- Energy Storage & Decarbonization Pathways

- Grid Infrastructure

- Renewable Energy Innovation

- Transmission & Power Markets

- Reports

ReSISting a Resource Shortfall: Fixing PJM’s Surplus Interconnection Service (SIS) to Enable Battery Storage

Prepared by Gabel Associates Inc. for the American Council on Renewable Energy in partnership with the American Clean Power Association and the Solar Energy Industries Association. Feedback was provided by ACORE, ACP, and SEIA.1

Executive SummaryExecutive Summary

As one of the world’s largest power markets, PJM Interconnection, LLC (“PJM”) plans and operates the transmission system and wholesale power markets in a nearly 370,000-mile service territory spanning some or all thirteen states and the District of Columbia. However, PJM has acknowledged the risk of its capacity market failing to address regional needs as soon as 2030. Despite recognizing the need to encourage the entry of new resources, including and specifically storage resources, PJM has in practice effectively prevented battery energy storage systems (“BESS”) from using a tool that could expedite BESS entry: Surplus Interconnection Service (“SIS”).

SIS provides a simpler, expedited study process that occurs outside the conventional interconnection queue, allowing new generators that do not trigger transmission system upgrades to use an existing generator’s unused interconnection capability. FERC has emphasized the importance of SIS, encouraging the use of existing interconnection facilities. Moreover, it has stated that SIS must be made available even if the surplus interconnection customer does not have the same electrical characteristics as the original interconnection customer, if the differences don’t require new network upgrades to maintain reliability.

Nevertheless, PJM continues to apply SIS study processes that discourage, rather than encourage, resources from participating in SIS. For BESS resources, in particular, PJM’s approach makes participation next to impossible. These study processes are inconsistent with FERC precedent and internally inconsistent, applying different standards to BESS and other resources such as pumped hydro. PJM should look to the generally successful and FERC-approved approaches in MISO and SPP and make the following changes to its SIS processes:

- Eliminate the current prohibition of SIS participation by grid-charging BESS resources

- Harmonize BESS and pumped hydro storage modeling assumptions

- Adopt FERC’s standard allowing SIS if resources do not trigger the need for new network upgrades

These changes would encourage and expedite BESS resource additions that can help address PJM’s looming capacity shortfall.

1. PJM Regulatory Overview

The U.S. Federal Government has exclusive jurisdiction over electricity transmission between two or more states and wholesale energy sales by public utilities. These activities are predominantly regulated by an independent agency within the Department of Energy (“DOE”) known as the Federal Energy Regulatory Commission (“FERC” or the “Commission”), under authority delegated to it by the Federal Power Act and other statutes. FERC’s primary responsibilities include establishing just and reasonable rates for electric and natural gas transmission in interstate commerce and rates for wholesale energy sales.2

In 1996, the Commission began establishing a national policy of promoting competition among suppliers to create just and reasonable rates for the transactions and services under its jurisdiction. In Order No. 888, FERC directed all federally regulated public utilities to remove barriers to competition in wholesale power markets and provide non-discriminatory access to the interstate transmission grid.3

As part of this process, FERC required all electric utilities to allow Independent Power Producers (“IPPs”) to connect new generators to the transmission system, so long as the developers paid for upgrades to maintain grid reliability. Over time, these requirements have evolved into study processes to evaluate the aggregate impact of many interconnection requests and assign upgrade cost responsibility.

FERC simultaneously promoted the formation of Independent System Operators (“ISOs”) and Regional Transmission Organizations (“RTOs”) to plan and operate the transmission system efficiently, transparently, and independent from any business interest in sales or purchases of electric power utilities and other stakeholders.4 These policies ushered in the modern era of organized transmission systems and wholesale markets including those operated by PJM and others throughout North America.

PJM was founded in 1927 as a mechanism for three utilities in Pennsylvania, New Jersey, and Maryland to pool and share their generation resources. The number of participating utilities grew through the late 1990s when FERC approved PJM’s request to become the first Independent System Operator in 1997.

Today, PJM plans and operates the transmission system and wholesale power markets in a nearly 370,000-mile service territory spanning some or all of thirteen states and the District of Columbia. PJM manages about 88,000 miles of transmission lines and dispatches around 180,000 megawatts (“MW”) of generating capacity from nearly 1,500 generators.

Figure 1: PJM Service Territory Map

2. New Entry in PJM Must Accelerate to Avoid a Resource Adequacy Shortfall

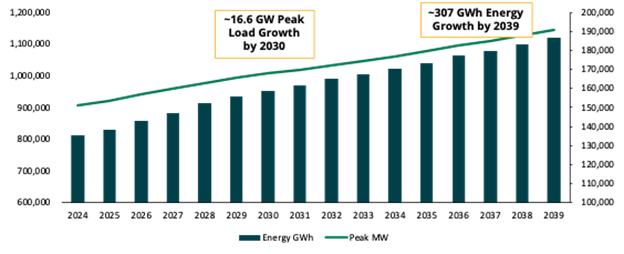

The need to accelerate the deployment of high capacity-value resources like BESS is acute as the rapid pace of load growth and legacy generation resource retirements challenge resource adequacy in PJM. PJM’s most recent load forecast report suggests that regional demand will grow by nearly 40 gigawatts (“GW”) by 2039.5 Retirements are also accelerating. An average of about 3.9 GW of generation in PJM has retired annually since 2011. About 5.4 GW of retirements are pending, an increase of about 37% above the historic average.6

Figure 2: PJM Forecast Energy Demand

A recent PJM white paper highlights storage as a crucial flexible resource for future system balancing and ramping needs and notes the pressure that will be placed on natural gas if additional storage resources are not built.7 Another analysis suggests that PJM faces an impending resource adequacy shortfall of nearly 4 GW by 2029 unless new entry from resources with high Accredited Capacity values like BESS accelerates.8

Figure 3: PJM Forecast Resource Adequacy Shortfall

| Delivery Year | ELCC Solved Load MW | PJM Forecast Peak Load MW | Surplus / (Shortfall) |

| 2027/28 | 165,306 | 159,859 | 5,447 |

| 2028/29 | 165,949 | 162,972 | 2,977 |

| 2029/30 | 161,939 | 165,681 | (3,742) |

| 2030/31 | 163,288 | 167,873 | (4,585) |

| 2031/32 | 162,882 | 170,008 | (7,126) |

| 2032/33 | 165,383 | 172,109 | (6,726) |

| 2033/34 | 167,149 | 174,366 | (7,217) |

| 2034/35 | 168,549 | 176,822 | (8,273) |

The shortfall grows to over 8 GWs by 2034, despite over 105 GW of new entry. The study also demonstrates the high resource adequacy potential for BESS resources. The Accredited Capacity values for battery storage resources for the 2026/2027 Delivery Year are 57%–78% of their Installed Capacity, depending on discharge duration, rivaling those of conventional generation.9

According to PJM’s resource mix forecast, new BESS resources provide about 25% of the market-wide Accredited Capacity additions by 2034 despite equating to just 9% of new Installed Capacity. For comparison, according to PJM about 9.3 GW of BESS provides roughly the same Accredited Capacity as nearly 38 GW of onshore and offshore wind.10

Figure 4: Comparison of Fleet-Wide and BESS Capacity in PJM’s Forecast Resource Mix

Our analysis of resources in PJM’s interconnection queue shows the substantial capacity deployment potential for BESS. As of June 2024, there are about 45 GW of BESS supply in PJM’s queue. Using current ELCC values, that could provide over 26 GW of Accredited Capacity for the 2026/2027 Delivery Year. This level of resource adequacy potential is comparable to that of the combustion turbine, wind, and solar generation combined.

