- Tax Incentives & Appropriations

- Fact Sheets

Treasury Department Notice of Proposed Rulemaking: Section 45X Advanced Manufacturing Production Credit

On December 14, 2023, the Treasury Department released guidance in the form of a notice of proposed rulemaking (NOPR) on the Section 45X Advanced Manufacturing Production Tax Credit, an uncapped, per-unit incentive under the Inflation Reduction Act (IRA) for key solar, wind, inverter, and battery components, and applicable critical minerals.

The proposed regulations offer important details on the eligibility and definition of various components, rules that taxpayers must follow regarding their production and sale, and special rules that apply to sales made to business affiliates, in addition to specific recordkeeping and reporting requirements. This document will detail relevant areas of the guidance, which the Treasury Department will seek to finalize by fall 2024.

The proposed regulation is open for a 60-day period for stakeholder comments, which are due February 13, 2024. Additionally, requests to speak and outline of topics will be discussed at a related public hearing scheduled for February 22, 2024 at 10 a.m. ET.

General RulesGeneral Rules

To claim the 45X credit, a taxpayer must produce an eligible component in full and sell it to an unrelated third party. Production entails a “substantial transformation” of base materials into a distinct eligible component that is functionally different than if “partial transformation,” “mere assembly,” or superficial modification” had occurred. Production of eligible components must be completed in 2023 or later, though production processes are allowed to have occurred before 2023. The 45X credit is available to contract manufacturing arrangements and partnerships, with specific applications for each.

Credit Amount

The proposed regulations provide that the 45X credit is equal to the sum of the applicable credit amount with respect to each eligible component produced and sold by the taxpayer. For additional details, see Eligible Components and Associated Credit Amounts below.

Stacking

The proposed regulations clarify that a manufacturer may claim the 45X credit for all of the eligible components it incorporates into a finished product, such as a battery module with integrated qualifying cells and electrode active materials.

Definition of “Produced by the Taxpayer”

“Produced by the taxpayer” means the manufacturing process conducted by the taxpayer that substantially transforms constituent elements, materials, or subcomponents into a “Produced by the taxpayer” means the manufacturing process conducted by the taxpayer that substantially transforms constituent elements, materials, or subcomponents into a complete and distinct eligible component. Specific considerations include:

- Partial transformation. The above definition does not cover partial transformation unless a complete and distinct eligible component is produced.

- Mere assembly or superficial modification. The above definition does not cover minor assembly of two or more constituent elements, materials, or subcomponents, or superficial modification of the final eligible component, barring a process by the taxpayer that results in a substantial transformation.

- Special rule for certain eligible components. For certain eligible components, such as solar grade polysilicon, the term “produced by the taxpayer” means processing, conversion, refinement, or purification of source materials.

- Example: Taxpayer A purchases a prefabricated wind turbine blade and applies paint and finishes. Taxpayer A has engaged in superficial modification of the blade and has not produced an eligible component.

Eligible Taxpayer

A taxpayer claiming the 45X credit must be the taxpayer that “directly performs” the production activities leading to an eligible component and must sell it to an unrelated person or third party.

- Special rule for contract manufacturing arrangements. If an eligible component is produced by a taxpayer pursuant to a contract manufacturing arrangement with one or more fabricators, the parties to such agreement may determine, by agreement, the party that may claim the 45X credit, so long as the required certification to this effect and overarching arrangement are entered into before final production of the eligible components occurs.

- Excluded arrangements: The proposed regulations bar two types of arrangements from accessing the 45X credit: (1) routine purchase orders for off-the-shelf property requiring de minimis modifications (2) and arrangements that the contractor knows or has reason to know can be satisfied with existing stocks or the normal production of finished goods.

- Example: “Taxpayers A, B, and C each produce one of three sections of a wind tower that together make up the wind tower. No Taxpayer has produced an eligible component within the meaning of section 45X(a)(1)(A) because no taxpayer has produced all sections of the component (wind tower).”

