2018 Outlook: Resilient Investors Cautiously Optimistic for New Year

The uncertainty surrounding tax reform kept many U.S. renewables investors in “wait-and-see” mode throughout 2017. Those brave enough to push forward despite the political backdrop did so vigilantly, with many expending additional financial and legal resources to keep their options open. Each legislative turn drove new scenarios and document drafts.

Without a confirmed corporate tax rate or tax reform timeline until nine days before the new year, project capital stacks remained opaque, delaying many project finance, and mergers and acquisition (M&A) processes. That said, thanks to lobbyist efforts, the final bill was a noticeable improvement since the U.S. House first proposed numerous industry killing items. With firms still digging through the details, 2018 will start slowly as many investors recalibrate their paths forward. We expect an active second half of 2018 with the potential to accelerate in Q2.

Additionally, we expect technology companies will plug some gaps in the tax equity market due to their increased tax liabilities from the repatriation of overseas profits. The top tech giants have approximately $700 billion of cash overseas they intend to bring back to the U.S. These companies have invested in and receive power from renewable projects already.

Renewables Investment Figures

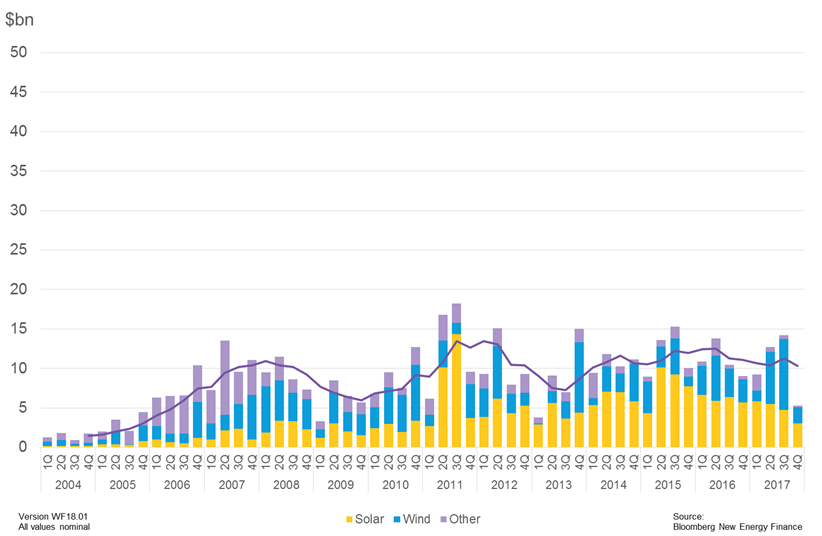

Overall, 2017 was surprisingly resilient regardless of the conversations on tax reform and the solar trade case, both of which ramped up in the fourth quarter. In fact, Q4 2017 investment dropped by 42 percent versus 2016 levels, and 52 percent compared to the average Q4 investment amount from 2012-2016, according to Bloomberg New Energy Finance’s latest Clean Energy Investment Trends report. See below for visual quarterly breakdown across solar, wind and other categories. “Other” includes small hydro, geothermal, marine, tidal, biomass & waste, low carbon services, storage and digital technologies.

Quarterly New Investment in Clean Energy, United States, by Sector ($Bn)

Note: Quarterly data excludes R&D and asset finance for energy smart technologies. Source: Bloomberg New Energy Finance

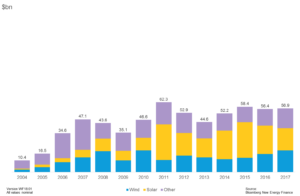

Assessing investment on an annualized basis tells a different story. 2015-2017 yearly figures show that investment was nearly flat, indicating perhaps that the industry’s approach was business as usual despite the political volatility.

Annualized New Investment in Clean Energy, United States, by Sector ($Bn)

Source: Bloomberg New Energy Finance

Tax Equity Market Update

The tax equity market remained relatively strong. Investment in wind and solar fell by nine percent from $11 billion in 2016 to $10 billion in 2017, according to J.P. Morgan’s John Eber on Norton Rose’s Cost of Capital call earlier this month. Solar’s drop from $4.6 billion in 2016 to $4 billion in 2017 was partially expected as net metering regulation took hold and developers indicated they were cutting back on growth to focus on profitability. Bank of America’s Jack Cargas added that he too was surprised with the outcome noting that the market remained more competitive than expected. Structures continued to evolve throughout the year for the benefit of sponsors and tax equity investors.

2018’s outlook should remain consistent with 2017 once investors recalibrate after adapting to the new tax laws. Here’s a brief look at how tax equity will address some of the tax reform provisions:

Base Erosion Anti-Abuse Tax

A handful of tax equity investors are heavily impacted by the Base Erosion Anti-Abuse Tax (BEAT) and, thus, are on pause to further understand and forecast its implications. This is delaying transaction processes by several months. Some foreign investors will need even longer to direct BEAT mitigation strategies. Some of these investors are attempting to push the corporate BEAT issues into their partnerships with sponsors, which we believe is not a sustainable solution.

We expect some of the approximately 45 tax equity investors to fully exit the market due to BEAT if it remains unchanged. The investors that depart will create increased opportunities for others. There is still appetite from tax equity investors for strong projects with experienced sponsors.