Figure 5: Comparison of Resource Adequacy Potential from Different Resources

| Resource Type | Interconnection Capacity MW | ELCC % | Potential Accredited Capacity MW |

| Gas Combustion Turbine | 2,480 | 68% | 1,686 |

| 4-hr Storage | 45,939 | 57% | 26,185 |

| Wind | 39,094 | 34% | 13,292 |

| Tracking Solar | 113,951 | 13% | 14,814 |

| Total | 201,464 | 55,977 | |

| BESS % Total | 23% | 47% |

BESS construction times are the shortest of any asset class, with a median period from receipt of an interconnection agreement to commercial operations of about 20 months.11 Unfortunately, PJM’s interconnection queue process has been plagued by extensive delays and a declining rate of projects reaching commercial operations. For example, it took about 2,100 days or nearly six years for a BESS resource that entered the queue in 2015 to achieve commercial operations.12

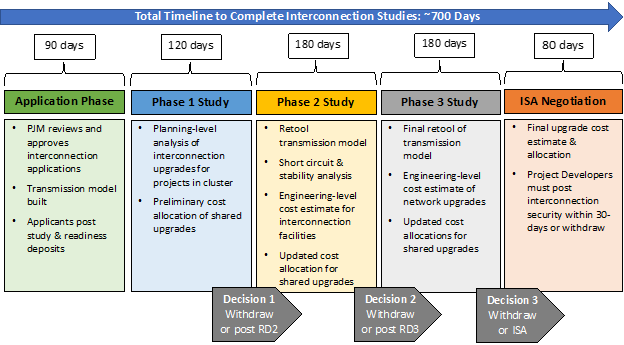

While PJM recently adopted a more efficient cluster study process, it will still take about 700 days to process new interconnection requests. PJM is also pausing work on new studies until mid-2026, while it processes the backlog of existing interconnection requests. Once work resumes, a new resource will not receive an interconnection agreement until early 2028, suggesting that commercial operations for a new BESS resource would not occur until around 2030, assuming a 24-month construction time.

Long interconnection study times, permitting challenges, and other factors all contributed to low rates of planned generation and storage resources reaching commercial operations. PJM’s historic completion rate is just 14.9%, suggesting that just the approximately 160 GW of the total capacity in the queue could contribute 6.3 GW of Accredited Capacity to resource adequacy after COD.

Figure 6: Capacity Adjustment for Commercial Probability and ELCC13

| Resource Type | Total Installed Capacity MW | Completion Rate Adjusted | Completion Rate & ELCC Adjusted |

| Solar | 68,071 | 13,113 | 1,836 |

| BESS | 45,935 | 173 | 102 |

| Wind | 11,570 | 1,629 | 570 |

| Solar+ BESS | 24,989 | 175 | 25 |

| NGCC | 6,923 | 3,570 | 2,820 |

| NGCT | 2,480 | 1,427 | 885 |

| Other | 392 | 110 | 70 |

| Total | 160,360 | 20,196 | 6,307 |

BESS facilities have historically fared worse than the average completion rate in PJM and elsewhere.14 As of June 2024, just 394 MW of the 68,000 MW total BESS interconnection applications have entered service.15 The completion rate increases to 39.6% for projects with executed interconnection rates. About 51,000 MW of BESS capacity remains active in the queue, suggesting the potential to improve success rates through more efficient interconnection strategies.16 SIS provides an important option to accelerate deployment of BESS resources by reducing interconnection study times and maximizing constructive use of the existing transmission grid with low or now interconnection costs.17

Key Takeaways

- Persistent interconnection queue delays, sluggish new entry, rising demand, and new capacity accreditation are pushing PJM to the brink of a resource adequacy shortfall before 2030.

- Energy storage has some of the highest accreditation values of any non-thermal resource type and provides necessary ancillary services for a changing system.

- Accelerating BESS deployment is crucial to meeting the region’s reliability needs.

3. Surplus Interconnection Service: An Expedited Interconnection Process That Can Help Address PJM’s Resource Adequacy Challenge

In 2018, FERC issued Order 845, directing all jurisdictional utilities to adopt expedited Surplus Interconnection Service (“SIS”) study processes to allow new resources that do not require transmission upgrades to interconnect at the site of an existing generator.18 Both units can operate if their aggregate output does not exceed the maximum levels studied in the legacy generator’s interconnection agreement. Importantly, SIS requests are studied separately from the conventional interconnection queue. Bifurcating these processes was intentional. FERC explained:

Requiring transmission providers to establish an expedited process, separate from the interconnection queue, for the use of surplus interconnection service could reduce costs for interconnection customers by increasing the utilization of existing interconnection facilities and network upgrades rather than requiring new ones, improve wholesale market competition by enabling more entities to compete through the more efficient use of surplus existing interconnection capacity, and remove economic barriers to the development of complementary technologies such as electric storage resources.19

FERC reiterated its support for an expedited and separate SIS study process construct in its landmark Order No. 2023, which mandated comprehensive reforms to accelerate generator interconnection processes nationally.20 There, the Commission reiterated that SIS enables “interconnection customers with unused interconnection service to allow other generating facilities to use that interconnection service earlier than was previously allowed and, therefore, will increase the overall efficiency of the interconnection queue.”21

In 2019, PJM proposed its SIS concept to FERC with an independent variation request seeking permission to process SIS requests within the conventional interconnection process.22 However, FERC rejected this request and directed PJM to make a subsequent compliance implementing SIS through an expedited process occurring outside of the conventional interconnection queue.23 FERC accepted PJM’s revised proposal in 2020 and began accepting SIS applications the following year.24

However, PJM’s implementation of SIS has severely constrained the resource deployment potential FERC hoped the construct would achieve. As we discuss below, PJM’s approach to these studies effectively precludes BESS and other resources from utilizing SIS. Adopting best practices from other markets like Southwest Power Pool (“SPP”) and Mid-Continent ISO (“MISO”) will unlock the value potential of SIS service and allow PJM to achieve the objectives of FERC Order Nos. 845 and 2023.