- Application to Partnerships: Alternatively, Taxpayers A, B, and C may claim the 45X credit by forming Partnership ABC, which produces all three sections of the wind tower and can claim the resulting eligible component. Unlike a contractor manufacturing arrangement, under which one party is entitled to the credit, Partnership ABC may allocate the 45X credit among the partners.

Timing of Production and Sale

Taxpayers may begin producing eligible components for purposes of the 45X credit before 2023, but both the production and sale of the components must occur in 2023 or later to claim the credit.

- Example: “Taxpayer A begins production of a related offshore wind vessel…in January 2022. Production is completed in December 2024 and the sale to an unrelated person occurs in 2025. Taxpayer A is eligible to claim the section 45X credit in 2025, assuming that all other requirements…are met.”

Definition of “Produced in the United States”

Sales are taken into account only for eligible components that are produced within the United States, as defined in section 638(1) of the Code.1 The domestic production requirement under this definition does not apply with respect to the constituent elements, materials, and subcomponents used in the production of eligible components.

Production and Sale in a Trade or Business

An eligible component produced and sold by the taxpayer is taken into account only if the production and sale are in a trade or business of the taxpayer.2 The proposed regulations reference existing Treasury rules disallowing a sale between disregarded subsidiaries of a common parent, but there can be a sale between corporate entities who together file a consolidated federal income tax return.3

Integrated, Incorporated, or Assembled

“Integrated, incorporated, or assembled” encompasses production activities by which an eligible component that is a constituent element, material, or subcomponent is substantially transformed into another complete and distinct eligible component, excluding mere assembly or superficial modification.

Sale of Integrated Components

A taxpayer is treated as having produced and sold an eligible component to an unrelated person if such component is integrated, incorporated, or assembled into another eligible component that is then sold to an unrelated person.

- Example: A taxpayer integrates solar wafers into cells in 2023 that are then sold to an unrelated or third party in 2024. The taxpayer who produced and sold the solar wafers is eligible to claim the 45X credit in 2023.

Application

A taxpayer may claim the 45X credit for each eligible component the taxpayer produces and sells to an unrelated person, including any eligible component used as a constituent element, material, or subcomponent and was integrated, incorporated, or assembled into another distinct product or eligible component that the taxpayer also produces and sells to an unrelated person.

- Example: “In 2022, A, a domestic corporation that has a calendar tax year, begins production of electrode active materials that are completed in 2023 and incorporated into battery cells that A also produces. In 2024, A incorporates those battery cells into battery modules…and integrates the battery modules into electric vehicles. A sells the electric vehicles to B, an unrelated person, in 2024. A may claim a section 45X credit for the electrode active materials, the battery cells, and the battery modules in 2024.

Rule for Anti-Abuse

The 45X credit is not allowable if the primary purpose of the production and sale of an eligible component is to obtain the benefit of the credit in a wasteful manner (e.g., discarding, disposing, or destroying components) without putting the component to a productive use.

Interaction Between Sections 45X and 48C

Eligible components for which the 45X credit are claimed must not be produced at a facility for which the Qualifying Advanced Energy Project Investment Tax Credit (48C) credit has also been claimed, subject to certain parameters.

- Section 45X facility. Includes all tangible property that comprises an independently functioning production unit that produces one or more eligible components.4

- Section 48C facility. Includes all eligible property in a qualifying advanced energy project for which a taxpayer receives an allocation of 48C credits and claims such credits after August 16, 2022.5

- Example: Two independent production units— taxpayer owns and operates a manufacturing site that contains Production Unit A and Production Unit B, each of which function independently and are arranged in serial fashion. Photovoltaic wafers produced by Production Unit A are utilized in Production Unit B to manufacture photovoltaic cells. Taxpayer was allocated a section 48C for a section 48C facility that includes Production Unit A and subsequently placed the section 48C facility and Production Unit A in service in taxable year 2026. Taxpayer claimed a section 48C credit for Production Unit A for taxable year 2026.

