- Trade & Supply Chain

- Reports

Overview of Use of U.S. Trade Restrictions on Clean Energy Technology Imports

Overview1

The U.S. clean energy industry has long relied on an international supply chain to source equipment for generation and storage technologies. However, stimulated by recent policy support, domestic clean energy manufacturing capacity is primed to scale up significantly over the next decade.

The People’s Republic of China (PRC or China) currently dominates global supply chains and production capacity for clean energy technologies.2 China’s ability to oversupply items for solar energy generation, lithium-ion batteries, and electric vehicles (EVs), and more, has become a major issue of concern for U.S. policymakers.3

While the Biden Administration recently announced a suite of actions to address these concerns, the use of trade restrictions to respond to Chinese oversupply, particularly in solar technologies, is not new. In fact, portions of the domestic solar industry have sought relief under U.S. trade laws to address unfair trade with China for more than a decade.4

This policy brief provides an overview of the primary provisions of U.S. trade law that have been used to address international trade concerns in the clean technology sector, particularly key components such as polysilicon, steel, and aluminum,5 and goods like cells and modules for solar energy generation, batteries, and EVs.

U.S. Trade LawsU.S. Trade Law and Unfair Competition

Broadly, U.S. trade laws are intended to help ensure a fair playing field for domestic businesses and workers, particularly in sectors where foreign competition exists to produce similar items. To address these concerns, U.S. trade laws allow for imposing tariffs (taxes or fees) on the import of foreign goods to address price imbalances or subsidized production. Goods may also be prohibited from entering the U.S. if they are found to be produced using forced or child labor.

Related to the clean technology sector, the U.S. government has imposed tariffs and duties under three primary legal authorities: (1) Section 201, (2) Section 3016, and (3) antidumping (AD) and countervailing duties (CVD).7 Each of these authorities has a different purpose and process for investigating and imposing tariffs, as described in this brief.

In addition to measures such as tariffs, U.S. trade laws include provisions that seek to protect U.S. intellectual property from infringement and other forms of unfair competition. These laws have long recognized that the use of forced labor to produce goods is a violation of human rights and contained provisions intended to prevent the importation of such goods. These authorities have also been used in the clean technology sector.

Specifically, Section 337 of the Tariff Act of 1930 allows petitioners to protect their intellectual property rights by seeking to stop imports of goods that violate their patents or trademarks, or which misappropriate their trade secrets.8 In 2021, Congress also amended Section 307 of the Tariff Act of 1930 (which prohibits the import of any product that was mined, produced, or manufactured wholly or in part by forced labor, including forced or indentured child labor)9 by enacting the Uyghur Forced Labor Prevention Act (UFLPA) to specifically address concerns regarding the importation of goods presumed to be produced using forced labor in the Xinjiang Uyghur Autonomous Region (XUAR).10

Responsible Departments & AgenciesResponsible Departments and Agencies

U.S. trade laws provide the President and, by delegation, the executive branch with substantial authority for determining what actions to take and how to implement them. This executive authority is exercised both by the White House and by personnel at several different agencies responsible for trade matters. The President’s authority is not absolute, and U.S. trade laws typically specify certain procedures and requirements that must be followed by executive agencies in their implementation of relevant trade measures. In some cases, interagency rulemaking processes—whereby several federal agencies develop policy recommendations and/or regulations, which then may be subject to formal notice and comment procedures—are used.

In certain cases, the process for initiating, investigating, and determining whether and what remedies might be appropriate is governed by statute and regulation and implemented directly by federal agencies.

The primary U.S. tariff laws that have been applied to date are administered by the Office of the U.S. Trade Representative (USTR)11 (Sections 201 and 301) and U.S. Department of Commerce’s (DOC) International Trade Administration (ITA) (AD/CVD).12

The U.S. International Trade Commission (USITC) is a nonpartisan, quasi-judicial organization that also plays an important role in investigating and determining injury to the U.S. industry and is involved in the Section 201 and AD/CVD processes.13 USITC is also responsible for investigating allegations brought under Section 337, most commonly in disputes that involve allegations of patent or registered trademark infringement, or trade secret misappropriation. It has authority to enforce cease and desist orders it issues under that provision, if applicable.14

Finally, the Department of Homeland Security’s (DHS) Customs and Border Protection (CBP) is charged with trade facilitation and enforcement, including the enforcement of trade remedies and the collection of duties, taxes, and fees.15 CBP is also responsible for enforcing USITC exclusion orders under Section 337.16 DHS is also the chair of the Forced Labor Enforcement Task Force (FLETF), which is charged with interagency coordination on the development of the UFLPA Entity List and other regulations, and the overall administration of UFLPA.17