3.1. PJM’s Current SIS Implementation Is Not FERC-Compliant

FERC Order No. 845 declared it unlawful for a transmission provider to deny an original interconnection customer the ability to use available surplus interconnection service for another resource or transfer its surplus capability to another interconnection customer.25 The original interconnection customer retains the right to make full use of its contracted-for interconnection service as long as the customer remains in compliance with its LGIA and as long as doing so would not impact system reliability.26 However, PJM’s business practices deny PJM customers that right by imposing restrictions on SIS eligibility. This prevents interconnection customers from using it even when system reliability would not be negatively impacted.

Furthermore, the Commission has clarified that Surplus Interconnection studies should not apply the “material modification” analysis from the traditional interconnection process, which can result in restarting interconnection requests if a project seeks to substantially change its technology type, capacity, configuration, or other aspects.27

SIS must be made available even if the surplus interconnection customer has different electrical characteristics than the original interconnection customer, as long as the differences don’t result in new network upgrades to maintain reliability.28 The Commission has taken this approach because Surplus Interconnection offers “an expedited process” to increase “utilization of existing interconnection facilities and network upgrades rather than requiring new ones.”29

The reforms suggested below enhance alternative interconnection pathways consistent with FERC precedent and FERC-approved SIS paradigms in other jurisdictions like SPP and MISO. It is highly likely that FERC would view such reforms favorably and allow PJM’s construct to achieve the interconnection efficiency and reliability benefits that SIS can provide.

3.2. SIS Processes in MISO & SPP Provide a Roadmap for Success

MISO uses a reasonable approach to determine whether a BESS resource triggers a material adverse impact for another interconnection request. Like PJM, MISO employs a three-phase Definitive Planning Process (“DPP”) interconnection cluster study process. It studies SIS requests using the models and new network upgrades identified for resources in the most recent Phase 3 System Impact Study.30

This configuration limits the material impact study to the projects in the latest stage of MISO’s conventional interconnection queue with the highest likelihood of moving to construction. It also reduces the burden of studying earlier-stage projects where factors like transmission system topology, load forecasts, and generation resource mix are more volatile and prone to greater uncertainty. PJM should adopt MISO’s study model, which strikes the appropriate balance between allowing BESS resources to utilize SIS without materially impacting other late-stage projects in the queue.

MISO also allows SIS resources to increase fault current during the short circuit analysis so long as it does not exceed the existing breaker ratings. Unlike PJM’s current process, MISO’s standard is consistent with FERC’s directive for SIS service. It also allows for the reliable integration of BESS resources through SIS. MISO has approved multiple SIS requests for BESS resources to date.

SPP makes SIS available to any resource the transmission system can accommodate without additional network upgrades unless:

- The Network Upgrades are located at the Point of Interconnection (“POI”) Substation and the same voltage level as the existing generator or are System Protection Facilities; and

- There are no material adverse impacts on the cost or timing of any interconnection requests pending when SPP receives the SIS application.31

This standard also reflects the right balance between allowing BESS and other inverter-based resources to interconnect using SIS without negatively impacting projects in SPP’s conventional interconnection queue. Allowing certain upgrades at the existing generator’s POI substation also addresses PJM’s concern about utilizing existing headroom that could be available to other interconnection customers.

For example, SPP allows BESS facilities to install technologies like shunt reactors to mitigate a need for additional voltage support.32 Upgrades at the generator’s POI have no negative impact on other projects seeking to connect to the grid and alleviate any potential changes in system headroom by adding new SIS resources. SPP has reviewed and approved multiple SIS requests for BESS resources, showing the construct is reliable and commercially viable.

3.3. SIS Can Accelerate the Route to Market for New Generation by Maximizing Use of PJM’s Existing Transmission Infrastructure

One of the most challenging aspects of PJM’s energy transition is the growing time needed to construct transmission upgrades that accommodate new supply resources. Increasingly lengthy equipment procurement timelines, limited access to skilled labor, and outage coordination logistics delay in-service dates even for projects that complete PJM’s traditional interconnection study process.

Of the nearly 500 transmission upgrades identified in PJM’s Transition Cycle 1 cluster study, 56% have a minimum construction estimate longer than 24 months.33 Almost 17% have minimum construction timelines of over 48 months, and about 5% of the upgrades have construction timelines of five or more years, with the longest estimate being ten years.34 These timelines are additive to the two to three years PJM anticipates it will take to complete its new interconnection study process.

