Introduction

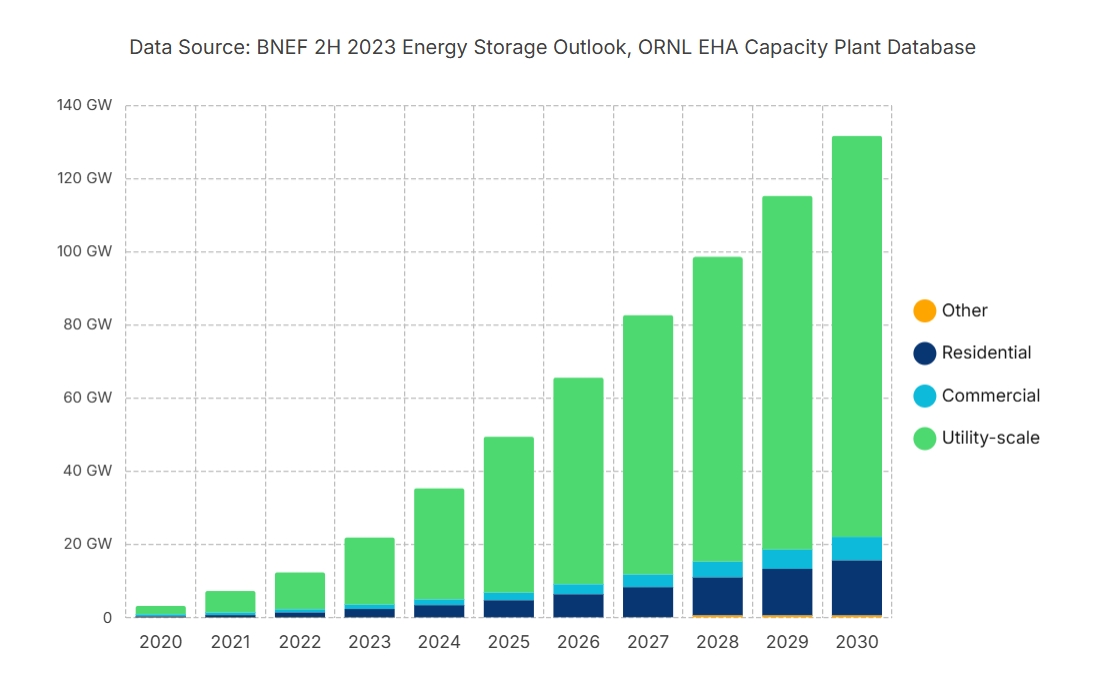

The U.S. energy storage market is prepared to skyrocket within the next decade to support the clean energy transition, with analysts projecting cumulative capacity to increase by more than tenfold by the end of 2030. The Inflation Reduction Act’s (IRA) tax credits for energy storage have significantly accelerated growth projections for both standalone and hybrid energy projects. Furthermore, state decarbonization targets, expanding corporate demand, and declining costs will continue to fuel growth. However, as discussed below, market headwinds could impede this trajectory.

Cumulative U.S. Energy Storage Deployment by Sector

*Chart excludes pumped storage hydro. As of 2022, the U.S. has approx. 22 GW of total pumped hydro capacity (ORNL EHA Capacity Plant Database).

Storage Technologies Are Diverse

Energy can be stored through a variety of forms, including batteries, thermal, hydrogen, pumped hydro, flywheels, and compressed air.

Energy Storage Provides Critical Services

- Peak Shaving: Energy storage can release stored energy during high-demand periods, which allows for “peak shaving” and reduced reliance on peaking power plants.

- Load Shifting: Energy storage can “shift” energy production from times of high generation and low demand to times of high demand and low generation. For instance, solar panels often produce more energy in the middle of the day than is needed, which can be stored and used during the evening peak hours when demand rises.

- Grid Stability and Reliability: In certain situations, rapid changes in renewable energy generation can cause imbalances on the power grid. Energy storage acts as a buffer, absorbing or releasing energy to maintain a stable grid.

