Renewable energy certificates (RECs) are a fundamental component underlying the operation of the U.S. clean energy market. By leveraging the distributed purchasing power of entities and individuals across the economy, REC sales help drive the development of new, and sustain existing, renewable resources.

Put simply, RECs are market accounting mechanisms used to substantiate claims of renewable electricity use – given that physical electrons consumed on a shared grid are indistinguishable by origin and generation fuel type. RECs provide a way for renewable purchases to demonstrate compliance with mandatory renewable obligations or voluntary claims of renewable electricity procurement.

| Compliance Purchasing | Voluntary Purchasing |

| Electricity service providers with mandated renewable obligations (i.e., state renewable portfolio standards) purchase RECs to demonstrate they have met requirements. | Business and residential customers purchase RECs to meet their sustainability goals and to prove they have met their self-imposed targets. |

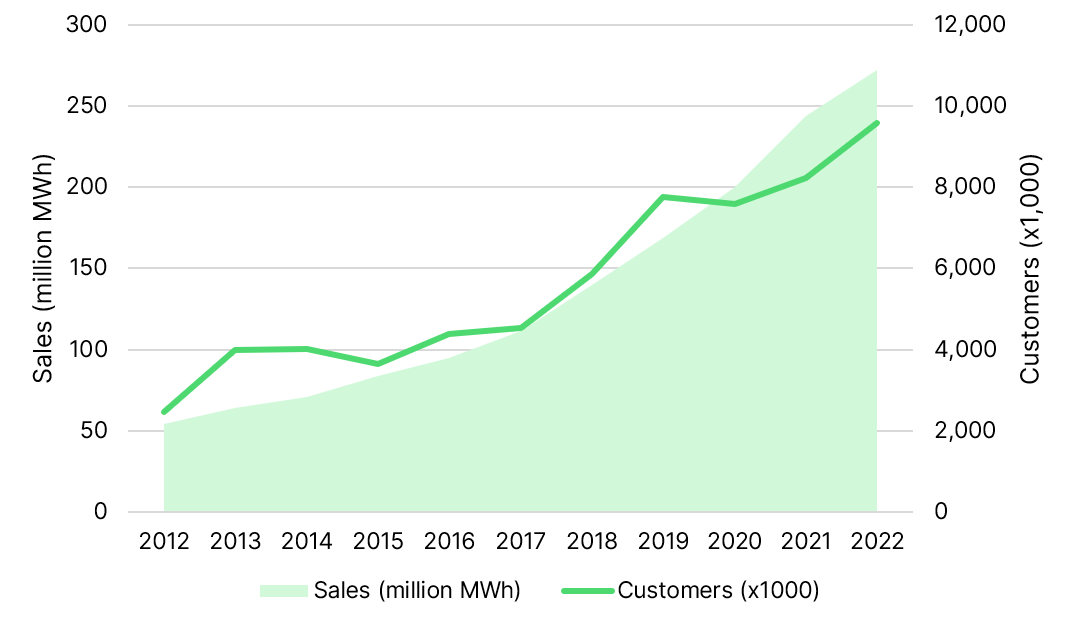

Voluntary Renewable Energy Procurement 2012-2022

Source: National Renewable Energy Laboratory, Status and Trends in the Voluntary Market (2022 Data)

There is a strong legal basis for RECs. They are the only mechanism to ensure that purchasers’ reporting of renewable procurement claims is verified, consistently and accurately measured, and uniquely retired to prevent double counting. Multiple government entities at different levels, regional electricity transmission authorities, non-governmental organizations, trade associations, and market participants have recognized that RECs represent and convey the non-power attributes of renewable electricity generation, along with the legal right to claim usage of that renewable electricity.

ValueVoluntary REC purchasing provides a critical value stream to renewable projects.

Many renewable energy projects that are operating now would not have been able to be financed or have continued operating without voluntary REC purchasing. This remains true despite cost efficiency improvements in renewable energy projects observed over recent years due to the variable nature of forecasted future generation and electricity market prices.

By providing additional sources of revenue for projects, voluntary purchasing helps create financial certainty to enable new projects to move forward or continue operating. Corporate buyers that sign power purchase agreements (PPAs) or virtual PPAs (vPPAs) create direct demand signals for renewable energy projects to come online. Projects cannot attract needed tax equity financing, which is responsible for one-third to two-thirds of a project’s capital stack, until an agreement with a PPA or vPPA offtaker is secured. In a vPPA, while the electricity is sold to the regional transmission organization (RTO) or local utility, the corporate buyer is transacting a financial swap that provides direct, long-term revenue to the project and the certainty needed to help it move forward. vPPAs also create demand for renewable generation in areas with good renewable resource potential but where regulation is not incentivizing demand sufficiently to promote new renewable development – allowing for the more efficient deployment of renewables across the U.S.