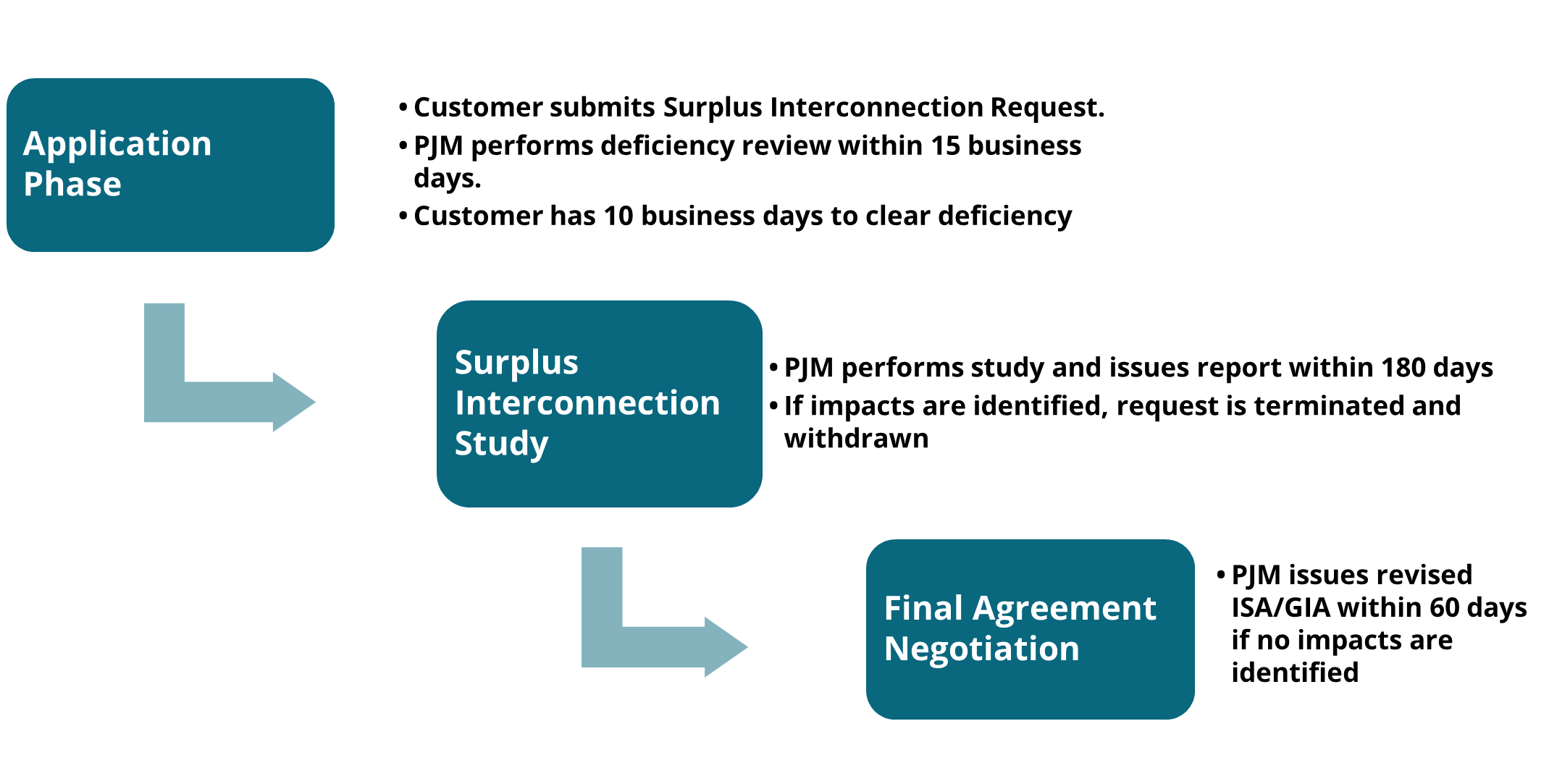

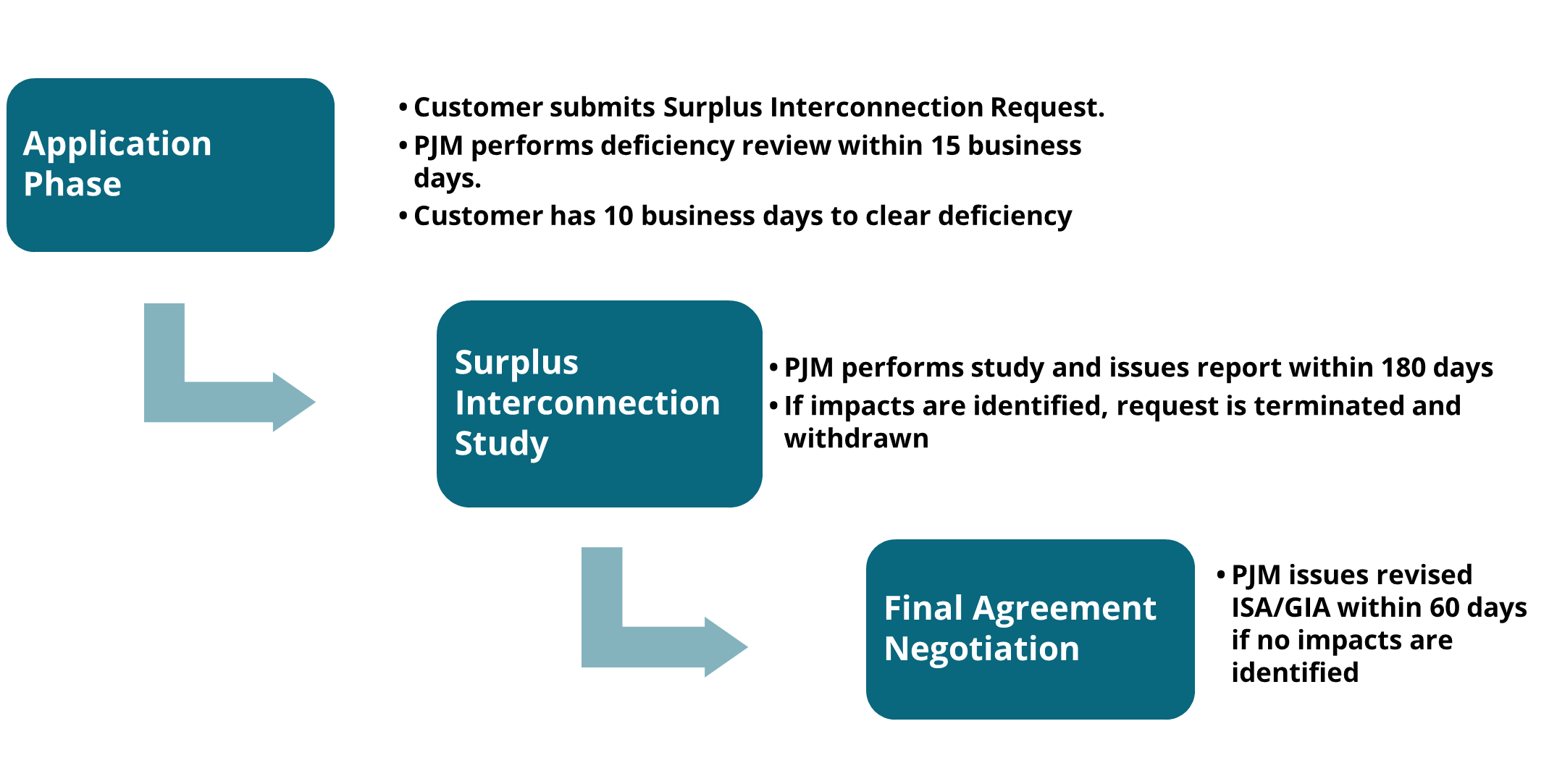

Conversely, PJM uses best efforts to complete SIS studies and issue a new Generator Interconnection Agreement (“GIA”) in less than half the time it takes to complete the conventional interconnection process. The entire three-phase process can allow a resource to begin construction in about 270 days, as shown in the figure below.

Figure 7: Surplus Interconnection Request Process

Because SIS is only available to resources that do not require transmission upgrades, there is no need for complicated cost allocation procedures among other projects in the queue. These studies are more straightforward and much less prone to delay. Resources with fast development timelines are not slowed by the well-documented challenges of siting, permitting, and constructing new transmission facilities. Therefore, SIS can substantially accelerate the deployment of new capacity resources like BESS to meet PJM’s resource adequacy needs.

