- Fact Sheets

Transferability Enables U.S. Energy Investments & Innovation

Transferability has rapidly transformed how companies invest in affordable, reliable, and clean energy projects. Introduced for federal energy tax credits in 2022, it has established a simpler process for energy sector financings, allowing companies across the economy to invest in a broad spectrum of generation technologies and domestic manufacturing facilities. Founded on market principles, transferability marshals the benefits of the private markets to drive a healthy, transparent and liquid market to tax credits.

Why Transferability Matters

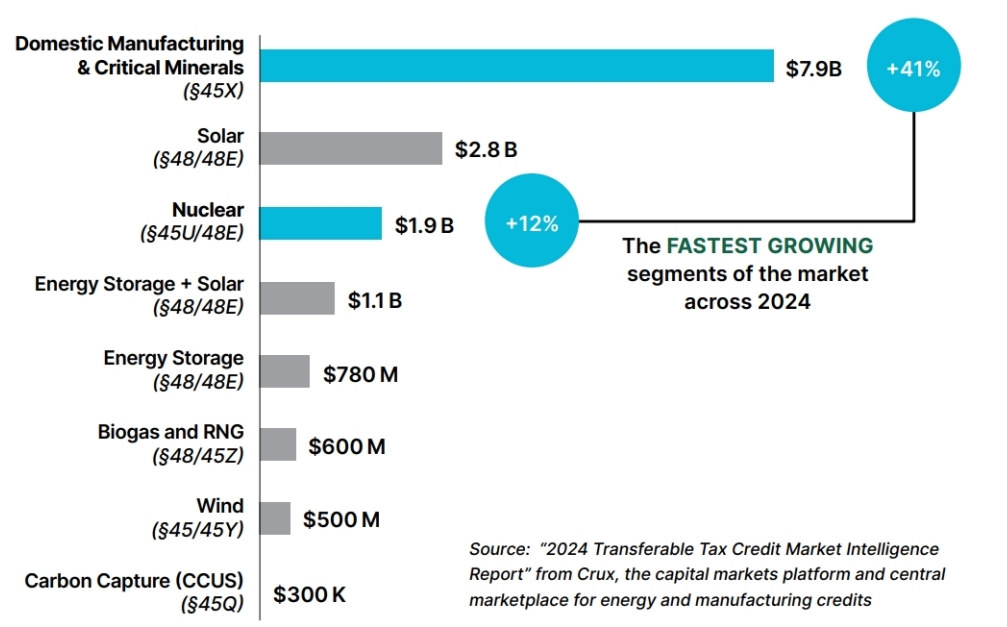

- Finances Advanced Technologies: Technologies newly eligible for tax credits – advanced nuclear, CCUS, biogas/RNG, storage, and manufacturing and critical minerals – made up 72% of the direct tax credit transfer market in the second half of 2024.i

- Benefits Small Businesses: Transferability promotes innovation and access to the market by non-traditional participants like smaller businesses.

- Boosts Private Spending and Lowers Costs: Every $1 of transferable tax credits generates $2.68 in capital expenditures and leads to $5 in spending in the U.S. economy.ii Transferability contributes to lower costs by supporting more diverse and resilient domestic energy production

- Heightens U.S. Competitiveness: Transferability supports competitiveness and national security by strengthening domestic supply chains.

How Transferability Works

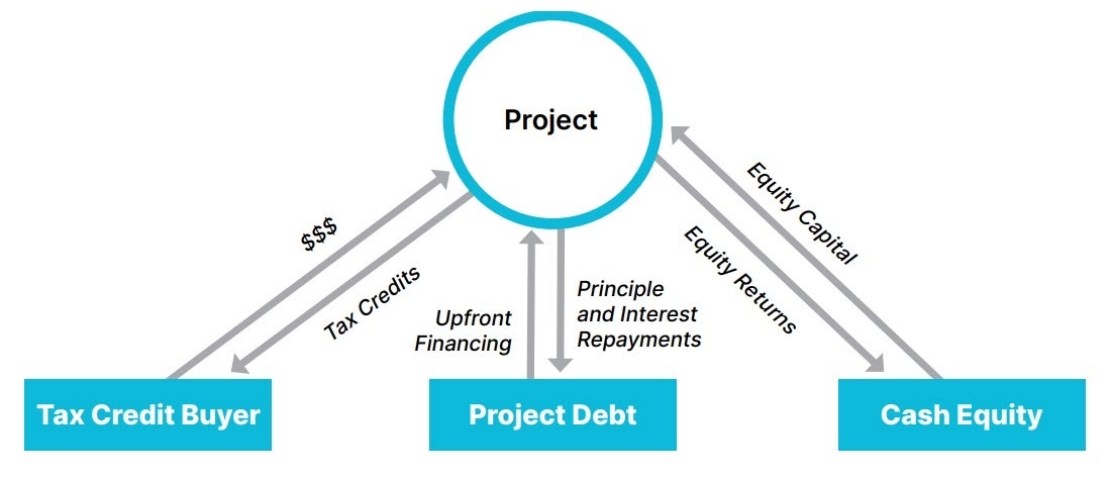

Transferability provides a way for developers of energy projects to benefit from the federal tax credits they can receive for building new manufacturing and critical minerals production facilities, nuclear, CCUS, geothermal, hydropower, hydrogen, solar, wind, energy storage, and other advanced technologies. Tax credit investments typically make up between one-third to two-thirds of the overall investments in these energy projects and are a critical way to raise capital for construction and get steel in the ground.

Project developers often do not have the tax capacity to use the credits themselves, and transferability allows them to sell the credits to a third party through a straightforward transaction. Because the tax credit buyer bears the risk of recapture or disallowance, this structure ensures private market oversight of the program and compliance with laws and regulations.

Who Benefits

Previously, only large banks could invest in energy tax credits through more complex tax equity arrangements, which involve taking on a multi-year ownership position in an energy project. While tax equity still plays a role in the market, transferability lowers the stakes for these investments and allows investors to focus on specific value streams to suit their investment appetites, thereby expanding the types of companies that can participate to:

What’s At Risk Without Transferability

Without transferability, certain technologies like nuclear, advanced manufacturing, CCUS, and biogas/RNG could become unfinanceable and not get built. The market would revert to tax equity as the only financing alternative for tax credits, but tax equity investments are generally only available for the lowest-risk projects such as wind, solar, and storage projects from established developers.

- Through the next decade, more than 10 GW of merchant nuclear projects, including traditional and small modular reactors, are coming online to meet demand growth needs driven by data centers and artificial intelligence applications. These new nuclear facilities rely on transferability for financing and are unlikely to move forward without it.

- Additionally, the 242,000 advanced manufacturing jobs/year, enabled by the Section 45X tax credit,iii rely on transferability and would be at risk if transferability were to be eliminated.

Preserving transferability ensures continued tax efficiency by enabling energy tax credits to be used by more market participants, including small and mid-sized businesses – while quickly bringing low-cost, reliable, domestically produced energy online to meet our nation’s rapidly growing electricity demand needs.

i Crux, 2024 Transferable Tax Credit Market Intelligence Report, February 10, 2025, https://www.cruxclimate.com/2024-market-report.

ii ICF, Economy-wide Impacts of the Inflation Reduction Act Energy Provisions, December 19, 2024,

https://cleanpower.org/resources/economy-wide-benefits-of-energy-tax-credits/.

iii Ibid.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)