- Analysis: Production Unit A is eligible property included in Taxpayer’s 48C facility and, therefore, cannot qualify as a 45X facility. Production Unit B, however, is tangible property that comprises an independently functioning production unit that produces eligible components and, therefore, can be treated as a 45X facility.

- Example: Single production unit— taxpayer owns and operates two manufacturing sites. Manufacturing Site 1 includes tangible property that forms ingots from policysilicon to partially produce photovoltaic wafers. Manufacturing Site 2 completes the production process of the photovoltaic wafers. Taxpayer was allocated a section 48C credit for tangible property that is used to produce the ingots at Manufacturing Site 1.

- Analysis: Manufacturing Sites 1 and 2 comprise a single production unit. As a result, Taxpayer may not claim the credit because the 48C credit was claimed for tangible property used to produce the ingots at Manufacturing Site 1, which is part of a single production unit.

Eligible Components

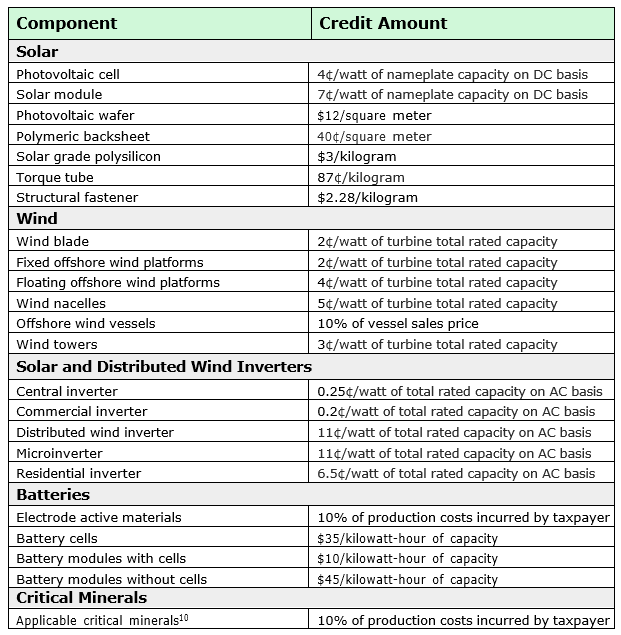

The proposed regulations offer specific definitions for various eligible components and their respective per-unit credit amount for purposes of the 45X credit, which are detailed in Figure 1 below. Products that do not fit any of the descriptions under the proposed regulations are ineligible even if they were designed to perform the same function.

Solar Energy Components

The proposed regulations define “solar energy components” to include a solar module, photovoltaic cell, photovoltaic wafer, solar grade polysilicon, torque tube, structural fastener, or polymeric backsheet.

- Solar cells and modules. The credit amount is equal to the respective per-unit credit amount multiplied by the capacity of each unit. The taxpayer must document the capacity, referring to nameplate capacity (expressed on a direct current watt basis) of the applicable component in a bill of sale or design documentation, such as International Electrotechnical Commission (IEC) certification.6

- Solar wafer, polymeric backsheet, solar grade polysilicon. Wafers must be produced by a single manufacturer to a dimension of at least 240 square centimeters. The proposed regulations also specify technical characteristics of qualifying polymeric backsheets and solar grade polysilicon.

- Structural fasteners and torque tubes. Structural fasteners and torque tubes are defined as eligible solar tracker components. Torque tubes must be part of a solar tracker to be eligible for the credit. Structural fasteners must be used in one of three ways (1) connect the mechanical and drive system components of a solar tracker to the foundation of such solar tracker, (2) connect torque tubes to drive assemblies, (3) or connect segments of torque tubes to one another.

Wind Energy Components

The proposed regulations define “wind energy components” to include a blade, nacelle, offshore wind foundation, or related offshore wind vessel.