3.4. SIS Maximizes the Reliability Value of Existing Capacity Resources

Resources seeking to provide resource adequacy in PJM must request Capacity Interconnection Rights (“CIRs”) through the interconnection study process. CIRs are similar to Network Resource Interconnection Service (“NRIS”) in other jurisdictions and represent the firm deliverable output of a generator during periods of peak demand. Once a resource is operational, PJM refers to its CIRs as Installed Capacity or ICAP.

The amount of resource adequacy that a generator or BESS facility can provide PJM equals the lesser of its ICAP or ELCC Accredited Capacity. The ELCC Accredited Capacity values differ depending on the operating characteristics of the asset class. For example, the ELCC value for a 4-hour duration BESS resource in the 2026/2027 Delivery Year is 57% of its maximum energy output compared to just 13% for tracking solar resources.35

SIS allows the new BESS facility or other generator to provide resource adequacy up to the existing facility’s CIRs. Said differently, the existing and SIS resources can supply capacity up to the lower of their combined ELCC Accredited Capacity or the legacy facility’s CIRs.36 Using the example above, a solar facility with 100 MW nameplate capability and 100 MW of CIRs can provide 13 MW of Accredited Capacity to PJM.

However, using SIS to add a 100 MW BESS resource at the existing solar generator’s site would increase the combined Accredited Capacity from both facilities to 70 MW. Both resources could provide up to 100 MW of energy, allowing the BESS facility to increase its power production when solar output declines.

The resource adequacy deployment potential of SIS is meaningful. PJM’s forecast resource mix for the 2026/2027 Delivery Year includes about 9.7 GW of ICAP from solar fixed and tracking resources.37 However, these resources provide less than two GW of Accredited Capacity due to low ELCC values. SIS resources could utilize these resources’ remaining ICAP and increase the Accredited Capacity available to PJM by almost 8 GW.

Figure 8: SIS Capacity Deployment Potential

| Resource Class | Effective Nameplate MW | ICAP MW | ELCC % | ELCC Accredited Capacity MW | SIS Potential Capacity MW |

| Formula | a | b | c | d = Min a * c or b | e = b – c |

| Solar Fixed | 2,670 | 1,228 | 8% | 214 | 1,014 |

| Solar Tracking | 13,082 | 8,462 | 13% | 1,701 | 6,761 |

| Total | 15,752 | 9,690 | 1,914 | 7,776 |

Despite FERC’s direction to implement SIS more than a half-decade ago, PJM’s implementation strategy severely limits the viability of this construct for nearly all resources, and renders it infeasible for grid-charging battery storage resources. Enhancing PJM’s SIS construct by adopting methodologies that other markets have shown to be reliable and commercially viable will unlock the potential for this alternative interconnection pathway.

Key Takeaways:

- SIS allows new generators that do not trigger a need for transmission system upgrades to co-locate behind an existing generator’s point of interconnection.

- SIS provides a simpler, expedited study process that occurs outside of the conventional interconnection queue that is historically prone to delays.

- PJM’s current SIS study process is not FERC compliant and effectively prohibits SIS for grid-charging BESS resources

4. Adopting Best Practices for SIS in PJM

PJM should not apply the material impacts standard in the context of the SIS. The deliverability tests that PJM conducts for the material impact analysis consider batteries in charging mode, which reduces available surplus capacity. The Commission has clarified that the material adverse impacts test does not apply to Surplus Interconnection. PJM should allow SIS unless doing so would trigger the need for network upgrades, and it should eliminate the assumption that specific configurations will not qualify before completing the necessary studies.

PJM should also revise its tariff to comply with the pro forma provisions of Order No. 2023, which allow Interconnection Customers to access SIS when the original interconnection customer executes an LGIA (or requests filing of an unexecuted LGIA) instead of allowing access only after the existing generating facility has interconnected to the PJM system.

4.1. Eliminate the Current Prohibition Against SIS for Grid-Charging BESS Resources

FERC does not require SIS eligibility for projects that trigger new transmission costs or construction timelines for existing projects in the interconnection queue. FERC’s rule aims to maximize SIS’s efficiency benefits without creating preferential treatment for SIS resources to the detriment of conventional interconnections. While this construct reasonably balances the interests of resources competing for access to the transmission system, PJM’s current implementation effectively prohibits BESS resources from utilizing SIS.

PJM performs a detailed system analysis for new service requests to test deliverability under Peak Load and Light Load conditions as part of the interconnection study process.38 Light Load generally refers to the off-peak period during which energy consumption is 40-60% below daily seasonal-adjusted peak demand.

PJM presumes that any new resource that could utilize transmission capability beyond what was allocated to the legacy generator is ineligible for SIS, regardless of whether it impacts another project in the queue. This interpretation means that grid-charging batteries are ineligible for SIS because the charging load presumptively utilizes existing transmission headroom during the Light Load deliverability study that could be allocated to a conventional interconnection project. Importantly, PJM does not study the new BESS resources to determine if they materially impact another project in the queue. It assumes that the charging load, per se, impacts a hypothetical future interconnection request.

4.2. Apply Pumped Hydro Storage Operating Assumptions to BESS During Light Load Studies

During light load periods, PJM studies BESS resources in both charging and discharging modes, meaning both the charging load and generation output from discharging can contribute to upgrade cost responsibility.39 This configuration is antithetical to the anticipated operation of BESS resources, which charge during off-peak periods when power prices are typically lower and discharge during peak periods when prices are higher.40 Here, PJM’s study model presumes that the BESS resource would deliver energy during the lowest price period. If this energy delivery increases the load on a monitored flowgate, PJM will label the resource a “harmer,” ramp the BESS resource up to the assigned higher deliverability output and assign transmission upgrades to resolve any identified constraints.

PJM does not apply this same treatment to pumped hydro storage resources, which have operating profiles similar to BESS resources. PJM assumes these resources are only in pumping mode (equivalent to BESS charging mode) during light load condition studies. Therefore, a new pumped hydro storage resource would not be responsible for upgrade costs for energy discharge during light load periods. PJM should apply the correct operating profile for pumped hydro facilities to BESS. This change would better align interconnection cost responsibility with the resources’ likely operating profile and reduce the need for unnecessary interconnection costs.

In addition to creating consistency in treatment with pumped hydro storage resources in PJM, it would also align with best practices from comparable markets. California ISO (“CAISO”), MISO, and SPP do not study battery storage injections during light load, shoulder, or off-peak conditions. Notably, BESS capacity in CAISO grew to over 11,000 MW in 2024, compared to about 400 MW in PJM, demonstrating that their interconnection study methodologies allow for reliable interconnection of BESS resources. PJM should amend its standards to be consistent with these best practices.