The following table provides a brief digest of the information covered in this overview.

| Provision | Lead Agency | Issues Addressed | Process Overview | Tools / Remedies |

| Section 201 of the Trade Act of 1974 (“Section 201 Safeguard measures”) | USTR/ USITC | To help U.S. domestic industry compete successfully against increases in foreign competition. | USITC investigates allegations; USTR makes recommendations to POTUS; POTUS directs action; USTR implements via regulation. | Tariffs or other import restrictions, support for U.S. firms and workers, international negotiations, other measures as appropriate. |

| Section 301 of the Trade Act of 1974 | USTR | Address violations of trade agreements or “unjustifiable” / ”unreasonable” burdens on U.S. commerce. | USTR investigates, formal dispute resolution proceedings requested, USTR implements (with POTUS direction). | Tariffs or other import restrictions, withdrawal or suspension of trade agreement concessions, direct negotiations with foreign governments. |

| Tariff Act of 1930 Antidumping & Countervailing Duties (AD/CVD) | Joint/ Concurrent: DOC/ ITA and USITC | Sale of foreign goods into U.S. at unfair prices (“dumping”) and/or found to be unfairly subsidized. | DOC/USITC investigate concurrently according to regulations; CBP collects duties. | Impose duties on imports. |

| Section 337 of the Tariff Act of 1930 | USITC | Unfair acts in import trade not covered by AD/CVD; Mainly intellectual property violations. | Quasi-judicial process run by USITC | Exclusion orders and cease and desist orders; CBP enforces ITC orders. |

| Uyghur Forced Labor Protection Act (UFLPA) | DHS/ CBP | Forced Labor/human rights | Rulemakings and UFLPA Entity List designations—Interagency process. | Import restrictions; CBP enforces. |

Section 201 (“Safeguard measures”)

Purpose

Measures implemented under Section 201 of the Trade Act of 1974 (19 USC Ch. 12),18 are referred to as “safeguard” measures and are intended to help U.S. industry compete successfully with increases in foreign competition.19

Process

Investigations under this section are generally submitted to the USITC by domestic industry stakeholders who are seriously injured or are threatened by serious injury by increased foreign imports of comparable products.20 Investigations can also be initiated by resolutions passed by the Ways and Means Committee of the U.S. House of Representatives or Finance Committee of the U.S. Senate or the USITC on its own. The USITC then conducts an injury investigation to determine whether injury to U.S. industry has occurred and meets the threshold for relief.21

If the USITC sends the President a report containing an affirmative finding of serious injury or the threat thereof to domestic industry, the President then makes a determination as to what actions are appropriate to support domestic industry. There are a range of actions that the President can take, which can include the imposition of tariffs, providing support for U.S. firms and workers, negotiating with other countries, or other measures.22

Import relief (tariffs) can be imposed for up to four years and may be extended for an additional four years, or up to eight total years. The USITC conducts an ongoing review of 201 measures, and the President may determine that modifications, reductions, or termination of safeguard actions may be appropriate.23

Recent Actions Related to Clean Energy Technologies

Since 2018, “safeguard” measures on Chinese-produced solar cells and modules have been in place and have been extended through 2026. The 2018 Presidential Proclamation implementing the recommendations of the USITC imposed a tariff-rate quota (TRQ) of 2.5 gigawatts (GW), allowing for up to that amount to be imported, above which tariffs are imposed. It also imposed duties on the import of cells and modules, and directed the USTR to establish a process for interested persons to seek exclusions from having to pay duties on particular products.24

As a result of the public input received, USTR announced certain products would be excluded from tariffs in September 2018,25 and excluded further products in June 2019, including bifacial solar panels that absorb light and generate electricity on both sides of the panel (bifacial modules).26

In 2020, the President issued a proclamation seeking to end the bifacial exclusion;27 however, the exclusions were reinstated after being challenged at the Court of International Trade (CIT).28

In 2022, the Biden Administration extended 201 tariffs for another four years29 at the rates of:

| Current 201 Safeguard Tariff Rates30 | |

| Applicable Dates | Rate |

| February 7, 2022-February 6, 2023 | 14.75 % |

| February 7, 2023-February 6, 2024 | 14.50 % |

| February 7, 2024-February 6, 2025 | 14.25 % |

| February 7, 2025-February 6, 2026 | 14 % |

The 2022 modifications retained the bifacial exclusion and increased the TRQ to 5 GW.