IncentiveThe revenue stream unbundled RECs provide can also serve as the inducement needed to incentivize new generation and keep projects operating.

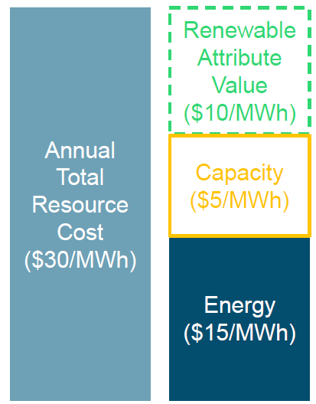

Unbundled REC sales account for a growing proportion of total renewable project revenue and make projects more attractive to investors and lenders. The REC revenue stream is increasingly important given the growing volatility in wholesale market pricing for other project revenue sources (i.e., energy, capacity, and ancillary services). Many renewable-rich states in the U.S. are in regions where there is no capacity market. Non-utility developed renewable resources are unable to capture resource adequacy value, such as those developed in the Midwest and Texas. Energy and ancillary prices are often low and/or volatile throughout several of these states, challenging the ability to finance projects solely off these revenue streams. RECs are, therefore, critical for project financing and thus favorably impact the economics of the renewable energy industry.

Unbundled REC purchasing from a new project over a multi-year period can provide the project with an important, long-term, reliable revenue stream. Furthermore, REC purchasing from a preexisting renewable project is also critical because REC sales were a part of the initial underwriting and financing of the project when it was developed. Projects do not typically have PPA offtakers through the full lives of the assets. The ability to obtain the benefit of merchant RECs after the end of the PPA supports the overall economics of a project. Without these REC sales, or an equivalent support mechanism, these projects may not have been built or be able to stay operational in the merchant phase.

Revenue Per MWh (Illustrative Values)

REC sales help align the supply-demand mismatch in the country’s renewable energy availability.

There are regions in the U.S. with high renewable supply but more limited REC demand (e.g., ERCOT), as well as regions with lower supply and higher demand (e.g., PJM). Furthermore, due to pricing variance across U.S. markets, RECs can be traded to capture arbitrage opportunities. The buying and selling of RECs both improves the economics of electricity procurement and continues to enable the buyer to substantiate renewable energy claims.

While the voluntary and compliance renewable energy markets generally operate separately, they can be complementary in providing multiple revenue streams that operate on different timetables for project developers. Renewable Portfolio Standards (RPS) targets generally increase incrementally over time, and renewable energy projects are often constructed in large increments to take advantage of economies of scale; therefore, available renewable generation may exceed current RPS requirements. Voluntary markets can help provide an alternative market for the output of excess renewable energy capacity, which can be beneficial for project developers.

REC arbitrage also reduces the cost of RPS compliance by allowing renewable energy to be generated where it makes the most economic sense, allowing greater geographic reach than a given electric delivery system provides and helping to reduce the need for new transmission and distribution. The flexibility RECs provide to meet RPS mandates translates into more renewable deployment. Unbundled RECs can be banked for months or longer, varying by market.

AvailabilityWhile certain renewable purchasing options are limited to certain customer segments, unbundled RECs are available to more than half of electricity consumers.

According to the Environmental Protection Agency (EPA), unbundled RECs are the only purchasing vehicle that are available to more than half of electricity consumers. In fact, 22% of total U.S. non-residential consumers do not have access to any green power supply option other than unbundled RECs. Given their lower barrier to entry, unbundled RECs are the primary way for many entities to claim the environmental attributes represented by renewable electricity. PPAs and vPPAs are limited to certain customer segments, and depend on an organization’s electricity load requirements, creditworthiness, internal risk policies on the tenure of the supply deals, and internal capabilities to enter into these agreements. Unbundled RECs, therefore, can be an equitable option to promote access to renewable energy across underserved customer segments.

RECs play a crucial role in the renewable energy landscape, serving as essential instruments for verifying and substantiating claims of renewable electricity use. They drive the development of emissions-free renewable resources by providing critical financial support for projects. As an accessible and equitable option for a significant portion of electricity consumers, RECs are a key tool in promoting widespread access to the environmental benefits of renewable energy.

Author

ACORE Team Member

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)