4.3. Adopt FERC’s Reasonable SIS Study Implementation Standards

Rather than adopting FERC’s straightforward standard of allowing SIS for projects that do not trigger new transmission upgrades, PJM denies any SIS request that impacts short circuit capability, thermal, voltage, or dynamic stability limits, even if the impact is de minimis.41 This is true even in cases where the new generator does not overload any existing transmission facilities. Therefore, this approach severely limits SIS’s eligibility BESS and other inverter-based resources.

Key Takeaways:

- MISO and SPP offer examples of FERC-approved SIS study processes that balance the interests of encouraging BESS participation in SIS without impacting late-stage projects in the interconnection queue.

- Like MISO and SPP, PJM should allow SIS for BESS when studies of late-stage interconnection requests show no need for additional upgrades.

- PJM’s inconsistent approach to BESS and pumped hydro operating profiles are illogical and should be corrected so BESS are not studied as fully discharging in light load studies.

For example, PJM recently rejected a request to add a new solar facility to an existing wind farm. PJM found that adding inverters for the solar facility could increase fault current and occupy the transmission system, which must remain available to “Project Developers seeking to interconnect new generation or merchant transmission already in the queue.”42 PJM did not identify a particular generator or merchant transmission project impacted by the SIS request. Instead, the hypothetical impact was enough for PJM to deny the project without further study. This additional requirement creates a de facto prohibition against interconnecting new BESS facilities at the same point of interconnection (“POI”) as existing inverter-based resources.

Conclusion5. Conclusion

PJM’s current implementation of SIS unnecessarily constrains this vital option to address the region’s reliability puzzle. PJM needs more storage resources to support the system as it transitions to include more intermittent resources, yet it limits BESS’s ability to participate in SIS. Instead of summarily denying BESS’s SIS applications for de minimis impacts on the existing transmission system, PJM should follow FERC’s requirements and allow SIS as long as approving the request would not require new system upgrades. PJM can achieve this result by adopting best practices for SIS implementation from other jurisdictions like MISO and SPP.

5.1. Summary of Recommendations

| Recommendation | Reasoning |

| Eliminate prohibition against SIS for grid- charging BESS resources | PJM should embrace FERC’s requirements from Order Nos. 845 and allow projects that do not impact other late-stage interconnection requests to receive SIS, instead of rejecting any SIS request that could impact hypothetical future projects. |

| Harmonize BESS and pumped storage modeling assumptions | In Light Load conditions studies, PJM studies BESS resources in both charging and discharging modes, whereas it studies pumped hydro in pumping mode only. Unlike BESS, A new pumped hydro storage resource would therefore not be responsible for upgrade costs for energy discharge during light load periods. PJM should treat these resources the same way. |

| Allow SIS for resources that do not trigger new network upgrades | PJM’s existing approach denies SIS even in cases where the new generator does not overload any existing transmission facilities and therefore severely limits the viability of SIS for new inverter-based resources like BESS. PJM should adopt approaches like those in MISO and SPP that allow SIS for resources that do not trigger a need for new transmission system upgrades. |

Appendix A: PJM’s Generation Interconnection Study Process

PJM’s New Three-Phase Cluster Study Process Aims to Streamline Interconnection Analysis

All new generators, including BESS resources seeking to connect to the FERC-jurisdictional transmission system or participate in the region’s wholesale markets, must complete PJM’s interconnection study process. PJM uses a “first-ready, first-served” cluster study approach to assign upgrade cost responsibility to all resources that submit interconnection applications during the same study window. PJM releases the results of their analysis in three phases that take about 700 days to complete.

Phase 1 starts immediately after the close of the Application Review Phase of a Cycle and lasts about 120 days. During Phase 1, PJM conducts the Phase 1 System Impact Study, which consists of the Load Flow Analysis and Determination of Planning Level Costs. Projects that do not require new interconnection facilities or network upgrades can exit the queue at the end of this phase.

Phase 2 starts on the first Business Day immediately after the close of Decision Point 1 and lasts about 180 days. During Phase 2, PJM conducts the Phase 2 System Impact Study, consisting of the First Retool, Short Circuit, Stability, and Interconnection Facilities Study. Projects that only require Interconnection Facilities and not Network Upgrades can exit the queue at the end of this phase.

Phase 3 starts on the first Business Day immediately after the close of Decision Point 2 and lasts about 180 days; during Phase 3, PJM conducts the Phase 3 System Impact Study, which consists of the Final Retool and System Upgrades Facilities Study. All remaining projects exit the queue at the end of this phase.

Figure 9: PJM Interconnection Cluster Study Process

Developers must post Readiness Deposits (“RD”) with their applications that increase in amount at the end of each phase. The amount of these deposits at risk of forfeiture if projects withdraw from the queue also increases to incentivize non-viable projects to exit the queue earlier in the process.

However, projects with the least impact on the grid exit the queue as soon as they are processed and can proceed to construction. These complementary elements of PJM’s process provide a “carrot and stick” incentive framework designed to disincentivize speculative projects from entering and remaining in the queue and rewarding the most efficient projects that require the fewest transmission system upgrades.

Status of Process to Date

Implementation was delayed while PJM worked through its existing queue backlog, but the transition process commenced in July 2023. PJM’s process includes two transition cycles followed by New Cycle 1. Projects in the AE1–AG1 queues with less than $5 million in network upgrades were assigned to a “fast lane” process that PJM is clearing under the serial rule. Although PJM initially expected to clear the fast lane by July 2024, it is still working through it and will likely not finish by the end of 2024.

For Transition Cycle 1, Decision Point 1 submissions were due on June 20, 2024. 214 of the 310 projects previously in Transition Cycle 1 submitted readiness evidence for PJM review. As of July 2024, 130 were approved, four were withdrawn due to deficiencies, and 80 were still under review.43 Transition Cycle 2 projects should begin to get ready for application submissions in queue point by December 17, 2024.44

While the Fast Lane delay will not delay the application deadline for Transition Cycle 2, PJM cannot begin Phase 2 of Transition Cycle 1 until all Fast Lane projects are cleared from the queue.

Compliance with Order 2023

FERC Orders 2023 and 2023-A amend the pro-forma Generator Interconnection Procedures and, among other things, require transmission providers to eliminate the “reasonable efforts” standard for completing interconnection studies, update modeling standards, and enhance surplus interconnection processes.45

PJM’s Order 2023/2023-A compliance filing, made on May 16, 2024, asserted that the existing tariff, with recently approved revisions to PJM’s queue processes and current queue transition, “substantially complies” with Order Nos. 2023 and 2023-A.46 PJM’s compliance filing did not propose any tariff revisions and instead requested approval under the Commission’s “independent entity variation” standard. PJM suggested that it would file a second compliance filing in which additional revisions might be made if needed for clarity and for Commission endorsement of a conceptual proposal for handling study penalties and consequences of study delays.