On May 16, 2024, the Biden Administration announced modifications to the existing 201 tariffs. The announcement eliminates the exclusion for bifacial solar panels and provides for an increase in the TRQ of up to 7.5 GW if imports approach the current quota level. Imports above the TRQ will be assessed at a 14.25% tariff.31

On June 21, 2024, the Biden Administration released a Presidential Proclamation implementing its May 16, 2024 announcement.32 Generally, the Proclamation provides for panels that “are fulfilling contracts in effect and dated as executed prior to May 17, 2024,” to be imported for 90 days from the effective date of the Proclamation (June 21, 2024). The proclamation also provides directions for importers to appropriately classify and identify such imports, and directs CBP to take actions necessary to ensure compliance.33

On August 12, 2024, Proclamation 10790, which raises the TRQ limit from 5 GW to 12.5 GW, was published in the Federal Register.34

Section 301Section 301

Purpose

The Trade Act of 1974 includes several provisions (collectively “Section 301”) intended to provide legal authority to provide relief from unfair trade practices by imposing trade sanctions on foreign countries that violate U.S. trade agreements, or that burden U.S. commerce in an “unjustifiable” or “unreasonable” manner.35

Process

Investigations under this section can be initiated in response to a petition or by the USTR. Once an investigation is initiated, USTR must request consultations with the foreign government of concern. If the investigation involves a formal trade agreement, then USTR must request formal dispute resolution proceedings through the appropriate forum, such as the World Trade Organization. If not, the investigation continues, though bilateral or other consultations may be necessary. If the USTR’s investigation concludes that there has been a violation of a trade agreement or that a foreign government’s actions are “unjustifiable” and “burden or restrict” U.S. commerce, the USTR must take action.

Actions include imposition of duties or other import restrictions, withdrawal or suspension of trade agreement concessions, or direct engagement with the foreign government.36

Recent Actions Related to Clean Energy Technologies

In 2017, in response to a Presidential Memorandum, the USTR initiated a Section 301 investigation that determined PRC actions were unreasonable, discriminatory, and burdened or restricted U.S. commerce.37

Beginning in 2018, four lists were developed and implemented that imposed tariffs of between 10-25% on over $550 billion worth of imports from the PRC.38 The items covered a broad range of industrial, agricultural, consumer goods, and various inputs. Those inputs include certain items that can be used in a variety of clean energy technologies and applications, including: electrical transformers and components, systems for wind energy production, lithium and other batteries, industrial machines with multiple manufacturing applications, semiconductors, capacitors, resistors, fuses, cables, voltage regulators, among others.39 40

On May 14, 2024, The Biden Administration announced the completion of the legally required four-year review of tariffs on items from China under Section 301.41 While the USTR’s report42 found that to-date Section 301 actions have been effective in encouraging the PRC to take steps toward eliminating some of its technology transfer-related actions, policies, and practices, they have not eliminated enough of these policies to warrant the broad reduction or elimination of U.S. tariffs.

As a result, the Biden Administration is maintaining the tariffs in place on most items and substantially increasing or imposing tariffs on $18 billion worth of imports from China in 14 particular strategic sectors and items, including: electric vehicles, batteries, solar cells and modules, steel and aluminum, critical minerals and other inputs, semiconductors, certain health care items, and ship to shore cranes.43

The President also directed USTR to establish an exclusions process for a number of machines necessary for the production of certain items, including 19 types of solar manufacturing equipment.

On May 22, 2024, the USTR issued a Federal Register notice establishing temporary exclusions for solar manufacturing equipment through May 31, 2025, and requesting additional public comments through June 28, 2024. 44 The USTR received over 1,100 comments in response to the May 2024 Notice. On July 30, 202445 and again on August 30, 2024,46 USTR issued Notices delaying the release of its final determination and delaying the implementation of tariffs that were previously scheduled to take effect on August 1, 2024.