- Wind blades, nacelles, towers, and offshore wind foundations. The credit amount is equal to the respective per-unit credit amount multiplied by the total rated capacity of the completed wind turbine. The taxpayer must document the total rated capacity, referring to the nameplate capacity (expressed in watts), at the time of sale as certified to relevant national or international standards.7

- Related offshore wind vessels. The term “related offshore wind vessels” is further defined as any vessel that is purpose-built or retrofitted for purposes of the development, transport, installation, operation, or maintenance of offshore wind energy components. The credit amount is equal to 10 percent of the sales price of the vessel, which does not include the price of maintenance, services, or other similar items that may be sold with the vessel.

- Purpose-built vessel. A vessel (1) built to be capable of performing various functions (i.e., developing, transporting, installing, operating, or maintaining offshore wind energy components) (2) and of a type commonly used in the offshore wind industry.

- Retrofitted vessel. A vessel (1) previously incapable of performing the various functions described above prior to being retrofitted, (2) for which the retrofit causes it to be capable of performing such functions, (3) and of a type commonly used in the offshore wind energy industry.

Inverters

The proposed regulations define “inverter” to include an end product that is suitable to convert direct current (DC) electricity from 1 or more solar modules or certified distributed wind energy systems into alternating current (AC) electricity, apparently limited to those suited for solar and distributed wind projects, excluding storage and other applications.

- Solar and distributed wind inverters. For the inverter categories listed above, the credit amount is generally equal to the respective per-unit credit amount multiplied by the total rated capacity (expressed on an AC watt basis) of the inverter according to a specification sheet, bill of sale, or similar documentation.

Battery Components

The term “qualifying battery component” comprises electrode active materials, battery cells, or battery modules. The proposed regulations clarify that this definition includes emerging battery storage technologies such as thermal batteries and flow batteries.

- Electrode active materials. The credit amount is equal to 10 percent of the costs incurred by the taxpayer with respect to the production of such materials.

- Battery cells and modules. The credit amount is generally equal to the respective per- unit credit amount multiplied by the capacity of each unit, which must be measured in accordance with a national or international standard, provided that the capacity- to-power ratio of such battery cell or module does not exceed 100:1.8,9

- Modules with no battery cells. Taxpayers must document capacity with a testing procedure that complies with a national or international standard published by a recognized standard setting organization. Absent such standards, taxpayers must rely on future regulations.

Applicable Critical Minerals

The term “applicable critical mineral” comprises any of the various minerals outlined in the proposed regulations. For any applicable critical mineral, the credit amount is equal to 10 percent of the production costs incurred by the taxpayer. Further details are below.

Sales of Eligible Components

The 45X credit must either be sold to an unrelated third party or integrated by the manufacturer into another distinct eligible component that is later to sold to an unrelated third party. Manufacturers may sell eligible components to an affiliated party upon their resale to an unrelated third party or via a special “Related Person Election” filed with the Internal Revenue Service (IRS).

Special Rule for Sale to Related Person

A taxpayer is treated as selling an eligible component to an unrelated person if a related person to the taxpayer sells such component to an unrelated person.

- Example: “A and B are members of a group of trades or businesses…[and] are related persons…Each of A and B has a calendar tax year. C is an unrelated person. A is in the trade or business of producing and selling solar modules. A produces and sells solar modules to B in 2023. B sells the solar modules to C in 2024. A may claim a section 45X credit for the sale of the solar modules in 2024, the taxable year of A in which B sells the solar modules to C.”

Related Person Election

The proposed regulations establish a Related Person Election to treat a sale of an eligible component to a business affiliate as if it was made to an unrelated third party.

- Members of a consolidated group. A member of a consolidated group that sells eligible components in an intercompany transaction may make the Related Person Election to claim the 45X credit in the year of the intercompany sale.11

- Time and manner of making election. A taxpayer must make an affirmative Related Person Election annually on the taxpayer’s timely filed original Federal income tax return. The Related Person Election will be applicable to all sales of eligible components to business affiliates and other related persons by the taxpayer during the taxable year in which the 45X credit and Related Person Election were claimed.

