Making Sure Renewable Energy is in Your Business Plan for the Economic Recovery

By: Mona Dajani, Partner and Global Head of Energy and Infrastructure, Pillsbury Winthrop Shaw Pittman LLP

July 1, 2020

While stay-at-home orders, travel restrictions and global supply chain constraints have led to renewable energy project delays, and challenges securing financing and monetizing federal tax credits, there’s consensus among industry observers that renewable energy needs to be part of the solution in the economic recovery from COVID-19. Investor interest in renewables remains strong, and sustainable values have become all the more pressing during this pandemic.

“I am more convinced than ever that this is the right thing to do, and we need to crack on with it,” BP CEO Bernard Looney recently told The Guardian newspaper.

BP announced that it will accelerate – not slow down – its planned transition to a lower-carbon economy. BP’s fresh commitment to achieve net-zero emissions will balance the carbon footprint of its fossil fuel products with reductions elsewhere, including building more wind and solar farms. Moreover, on June 15, BP reaffirmed its view that oil and natural gas prices and consumer demand for fossil fuels may never fully recover. The company said it is reevaluating whether it will develop all of its fossil fuel assets, and is writing off up to $17.5 billion in the second quarter.

Other energy supermajors including Shell, Enel, Total, and Aramco, are also doubling down on renewables, as climate impacts mount, pressure to cut carbon grows, and investors seek favorable rates of return in the sector.

Growth in Sustainable Investment

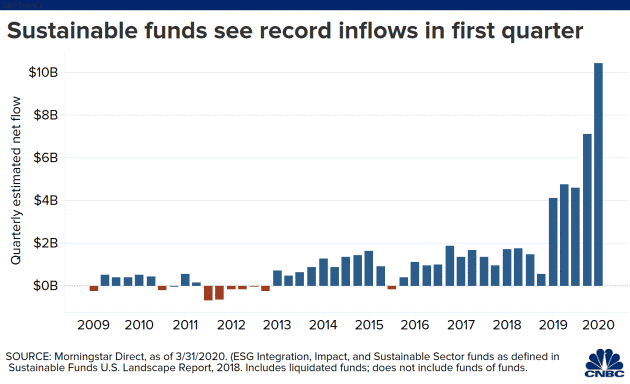

Post-pandemic, we will continue to see a shift in the fundamentals of doing business. Despite market volatility, U.S.-listed sustainable funds are seeing record inflows this year. While this growing focus on sustainability is promising, the lack of transparent and meaningful standards remains both a challenge and an opportunity with ESG investing.

Companies promising a sustainable future should be asked which global standard they support to achieve transparency for all their sustainability claims.

The Importance of Standards Remains

With so many buzzwords and so little standardization surrounding climate-related investments, it’s been easy to talk the talk without walking the walk. For that reason, market analysts from Moody’s to Dow Jones are helping score the over $12 trillion of sustainability investments of which ESG investing is part. Financial institutions, energy companies and the C&I sector are seeking a universal climate benchmark to accelerate the transition to renewable energy. And renewable energy advocates have begun to examine how corporate sustainability goals are measured. In a report issued last fall, ACORE outlined ways ESG scoring can be improved to better reflect renewable energy use and investment.

One mechanism for improved transparency is CDP, formerly known as the Carbon Disclosure Project. This nonprofit runs a global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts. As of today, more than 8,400 companies have submitted climate disclosure reports and received a score for their awareness of the issues, management methods, and action on renewable energy and other solutions.

In addition, prominent U.S. public investment firms like Hannon Armstrong, a company solely dedicated to investments in climate change solutions, use proprietary methodologies like Hannon’s Carbon Count Score to incorporate climate risk into their investment strategies. As these markets expand, standardizing and optimizing these disclosure and rating methodologies becomes increasingly important.

From the Business Roundtable’s “Purpose of a Corporation” declaration to forward-looking planning at businesses of all sizes across the U.S. and the world, there is an increasing recognition that the future will belong to companies taking tangible steps today to build a more sustainable and prosperous tomorrow.

Mona Dajani is a partner and the international leader of the Energy, Infrastructure & Water team at Pillsbury Winthrop Shaw Pittman in the New York and London offices. As a market dealmaker in the renewable energy industry for over 20 years, she has led numerous acquisitions, dispositions, financing, leasing, and project development transactions involving energy and infrastructure facilities in the U.S. and globally.

Ms. Dajani, who holds an MBA as well as a law degree and is a professional licensed engineer, also works with a wide array of commercial and public institutions, sponsors, private equity funds, utilities, investment banks and others in the structuring and negotiation of joint ventures, project contracts and financing connected to the development, financing and leasing of complex energy and infrastructure projects, equipment and facilities. Ms. Dajani was identified for her work in renewable energy as one of “The Decade’s Most Influential Lawyers” by the National Law Journal, and was named one of the “Five Most Influential People in Energy” by Euromoney/Institutional Investor.

Join leaders from across the renewable energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)