On September 13, 2024, the USTR released its final determination47 implementing the tariffs with certain modifications. The final determination addresses comments received by USTR, outlines certain modifications to the May 2024 proposal, and sets updated final implementation dates for the tariffs that were scheduled to be implemented on August 1, 2024 (now Sept. 27, 2024). Notable modifications in the final determination of interest to the clean energy sector include:

- Additional Tariffs on Solar Cell Inputs: USTR intends to propose 50% tariff rates on two inputs for solar cell production: (1) HS subheading 2894.61.00, (Silicon containing by weight not less than 99.99 percent of silicon), and (2) HS subheading 3818.00.00 (Chemical elements doped for use in electronics, in the form of discs, wafers, etc., chemical compounds doped for electronic use). USTR will issue a separate notice seeking public comment on the matter. The USTR’s rationale is that increasing tariffs on these items will “encourage the diversification of supply chains and will lessen dependence on China for these products,” and provide additional leverage with the PRC.

- Exclusions for solar manufacturing equipment, reduced to 14 from the 19 initially proposed: USTR’s May Notice proposed 19 exclusions covering solar manufacturing equipment: five for equipment to manufacture solar modules; six for solar cells; and eight for solar wafers. USTR’s final determination adopts exclusions for 14 types of equipment for manufacturing solar cells and wafers effective January 1, 2024, and through May 31, 2025. The list of equipment listed in Annex B of the Notice48 and included below.

- On December 11, 2024, the USTR announced49 the final tariff increases on the five additional items identified in the September 13 announcement, including solar inputs. Effective January 1, 2025, imports of solar wafers and polysilicon will be subject to a 50% tariff rate, and tungsten products will be subject to a 25 % rate. 50

A brief summary of key clean energy technology items and inputs, the rates of tariff increase, and date of imposition are below (please consult the final determinations 51 52for full lists of items subject to tariff increases by HS code as well as other implementation details):

301 Tariff Increases for Clean Technology Products/Inputs

| Item | Rate | Date | |

| 1 | Electric Vehicles | From 25% to 100% | September 27, 2024 |

| 2 | Solar cells (whether or not assembled into modules) | From 25% to 50% | September 27, 2024 |

| 3 | Steel and aluminum products | From 0-7.5% to 25% | September 27, 2024 |

| 4 | Lithium-ion EV batteries | From 7.5% to 25% | September 27, 2024 |

| 5 | Critical minerals | From 0% to 25% | September 27, 2024 |

| 6 | Polysilicon | From 25% to 50% | January 1, 2025 |

| 7 | Natural graphite and permanent magnets | From 25% to 50% | January 1, 2025 |

| 8 | Lithium-ion non-EV batteries | From 7.5% to 25% | January 1, 2026 |

| 9 | Natural graphite and permanent magnets | From 0% to 25% | January 1, 2026 |

Solar Manufacturing Equipment Exclusion Product Description (Annex B of USTR Final Determination)

| Silicon growth furnaces, including Czochralski crystal growth furnaces, designed for growing monocrystalline silicon ingots (boules) of a mass exceeding 700 kg, for use in solar wafer manufacturing (described in statistical reporting number 8486.10.0000). |

| Band saws designed for cutting or slicing cylindrical monocrystalline silicon ingots (boules) of an initial mass exceeding 400 kg into square or rectangular ingots (boules), for use in solar wafer manufacturing (described in statistical reporting number 8486.10.0000). |

| Machines designed to align and adhere square or rectangular monocrystalline silicon ingots (boules) of an initial mass exceeding 200 kg to plastic support boards on metal mounting plates to provide support during diamond wire sawing, for use in solar wafer manufacturing (described in statistical reporting number 8486.10.0000). |

| Diamond wire saws designed for cutting or slicing square or rectangular monocrystalline silicon ingots (boules) of an initial mass exceeding 400 kg into solar wafers of a thickness not exceeding 200 micrometers (described in statistical reporting number 8486.10.0000). |

| Wire guide roller machines, presented with diamond wire saws designed for slicing square or rectangular monocrystalline silicon ingots (boules) of an initial mass exceeding 400 kg into solar wafers of a thickness not exceeding 200 micrometers, all of the foregoing for use in solar wafer manufacturing (described in statistical reporting number 8486.10.0000). |

| Coolant fluid recycling machines, presented with diamond wire saws designed for slicing square or rectangular monocrystalline silicon ingots (boules) of an initial mass exceeding 400 kg into solar wafers of a thickness not exceeding 200 micrometers, all of the foregoing for use in solar wafer manufacturing (described in statistical reporting number 8486.10.0000). |

| Degumming machines designed to remove adhesives from solar wafers (described in statistical reporting number 8486.10.0000). |