- Scope and effect of election. A separate Related Person election must be made with respect to related person sales made by a taxpayer for each eligible trade or business of the taxpayer.

- Application to consolidated groups. For a trade or business of a consolidated group, a Related Person Election must be made by an agent on behalf of the members of the group. A separate election must be filed for each member claiming the 45X credit.

- Application to partnerships. The Related Person Election for a partnership must be made on its timely filed original Federal income tax return and does not apply to any trade or business conducted by a partner outside the partnership.

- Anti-abuse rule. The Related Person Election is subject to the anti-abuse rules described further above.

Sales of Integrated Components to Related Person

A taxpayer that produces and then sells an eligible component to a related person, who then, integrates, incorporates, or assembles the taxpayer’s eligible component into another complete and distinct eligible component that is subsequently sold to an unrelated person, may claim the 45X credit.

- Example: “A, B, and C are domestic C-corporations that are members of a group of trades or businesses…[and] are related persons…. Each of A, B, and C has a calendar tax year. A produces electrode active materials (EAMs) and sells the EAMs to B in 2023. In 2024, B incorporates the EAMs into battery cells that it produces and sells the battery cells to C. In 2025, C incorporates the battery cells into battery modules…that it produces and sells the battery modules to D, an unrelated person. A may claim a section 45X credit for EAMs sold to B, B may claim a section 45X credit for the battery cells sold to C, and C may claim a section 45X credit for the battery modules sold to D in 2025, the taxable year of each of A, B, and C in which the battery modules are sold to D.”

Pass-thru from Estates and Trusts

The Treasury Department intends to provide rules addressing how the 45X credit applies in the case of pass-thru from estates and trusts and requests additional public comments.

1 For purposes of section 45X and the section 45X regulations specifically, Treasury relies on the meaning of the term “possession” provided in section 638(2) of the Internal Revenue Code (IRC).

2 Defined within the meaning of IRC section 162.

3 See §1.1502-77.

4 “Production unit” is the tangible property that substantially transforms the material inputs to complete the production process of an eligible component.

5 “Eligible property” is (1) necessary for the production of recycling of property described in section 48C(c)(1)(A)(i), re-equipping an industrial or manufacturing facility described in section 48C(c)(1)(A)(ii), or re-equipping, expanding, or establishing an industrial facility described in section 48C(c)(1)(A)(iii); (2) tangible personal property, or other tangible property (not including a building or its structural components), but only if such property is used as an integral part of the qualified investment credit facility; and (3) with respect to which depreciation (or amortization in lieu of depreciation) is allowable.

6 On “design documentation,” the proposed regulations reference as examples IEC 61215 and IEC 60904.

7 On “relevant national or international standards,” the proposed regulations reference as examples IEC 61400, or ANSI/ACP 101-1-2021, the Small Wind Turbine Standard.

8 On “a national or international standard,” the proposed regulations reference as an example IEC 60086-1 (Primary Batteries) and further direct stakeholders to reference the United States Advanced Battery Consortium (USABC) Battery Test Manual for guidance on equivalent examples.

9 The term “capacity-to-power ratio” refers to the ratio of the capacity of such cell or module to the maximum discharge amount of such cell or module.

10 The 50 applicable critical minerals are as follows: Aluminum, Antimony, Arsenic, Barite, Beryllium, Bismuth, Cerium, Cesium, Chromium, Cobalt, Dysprosium, Erbium, Europium, Fluorspar, Gadolinium, Gallium, Germanium, Graphite, Hafnium, Holmium, Indium, Iridium, Lanthanum, Lithium, Lutetium, Magnesium, Manganese, Neodymium, Nickel, Niobium, Palladium, Platinum, Praseodymium, Rhodium, Rubidium, Ruthenium, Samarium, Scandium, Tantalum, Tellurium, Terbium, Thulium, Tin, Titanium, Tungsten, Vanadium, Ytterbium, Yttrium, Zinc, Zirconium.

11 The term “intercompany transaction” is defined according to its meaning under §1.1502-13(b)(1)).

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)