As we saw in 2017, and as published by Forbes last year highlighting CohnReznick’s position (see Renewable Energy Tax Credits – Forever? September 2017), we anticipate new investors to continue entering the market, but cautiously. However, newer investors present uncertainty because they may be less sophisticated and have a steep learning curve. That said, they too have budget targets to hit and are committed to the space. We also expect some wind developers to consider Pay-Go structures or the Investment Tax Credit to limit downside risks of BEAT’s clawback ruling.

Finally, we remain hopeful there will be adjustments to tax credit treatment as it relates to BEAT with potential for improvements such as allowing unmonetized renewable tax credits under BEAT to carry forward. Timing for this, however, remains uncertain. A change of this nature would position impacted investors to dive back in and further invest in the space.

Corporate Tax Rate

In addition to further delays due to BEAT, a lower tax rate creates more stress on tax equity investment capacity, now with smaller tax liabilities. For some, it is also a question of how to allocate a potential shrinking investment budget across their non-renewable energy tax credit programs (e.g., low-income housing and historic tax credits).

Generally, a lower tax rate also puts downward pressure on tax equity investors’ appetite for deals because they have fewer liabilities that must be offset by tax credits and depreciation. This should have a reduced effect on the larger U.S. banks that maintain a safe distance from their total tax liability. Some banks generate additional revenue by cross-selling products for equipment sales, hedges, and lending. Lowering tax equity deal flow could impact profitability in other business lines and, therefore, we would not anticipate a significant reduction in their annual investment volume. However, we expect midsize corporations will need to reduce investment volume targets to some extent. Yet they still must support client relationships that they’ve worked hard to develop over years and, equally important, to support renewable energy proliferation. They will do their best to proceed strategically.

Lower tax rates will reduce depreciation benefits as well, causing tax equity upfront investments to shrink. According to Eber, a wind tax equity investment will experience an average reduction of eight percent while solar will have a more modest three percent drop. In these cases, the sponsor will be expected to make up the difference, most likely with debt.

Bonus Depreciation

Investors generally do not elect bonus depreciation in favor of spreading their tax capacity over more projects and a longer yielding investment life. However, we may see some investors using bonus in 2018 as a competitive advantage in wind deals and to help sponsor partners offset the reduced economics due to tax rate reduction. Over time, we expect continued trends in equipment cost, efficiency improvements, and revenue contract adjustments to help neutralize lost tax rate economics. The 100 percent bonus election, however, can be a material real-time remedy for shovel-ready projects.

2018 Trend Predictions

There are several trends to look for in 2018 that could impact investment. Despite progress, corporate adoption of direct offtake agreements has been slower than expected. The lack of process uniformity continues to make diligence and financing challenging.

Corporates might contend, however, that it isn’t their fault. According to a recent report by the Wind Energy Foundation (WEF) that was covered by Wind Power Monthly, “transmission planners are failing to account for up to 51 gigawatts (GW) of potential near-term corporate procurement of renewable energy.” General Motors (GM) global manager of renewable energy Rob Threlkeld noted that his company’s “ability to access renewable energy is key to our decisions about where to expand new facilities.” GM is part of the RE100 group pledging to procure 100 percent of its electricity from renewable energy by 2050.

Expect technology companies to be active investors this year, plugging some of the gap in tax equity investment volumes. Many tech firms are already committed to renewable energy. They have several years of experience as tax equity investors outside of renewables and as renewable energy offtakers. As they begin repatriating overseas profits, technology companies will seek to offset their larger than usual tax liabilities through renewables investments. Furthermore, these companies are seeing direct investing as another way to support the acceleration of the shift to clean energy. The top eight tech companies have an estimated $700 billion they want to repatriate. This will have a material financial impact for them over the next 8-10 years.

S&P 500 Companies with the Highest Share of Cash Held Overseas

Source: Bloomberg, Nov. 2017, 10ks and 10Qs

Secondly, basis risk is hurting growth in resource rich areas more than previously expected. We expect this to continue in 2018, especially in the Panhandle region. The aforementioned WEF report noted that planned transmission demand through 2025 will only meet 42 percent of corporate renewables demand.

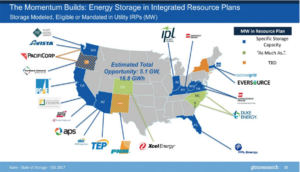

To the positive, initially reluctant Southeast and Midwest utilities are joining renewable mainstays and embracing their solar resources, per Greentech Media.

Source: Greentech Media

This trend was recently augmented by Shell’s 44 percent acquisition of Tennessee-based solar developer Silicon Ranch, which was disclosed on Jan. 15. Silicon Ranch has a substantial development pipeline in the Southeast.

A second trend is further integration of storage technologies into renewable energy projects. Greentech Media again highlighted this as a major focus for utilities stating that “there are already modeled, eligible or mandated plans accounting for 5.1GW of storage.”

Source: Greentech Media

Finally, in addition to corporate M&A, we believe there will be heightened activity in secondary wind and solar sales that will hit highs in trading volume in 2018. This activity will be sustained as renewables arrive as a mature industry.

The adjustment in tax rate, BEAT, and continued unfavorable political environment should not slow renewable energy’s momentum. The solar trade case will have deleterious implications, but after an initial contraction, we expect a stabilization to occur. According to a recent Energy Information Administration study, 25GW of newly installed utility-scale generating capacity came online in the U.S. in 2017, with about 50 percent of that total coming from wind, solar and other renewables. Over time, we expect that trend to continue.

EDITOR’S NOTE: This guest blog was written by ACORE Member CohnReznick Capital, and originally appeared on the CohnReznick Capital Blog

Join leaders from across the renewable energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)