| Texturing, etching, polishing, and cleaning machines designed to prepare, repair, clean, etch, polish or texture the solar wafer substrate, whether or not integrated with automation equipment for transferring solar wafers from one process station to the next, all the foregoing for use in solar wafer manufacturing (described in statistical reporting number 8486.20.0000). |

| Thermal diffusion quartz-tube furnaces, designed to diffuse dopant impurities into square or rectangular silicon wafers, whether or not integrated with automation equipment for transferring solar wafers from one process station to the next or boat loading or unloading machines, all the foregoing for use in solar cell manufacturing (described in statistical reporting number 8486.20.0000). |

| Plasma-enhanced or low-pressure chemical vapor deposition machines designed to deposit amorphous or nanocrystalline layers on one or both surfaces of a solar wafer, whether or not integrated with automation equipment for transferring solar wafers from one process station to the next, all the foregoing for use in solar cell manufacturing (described in statistical reporting number 8486.20.0000). |

| Physical vapor deposition (PVD) machines, designed to deposit a thin film of transparent conducting oxide on one or both surfaces of a solar wafer, whether or not integrated with automation equipment for transferring solar wafers from one process station to the next, all the foregoing for use in solar cell manufacturing (described in statistical reporting number 8486.20.0000). |

| Screen printing line machines, including sintering furnaces for printing conducting contacts on both surfaces of a solar wafer, whether or not integrated with automation equipment for transferring solar wafers from one process station to the next, and whether or not integrated with equipment for solar cell testing, all the foregoing for use in solar cell manufacturing (described in statistical reporting number 8486.20.0000). |

| Machines designed for transporting polysilicon material to growth furnaces and machines designed for transporting monocrystalline ingots (boules) and wafers throughout the solar wafer manufacturing process, including machines for loading or unloading solar wafers during the diamond wire slicing process (described in statistical reporting number 8486.40.0030). |

| Machines designed for lifting, handling, loading, or unloading of solar wafers of a thickness not exceeding 200 micrometers, for use in solar wafer manufacturing (described in statistical reporting number 8486.40.0030) |

Antidumping/ Countervailing Duties (AD/CVD)

Purpose

AD/CVD duties are intended to counteract the adverse effects of sales of foreign goods in the United States at unfair prices (“dumping”) or of foreign goods whose production benefited from certain foreign subsidies, either of which injure or threaten to injure U.S. businesses. AD/CVD duties are applied to imports of those foreign goods.53

In general, “dumping” occurs when a foreign company sells a product in the U.S. at a lower price than it normally charges in its home market or below the cost of production plus a reasonable amount of profit.54

While certain subsidies are allowed under international law, U.S. law sets forth standards for determining if subsidies (which can include direct payments, tax credits, below-market-rate loans, the provision of goods or services for less than adequate remuneration, or other financial support) are unfair and allow for imposing tariffs (“countervailing duties”) to offset the unfair subsidies.55 Actions have also been pursued against firms located in other countries that utilize unfairly priced PRC components.56

Process

AD/CVD duties imposed under the Tariff Act of 1930, as amended (19 USC Ch. 4)57, are administered by the U.S. DOC, specifically the department’s International Trade Administration.

Petitions are generally filed by domestic manufacturers, trade associations, unions, or other affected parties involved in producing goods that are being impacted by foreign imports.58 Petitions may seek either AD or CVD duties, or both, and may be submitted by the domestic industry or very rarely self-initiated by DOC.

Petitions are filed with both the DOC and the USITC. The DOC is charged with determining whether dumping or countervailable subsidies exist and the margin of the dumping or amount of subsidy. The USITC is responsible for determining whether there is either material injury or a threat of material injury to U.S. industry.59

If the DOC makes an initial affirmative determination, it instructs CBP to collect AD/CVD cash deposits from U.S. importers of the offending products. If both DOC and USITC make affirmative final findings, DOC issues an order and instructs CBP to continue collecting AD/CVD cash deposits from U.S. importers.

The final AD/CVD duties owed are determined through an administrative review, if requested, which often concludes years after importation.60 The U.S.’s “retrospective assessment” system,61 or the delay between importation and the determination of final duties owed, creates significant commercial uncertainty for importers, as there have been cases where final duties are not calculated for many years after entry, and when ultimately imposed are at a level many times higher than initial deposits. In practice, the framework itself can serve as a deterrent to imports of goods subject to AD/CVD orders—even where preliminary duty rates are commercially viable. This is because importers will not know the precise duty liability at the time of importation and may shift their purchasing to somewhat higher-priced goods from other countries that are not subject to the uncertainties of the AD/CVD orders.

