter in the fiscal year after the emissions occurred. Registrants will be required to disclose historical emissions data but only beginning with the first period in which they were required to disclose emissions.8

b. The Treatment of RECs in GHG Disclosures

As discussed above, registrants are required to disclose their Scope 1 and Scope 2 emissions in gross terms without any purchased or generated carbon offsets. However, registrants can disclose Scope 2 emissions using the market-based method, which may involve RECs, location-based method of accounting, or both. However, the registrant must describe its methodology and should include a description of whether and how the RECs factor into its gross emissions calculation.9

Other DisclosuresIII. Other Disclosures that Reference Renewable Energy Use, Generation, Provision, and Investment

Renewable energy use, generation, provision, and investment can help reduce a registrant’s exposure to climate risks and can be a material tool in companies’ transition planning.10 Registrants can discuss how renewable energy plays a role in their transition plans and how renewable energy can be a tool to manage climate-related risks in Regulation S-K.

It is also worth noting that a number of disclosure requirements are triggered only if the registrant is already engaged in certain conduct. For example, a registrant is required to provide details about transition plans, internal carbon costs and scenario analyses if they already have transition plans, internal carbon costs and scenario analyses.

The SEC also acknowledges that avoiding engagement in the renewable energy sector can constitute a material risk for businesses. Notably, the rule cites the Inflation Reduction Act (IRA) as a potential source of transition risk, by stating that if a company produces or uses less energy efficient products, it could face material impacts to its business.11 The SEC also indirectly references renewable energy in its comment that “any widespread market-based transition to lower carbon products, practices, and services—triggered, for example, by recent or future changes in consumer preferences or the availability of financing, technology, and other market forces—can lead to material changes in a company’s business model or strategy and may have a material impact on a registrant’s financial condition or operations.”12

Information about renewable energy use, generation, provision, and investment can be disclosed in:

- Regulation S-K, Item 1502: Strategy: Registrants are required to disclose climate-related risks that have materially impacted or are likely to have a material impact on the registrant, including on its strategy, results of operations, or financial condition. If a registrant has adopted a transition plan to manage risks, it must describe the plan, and include the quantitative and qualitative disclosure of material expenditures incurred and material impacts on financial estimates and assumptions. Discussion of a company’s climate-related targets and goals can also be included as part of the strategy discussion.13

- Regulation S-K, Item 1503: Risk management: Registrants must describe any processes for identifying, assessing, and managing material climate-related risks. If managing a climate-related risk, the registrant must disclose whether and how any processes have been integrated into their overall risk management system or process.

IV. Analysis on the Treatment of RECs

Under the final rule, the SEC has singled out the use of RECs and carbon offsets from other actions and expenditures related to climate-related targets and goals. A key rationale in the rule is that the acquisition and use of carbon offsets and RECs do not “present the definitional or scoping concerns raised by commenters with respect to transition activities generally.”14 The SEC also comments that carbon offsets and RECs can also pose material risks to a business because of their “fluctuating supply or demand, and corresponding variability of price.”15

The rule often pairs discussion of carbon offsets and RECs together but briefly acknowledges that these instruments serve different purposes in corporate climate strategies.16 There are unique requirements for RECs versus carbon offsets in certain sections, such as the gross Scope 2 emission disclosure requirement that allows for RECs to be included in market-based accounting disclosures, whereas carbon offsets must be excluded from all gross GHG emissions disclosures. However, many of the requirements for carbon offsets and RECs do not uniquely distinguish between these instruments and the disclosures that are required for each.

Information required on the features of RECs was informed by comment letters which argue that that not all RECs are equal, and therefore information on the features of RECs could allow investors to determine the integrity and validity of the RECs, whether they have met the standards of an established standard setter body (e.g., the Greenhouse Gas Protocol), and any risks that could stem from policy and regulation changes.

Specifically, the SEC comments that disclosures on the origination and source of RECs (i.e., whether they are bundled or unbundled) and carbon offsets are needed to evaluate the “effectiveness of a registrant’s transition risk strategy and management of climate-related impacts on its business,”17 and to help deter against greenwashing.18 Notably, the SEC specifies a distinction between the quality of RECs that have “originated from and met the standards of a compliance market or [are] instead derived from a more loosely regulated voluntary market,” which can “affect the value and cost of the offsets and RECs and their attendant risks.”19

Lastly, as REC disclosures are considered “historical facts,” they are exempt from the safe harbor for certain climate-related disclosures (Item 1507), which only applies to forward-looking statements.20

Phase-in ScheduleV. Phase-in Schedule

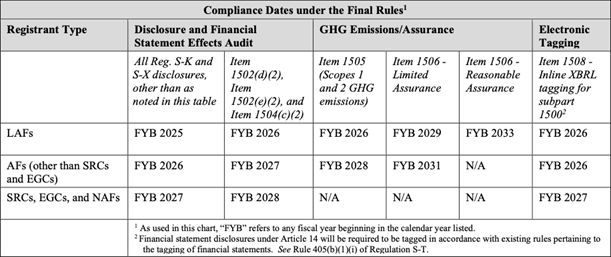

The table below describes the original compliance dates published by the SEC in the final rules;21 however, the rule is now delayed indefinitely pending the completion of judicial review.22

VI. Litigation Challenges

While companies are well advised to begin preparing for compliance, the final rules are being challenged in multiple appellate court proceedings that are now consolidated in a single case to be heard in the Eighth Circuit Court of Appeals. Following these challenges, the SEC voluntarily stayed the rule.23 There will be opportunities for interested parties to file briefs in the Eighth Circuit. ACORE will monitor the legal proceedings and update as warranted.

Author

ACORE Team Member

1 On April 4, the SEC voluntarily stayed the Final Rules pending judicial review. https://www.sec.gov/files/rules/other/2024/33-11280.pdf

2 SEC, The Enhancement and Standardization of Climate-Related Disclosures for Investors, https://www.sec.gov/files/rules/final/2024/33-11275.pdf, page 213

3 SEC, 465

4 Ibid.

5 SEC, 31.

6 SEC, 690 contains a discussion on this issue.

7 The SEC has allowed flexibility in GHG emissions reporting, allowing registrants to choose the methodology that best matches their circumstances. Although they noted that many companies use the GHG Protocol, they determined that providing flexibility would limit costs. SEC, 25-26.

8 SEC, 33-34.

9 SEC, 250, footnote 1030.

10 ACORE comments to the SEC, June 15, 2022, https://www.sec.gov/comments/s7-10-22/s71022-20131489-301852.pdf

11 SEC, 93.

12 SEC, 21.

13 SEC, 200.

14 SEC, 488.

15 SEC, 220.

16 SEC, 200-202, footnote: 797.

17 SEC, 207.

18 SEC, 680.

19 SEC, 221; footnote 842 “RECs purchased from a compliance market must meet certain standards and must be certified by an approved certifying group. RECs purchased in a voluntary market may or may not be subject to certain standards and technically are not required to be certified.”

20 SEC, 400; 867.

21 SEC, 589.

22 https://www.federalregister.gov/documents/2024/04/12/2024-07648/the-enhancement-and-standardization-of-climate-related-disclosures-for-investors-delay-of-effective

23 https://www.sec.gov/files/rules/other/2024/33-11280.pdf

Join leaders from across the renewable energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)