On July 31, 2024, FERC issued a data request letter related to PJM’s compliance filing for Orders 2023 and 2023-A, identifying the compliance filing as incomplete and requesting several clarification items from PJM.47 PJM is to provide tariff revisions or individual justifications to show that previously approved provisions continue to be permissible as required by Order 2023 for:

- Elimination of the reasonable efforts standard and adoption of study delay penalties;

- Affected system coordination;

- Availability of surplus interconnection service and

- Definition of network upgrades.

PJM must also provide a detailed justification under the independent entity variation standard for its “conceptual proposal” for handling study delays and specifically explain how it accomplishes the purposes of Order 2023. PJM’s response is due October 29, 2024.

Generation and Load Deliverability Tests

Projects seeking to qualify as Capacity Resources request Capacity Interconnection Rights (“CIRs”) when they apply to enter the Interconnection Queue. Capacity Resources are subject to a series of deliverability tests that identify any necessary transmission system upgrades to ensure the grid can accept the energy associated with the CIRs.48 Generator Deliverability refers to the ability of Capacity Resources in a given electrical area, in aggregate, to export to other regions in PJM.49 PJM performs a detailed system analysis for new BESS service requests to test energy deliverability under summer and winter peak load and light load conditions.

Load Deliverability confirms that the transmission system can support the delivery of energy from the aggregate of available PJM Capacity Resources to PJM electrical areas experiencing a capacity deficiency within the accepted probability of not more than one loss of load occurrence in ten years (1 in 10 loss of load expectation (“LOLE”).50 The Load Deliverability study aims to establish the amount of emergency power that can be reliably transferred to the study area from the rest of PJM.51

Like conventional generators, BESS resources are subject to PJM’s generation deliverability tests during summer and winter peak and light load conditions. Unlike traditional generation resources, BESS resources operating in charging mode are also subject to load deliverability tests, which refer to the grid’s ability to import power from generation resources under certain conditions. Collectively, these studies identify system constraints that the new resource would cause, along with the local upgrades and network upgrades required to solve those constraints.52

PJM uses different operating assumptions for BESS resources that materially impact the study results and resulting transmission upgrade cost responsibility. Reforming these assumptions to better reflect realistic operating profiles would simplify PJM’s interconnection study process and eliminate a potential barrier to market entry.

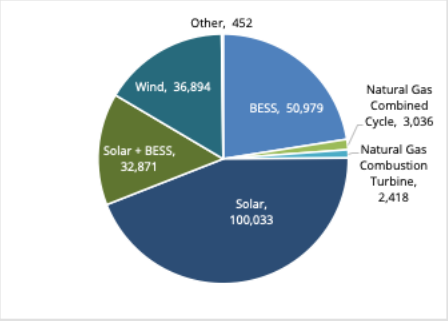

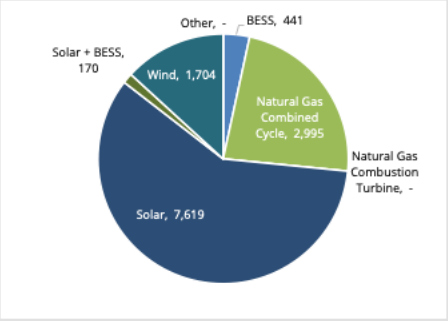

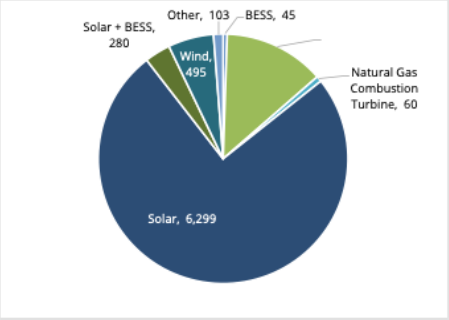

6. Appendix B: Interconnection Queue Resource Mix – Energy MWs53

As of June 2024, there are about 227 GW of nameplate energy under study in PJM’s interconnection queue. Another approximately 13 GWs have completed the interconnection queue study process and are currently suspended. About 8.4 GWs are under construction, bringing the total active generation development projects in PJM to about 248 GWs. Renewable generation and BESS resources comprise about 96% of the total proposed generation projects in PJM. Solar generation is the highest overall percentage of interconnection projects (46%), followed by stand-alone BESS (21%).

Active Interconnection Requests: 226,683 MW

Suspended Interconnection Requests: 12,929 MW

Under Construction: 8,375 MW

Index of Acronyms and Abbreviations

| ABBREVIATION | DEFINITION |

| ACORE | American Council on Renewable Energy |

| ACP | American Clean Power Association |

| BESS | Battery Energy Storage Systems |

| CAISO | California Independent System Operator |

| DOE | Department of Energy |

| DPP | Definitive Planning Process |

| ELCC | Effective Load Carrying Capacity |

| FERC | Federal Energy Regulatory Commission |

| GIA | Generator Interconnection Agreement |

| GW | Gigawatt |

| ICAP | Installed Capacity |

| IPP | Independent Power Producer |

| ISO | Independent System Operator |

| LGIA | Large Generator Interconnection Agreement |

| LLC | Limited Liability Corporation |

| LOLE | Loss of Load Expectation |

| MISO | Mid-Continent Independent System Operator |

| MW | Megawatt |

| NGCC | Natural Gas Combined Cycle |

| NGCT | Natural Gas Combustion Turbine |

| PJM | PJM Interconnection |

| POI | Point of Interconnection |

| RD | Readiness Deposits |

| RTO | Regional Transmission Organization |

| SEIA | Solar Energy Industries Association |

| SIS | Surplus Interconnection Service |

| SPP | Southwest Power Pool |

Authors

Michael Borgatti, Senior Vice President, Wholesale Power & Markets Services Group, Gabel Associates, Inc.

Sarah Yasutake, Senior Associate, Wholesale Power & Markets Services Group, Gabel Associates, Inc.

1 Gabel Associates is acting in a consulting capacity. Any opinions, advice, forecasts, or analysis presented herein are based on Gabel Associates’ professional judgment and do not constitute a guarantee. Gabel Associates shall not be liable for any impact, economic or otherwise, based on the information and reports provided and shall not be responsible for any direct, indirect, special or consequential damages arising under or in connection with the services and reports provided.

2 The owners of facilities that transmit or sell electricity subject to FERC jurisdiction are defined as “public utilities” but are not necessarily utilities in the traditional sense.

3 Promoting Wholesale Competition Through Open Access Non-Discriminatory Transmission Services by Public Utilities; Recovery of Stranded Costs by Public Utilities and Transmitting Utilities, Order No. 888, 75 FERC ¶ 61,080 (1996) (“Order No. 888”).