In addition to administrative reviews, which may occur on an annual basis starting approximately one year after issuance of an order,62 AD/CVD orders are subject to additional reviews outlined in regulation that may result in changes in the administration of AD/CVD orders.63 “Sunset” reviews are the next most common reviews and are conducted every five years to determine whether dumping or countervailable subsidies are occurring, and injury to the domestic industry would be likely to continue or resume in the absence of an order.64 Both DOC and ITC conduct sunset reviews, and domestic industry and other stakeholders have the opportunity to participate in the review process before either agency. The result of DOC’s review is then transmitted to USITC within 240 days of initiating the review via notice in the Federal Register.65 Generally USITC completes its reviews within 360 days of initiation. Both agencies must find that the need for the AD/CVD order continues, or the order will be revoked.66 In practice, both agencies typically find that AD/CVD orders should continue, and these orders often remain in place for many more than five years.

Investigations and the determination of cash deposits and final duties owed are conducted pursuant to the law and regulations which set forth specific deadlines and criteria for AD/CVD proceedings, including what information will be considered, how DOC calculates prices, subsidy benefits, and other matters.67

AD or CVD orders can provide for duties specific to examined firms, as well as rates broadly applicable to unexamined firms. In addition, once an AD/CVD order is issued, the domestic industry may request (or DOC can self-initiate) circumvention inquiries to determine whether items that are outside the scope of existing orders should be pulled within the orders to protect the remedial effects of the AD/CVD orders.

Examples of circumvention include activities such as minor alterations of goods by foreign producers, shifting of supply chains, or other circumstances intended to avoid duties.68 Circumvention inquiries are conducted by DOC and upon a determination that circumvention has occurred, AD/CVD duties are applied.69

Given the item and case-specificity, variety of potential rates depending on the firm, country of export, and other factors, importers need to conduct due diligence to understand whether their specific items or producers from which they source have been found to circumvent an AD/CVD order and what duty may be owed.

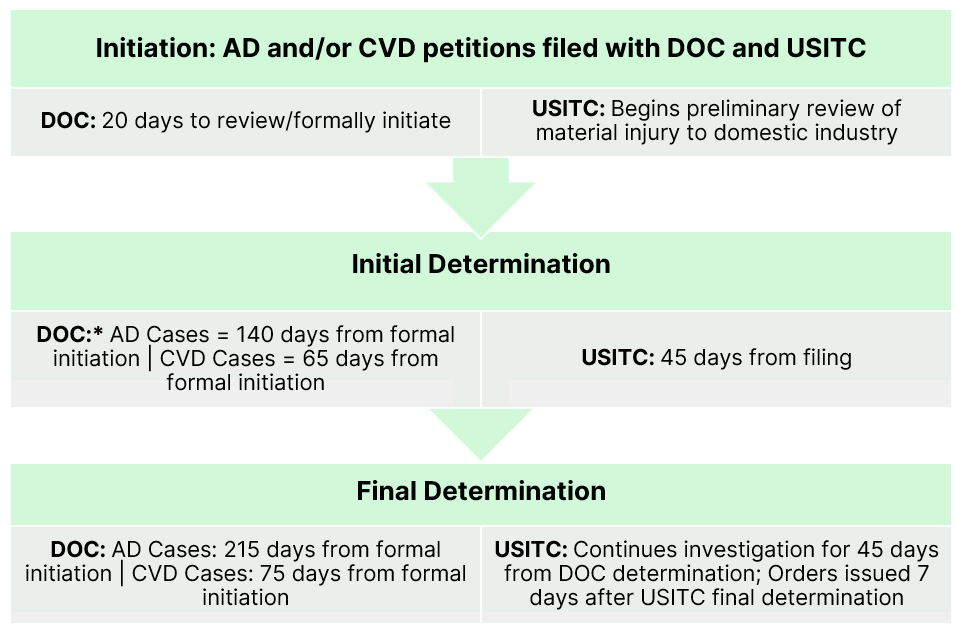

AD and CVD investigations follow procedures, phases, and timelines that are set by statute and regulation:70

*Cash deposits implemented by CBP may be imposed once DOC makes an affirmative initial determination. NOTE: While DOC preliminary and final determination deadlines are governed by statute, they may be extended under certain circumstances.