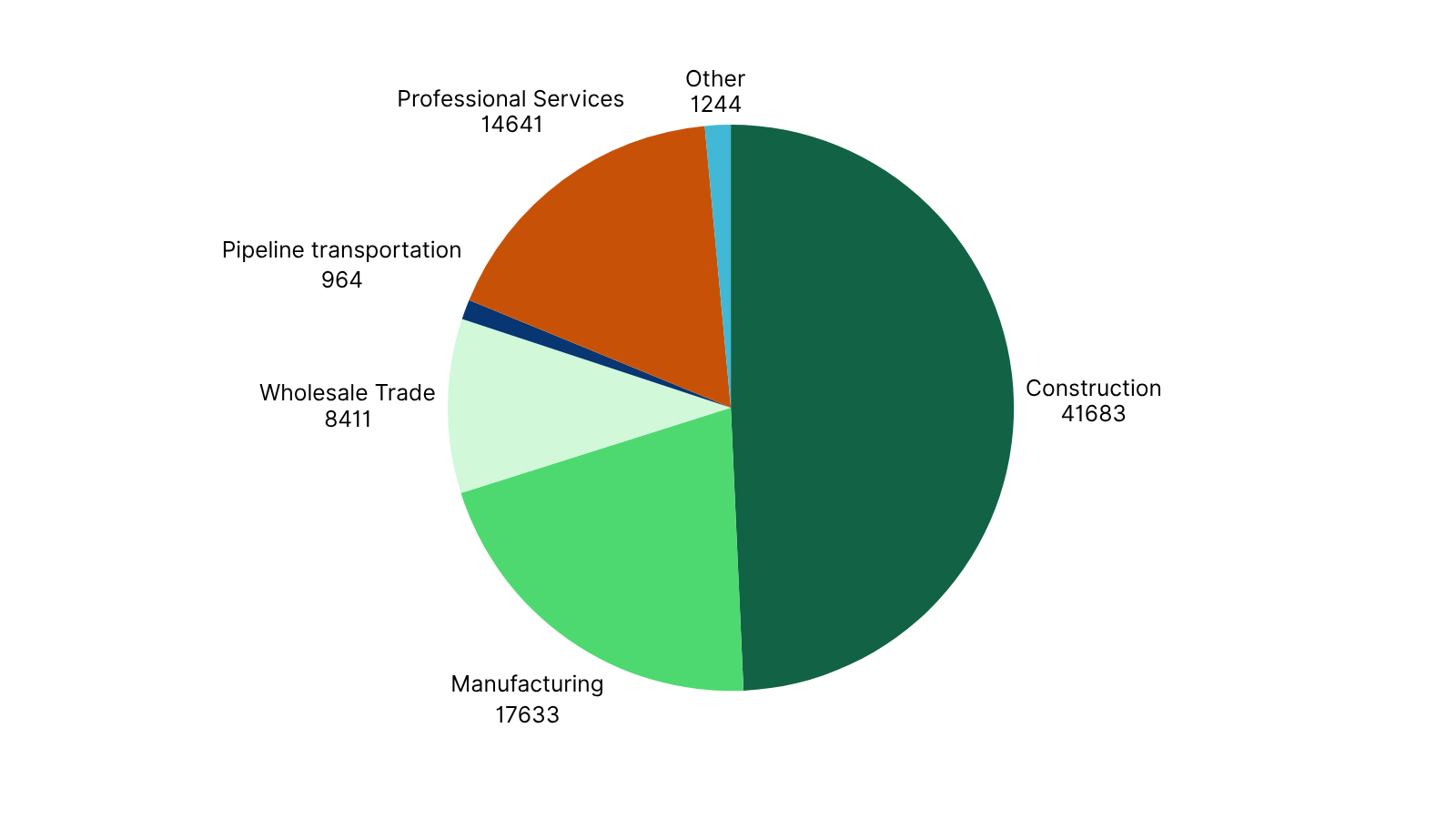

The Sector Employs a Growing Number of Americans

In 2022, the energy storage sector outpaced general U.S. workforce growth, expanding by 4.7% and providing gainful employment to nearly 85,000 people.

Energy Storage Deployment by Industry

Policy Changes Are Needed to Facilitate the Sector’s Potential

For energy storage systems to fully support the clean energy transition, it is critical for policymakers to continue to address certain obstacles:

- Market Design Adaptation: Existing wholesale market rules, predating the emergence of energy storage and hybrid technologies, are not fully aligned with these resources’ needs. Revised market rules are needed to ensure energy storage operations are fine-tuned for efficient charging and discharging activities, aligning with market demand and supply signals.

- Interconnection Queue Reforms: As of the end of 2022, over 680 GW of energy storage capacity is stalled in interconnection queues. To combat growing delays, it is crucial to further reform interconnection procedures and implement comprehensive transmission planning to expedite storage deployment.

- Supply Chain Resilience: It is essential to mitigate the potential impact of global supply chain disruptions in rare minerals (e.g., lithium, cobalt) and battery components that the U.S. battery sector relies upon. The U.S. should counter supply chain disruptions by leveraging policies like the IRA to boost domestic production of batteries and mineral resources, and promote battery recycling advancements to build a more robust and dependable supply framework.

Authors

ACORE Team Member

ACORE Team Member

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)