4 See https://www.ferc.gov/industries-data/electric/industry-activities/open-access-transmission-tariff-oatt-reform/history-oatt-reform/order-no-888; see also https://www.ferc.gov/sites/default/files/2020-06/OrderNo.2000-A_0.pdf.

5 PJM Resource Adequacy Planning Dept., PJM Load Forecast Report: January 2024 at 2(Rev. Feb. 1, 2024). https://www.pjm.com/-/media/library/reports-notices/load-forecast/2024-load-report.ashx

6 PJM Interconnection, LLC, Generation Deactivations (accessed Sept. 17, 2024). https://www.pjm.com/planning/service-requests/gen-deactivations

7 PJM Interconnection, LLC, Energy Transition in PJM: Flexibility for the Future at 21(2024). https://www.pjm.com/-/media/library/reports-notices/special-reports/2024/20240624-energy-transition-in-pjm-flexibility-for-the-future.ashx

8 PJM Interconnection, LLC, ELCC Class Ratings (Aug. 6, 2024) (“PJM Aug. 2024 ELCC Class Ratings”). https://www.pjm.com/-/media/committees-groups/committees/pc/2024/20240806/20240806-item-08—supplementary-information—elcc-class-ratings.ashx

9 PJM Interconnection, LLC, ELCC Class Ratings for the 2026/2027 Base Residual Auction (2024) (“PJM 26/27 Auction ELCC Class Ratings”). https://www.pjm.com/-/media/planning/res-adeq/elcc/2026-27-bra-elcc-class-ratings.ashx

10 Resource mix data supplied by PJM upon request.

11 Lawrence Berkely Nat’l Lab., Queued Up: 2024 Edition Characteristics of Power Plants Seeking Transmission Interconnection as of the End of 2024, https://emp.lbl.gov/sites/default/files/2024-04/Queued%20Up%202024%20Edition_R2.pdf (“LBL Report”).

12 Monitoring Analytics, 2024 Quarterly State of the Market Report for PJM: January through June § 12 at 740 (Aug. 8, 2024) (“2024 Quarterly SOM”). https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2024.shtml

13 Id. at 748.

14 LBL report at 28.

15 2024 Quarterly SOM at 765.

16 Id. at 747.

17 Id. at 744.

18 Reform of Generator Interconnection Procedures and Agreements, Order No. 845, 163 FERC ¶ 61,043 at PP 467, 471 (2018) (“Order No. 845”), reh’g denied & clarifications granted, Order No. 845-A, 166 FERC ¶ 61,137 at P 126 (“Order No. 845-A”), order on reh’g & clarification, Order No. 845-B, 168 FERC ¶ 61,092 (2019).

19 Id. at 277 (emphasis supplied)

20 See Improvements to Generator Interconnection Procedures & Agreements, Order No. 2023, 184 FERC ¶ 61,054 (2023) (“Order No. 2023), order on rehearing and clarification, Order No. 2023-A, 186 FERC ¶ 61,199 (2024) (“Order No. 2023-A”).

21 Order No. 2023-A at P 560.

22 PJM Interconnection, L.L.C., FERC Docket No. ER19-1958 at 38 (May 22, 2019).

23 Id. 169 FERC ¶ 61,226 at P 39 (2019) Order on Compliance Filing.

24 See PJM Interconnection, L.L.C., 171 FERC ¶ 61,145, at PP 35-36 (2020) (accepting PJM’s Surplus

Interconnection Service provisions, subject to minor compliance filing).

25 Order No. 845 at P 471 (“For these reasons, we find that, where proper precautions are taken to ensure system reliability, it would be unjust and unreasonable to deny an original interconnection customer the ability either to transfer or use for another resource surplus interconnection service.”).

26 Order No. 845-A at P 126.

27 Order No. 2023 at P 1418.

28 Order No. 845-A at P 138.

29 Id. at P 119.

30 MISO Business Practices Manual No. 015—Generation Interconnection § 6.7.3 (Jan. 22, 2024). https://www.misoenergy.org/legal/rules-manuals-and-agreements/business-practice-manuals/

31 SPP Open Access Transmission Tariff at § 3.3.4.1.

32 SPP GEN-2024-SR2 Surplus Service Impact Study (August 16, 2024). https://opsportal.spp.org/documents/studies/files/2024_Generation_Studies/FINAL_SPP_Report_GEN-2024-SR2_08162024.pdf

33 PJM Interconnection, Cycle Service Request Status: https://www.pjm.com/planning/m/cycle-service-request-status

34 Id.

35 PJM 26/27 Auction ELCC Class Ratings.

36 PJM Open Access Transmission Tariff Part IV, Subpart A § 36.1.1B.

37 PJM Interconnection, LLC, 2026-2027 Assumed Resource Mix. https://www.pjm.com/-/media/planning/res-adeq/elcc/2026-2027-assumed-resource-mix.ashx

38 See the Appendix for more information on PJM’s deliverability study process.

39 PJM Interconnection, Manual 14B: PJM Region Transmission Planning Process Attach. C § C.3.1.3 (Rev. 56, Effective June 27, 2024) (“PJM Manual 14B”). https://www.pjm.com/-/media/documents/manuals/m14b.ashx

40 Order No. 2023 at P 1509.

41 See PJM Interconnection, L.L.C., 171 FERC ¶ 61,145, at P 34 (2020) (“Second Compliance Order”).

42 EDP Renewables N.A., LLC v. PJM Interconnection, LLC, FERC Docket No. EL24-125-000, Answer of PJM Interconnection, LLC at 7 (July 25, 2024).

43 PJM Interconnection, LLC, TC1 DP1 Status Update (July 2024). https://www.pjm.com/-/media/committees-groups/subcommittees/ips/2024/20240729/20240729-item-04—tc1-dp1-status.ashx

44 PJM Interconnection, LLC, TC2 Reminders (July 2024). https://www.pjm.com/-/media/committees-groups/subcommittees/ips/2024/20240729/20240729-item-05—tc2-application-updates.ashx

45 See Order Nos. 2023 & 2023-A.

46 PJM Order 2023 Compliance Filing, FERC Docket No. ER24-2045 (May 2024). https://elibrary.ferc.gov/eLibrary/filelist?accession_number=20240516-5155&optimized=false

47 PJM Interconnection, LLC, FERC Docket No. ER24-0045-000, Office of Energy Market Regulation, Data Request (July 31, 2024).

48 PJM Manual 14B Attach. C, § C.1.1.

49 Id.

50 Id. at § C.2.1.1.

51 Id. at § C.2.5.

52 Id. at § C.1.2.

53 2024 Quarterly SOM at 765.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)