Recent Actions Related to Clean Energy Technologies

To date, U.S. trade remedies have primarily been applied in response to petitions from U.S. companies in the solar sector alleging harm to the domestic industry resulting from unfairly “dumped” or subsidized imports from abroad, particularly from China. A brief overview of the major AD/CVD and circumvention cases, and outcomes for the solar sector since 2011, follows:

November 2011: DOC and USITC received petitions for AD and CVD investigations into imports of solar cells from the PRC.71 Based on the affirmative final determinations of the USITC and DOC, in 2012, DOC issued both AD and CVD orders:

- The AD order imposed duties ranging from 18-25% on goods produced by firms listed in the rule and a PRC-wide rate of 250% on imports from all other PRC firms.72

- The CVD order imposed duties of 14-15% on all solar products from the PRC.73

- In June 2024, DOC issued the results of its second five-year review of the 2012 CVD order and determined that revocation of the order would likely lead to continuation or recurrence of a countervailable subsidies at rates of between 25.56-26.75% for certain firms, and at 26.15 % for all others subject to the order.74

December 2014: DOC issued affirmative final determinations on petitions received in December 2013: AD investigations of certain crystalline silicon photovoltaic products from the PRC and Taiwan, and its CVD investigation into certain crystalline silicon voltaic products from the PRC identified in the order.75 DOC then issued orders:

- February 2015: DOC issued a final AD order finding dumping margins of between 11.45 and 27.55 % for firms in Taiwan.76

- February 2015: DOC issued a final AD and CVD order that found dumping margins of between 26.71 and 165.04 % percent on imports from certain companies and PRC-wide, and CVD rates of between 27.64 and 38.43% from certain companies and PRC-wide.77

February 2022: DOC received a petition alleging that since the actions taken in 2012, Chinese producers acted to circumvent existing U.S. tariffs on imports directly from China by working through third countries, specifically Cambodia, Malaysia, Thailand, and Vietnam.78 In June 2022, prior to the DOC issuing a final determination in the case, the President issued a Proclamation that declared an emergency due to threats to the availability of sufficient electricity generation capacity to meet expected consumer demand and imposed a 24-month pause on the collection of AD/CVD duties on imports alleged to be circumventing existing AD/CVD orders.79

- The DOC issued its final determination in August 2023,80 which found that imports of certain crystalline silicon photovoltaic cells imported from Thailand, Vietnam, Malaysia, and Cambodia, using parts from China, are circumventing the AD and CVD orders on solar cells and modules from China.81 The two-year pause on imported items from the named countries expired on June 6, 2024, and items imported during that time must be used/installed within 180 days (December 3, 2024) to avoid AD/CVD duties.82

April 2024: The American Alliance for Solar Manufacturing Trade Committee (AASMTC), which is made up of seven domestic solar manufacturers, filed AD and CVD petitions with the USITC and DOC.83 The petitions allege that certain crystalline silicon photovoltaic cells, whether or not assembled into modules, imported primarily from Chinese-headquartered firms’ operations in Vietnam, Thailand, Malaysia, and Cambodia, are being or are likely being dumped in the U.S. and are being subsidized, and that these imports are materially injuring the U.S. domestic industry.84

- NOTE: The petitions were filed on the same day that the DOC’s updates to enhance, improve, and strengthen its existing AD/CVD regulations took effect. These amendments to the DOC’s regulations pertain to filing requirements, scope, circumvention, and covered merchandise inquiries, the use of new factual information, the CVD facts available hierarchy, surrogate value and CVD benchmark selections, particular market situations (PMS), and certain types of countervailable subsidies. The two changes in these amendments that could have the biggest effect on AD/CVD duty rates include: (1) allowing DOC to consider nonexistent, weak, or ineffective property (including intellectual property), human rights, labor, and environmental protections in evaluating costs and prices in AD/CVD proceedings; (2) allowing for investigation into, and when DOC determines appropriate, countervailing “transnational subsidies,” meaning subsidies provided by a government in one country to producers in another country which then exports to the U.S.85 As these are one of the first petitions to be adjudicated under these amended regulations, it is unclear what the precise impact will be on any AD/CVD duties that may be ultimately imposed.

On May 15, 2024, the DOC announced the initiation of AD and CVD investigations and set the dates for the case to proceed, which are likely to be extended.86

On June 7, 2024, the ITC voted 4-0 to continue the investigation based on ITC’s determination that U.S. industry is materially injured by the alleged sale of less than fair value and subsidized cells and modules from Malaysia, Thailand, and Vietnam, and subsidized cells from Cambodia.87

On August 15, 2024, AASMTC’s lawyers filed a “critical circumstances” petition, alleging that since the initial filing of the case in April, imports from Vietnam and Thailand have surged by 39% and 17%, respectively.88 “Critical circumstances” petitions are intended to deter importers from stockpiling large quantities of products that are subject to investigation before a preliminary determination is made, and provide relief if such stockpiling does occur (absent a petition and affirmative “critical circumstances” finding, duties would not begin to be assessed until DOC issues an affirmative preliminary finding). If DOC and ITC issue affirmative findings in response to a “critical circumstances” petition, then DOC will direct CBP to collect duties on imports that entered the U.S. up to 90 days before a preliminary determination is made.89

- Based on the current case calendar, if an affirmative “critical circumstances” finding is made, retroactive duties could be assessed for imports that entered the U.S. as of approximately July 3, 2024 (or potentially earlier).

On October 1, 2024, DOC released the preliminary affirmative determinations in the countervailing duty investigations, finding country-wide subsidy rates of 8.25% for Cambodia, 9.13% for Malaysia, 23.06% for Thailand, and 2.85% for Vietnam. Higher subsidy rates were found for particular firms operating within each country.90 As a result of the affirmative preliminary determination, DOC will direct CBP to begin suspending entries and collecting duties at the preliminarily determined rate of subsidization. Interested parties will also have 30 days to comment on the preliminary determination, which will help to inform DOC’s final determination.91

In addition, DOC preliminarily determined that, as alleged by the petitioners on August 15, critical circumstances existed for Thailand and Vietnam (although not for all suppliers; for specific information on the application of critical circumstances please refer to the Federal Register Notices for Thailand and Vietnam).92 CBP will be directed to collect cash deposits on applicable imports that entered the U.S. 90 days or less before the publication of DOC’s preliminary determination in the Federal Register. The affirmative preliminary determinations were published on October 4, 2024,93 therefore the 90-day window would date back to July 6, 2024. These cash deposits may be returned if the ITC does not make an affirmative determination on critical circumstances as part of its final determination, which will not occur until March 2025 based on the current case calendar (as of 10/3/24). The rates may also change the DOC’s final determinations.

On November 29, 2024, DOC released94 the preliminary determinations in the antidumping investigations of CSPV cells and modules from CMTV. The preliminary rates are generally consistent with the rates alleged by the petitioners. However, differing rates were found for particular producers in the exporting countries. DOC also affirmed “critical circumstances” for Vietnam95 and Thailand96 in its AD preliminary determination, which is effective in the Federal Register as of December 4, 2024, making the 90-day window retroactive to September 5, 2024.

| Current Timeline of Solar Manufacturing Trade Committee AD/CVD Case as Provided by DOC’s ITA97 | |||

| Event | AD Investigations | CVD Investigations | Outcomes/Impact |

| Petitions Filed | 4/24/2024 | 4/24/2024 | DOC/ITC begin review |

| Commerce Initiation Date | 5/14/2024 | 5/14/2024 | DOC determines petitions meet required standards and formally begins investigation. ITA issues case calendar, identifies alleged dumping/ subsidy rates, etc. |

| USITC Preliminary Determinations | 6/10/2024 | 6/10/2024 | If affirmative, case proceeds. ITC issued 4-0 affirmative determination. |

| “Critical Circumstances” Petition Filed Due to Allegations of Import Surge from Vietnam and Thailand (NOTE: This is not a standard/required step). | 8/15/2024 | 8/15/2024 | If DOC/ITC make affirmative determinations, then CBP is directed to collect cash deposits on imports up to 90 days or more prior to the date of preliminary determinations (e.g. July 6, 2024, based on October 4th filing of preliminary determinations in the Federal Register). In this case, retroactive duties could be imposed, and would be based on the margin set in the preliminary determination. |

| DOC Preliminary Determinations | 11/29/2024 | 9/30/2024 | DOC will instruct CBP to require cash deposits on imported merchandise in amounts equal to the preliminary dumping/subsidy rates; These provisional measures will be effective the day of the Federal Register publication and will be in effect no more than four months. |

| DOC Final Determinations | 4/18/2025 | 2/10/2025 | DOC issues final determination which includes final duty rates—these may differ from the preliminary rates, sometimes substantially. |

| ITC Final Determinations | 6/2/2025 | 3/27/2025 | ITC has 45 days from DOC final determination to issue its own. If affirmative, DOC issues AD/CVD orders; if negative, investigation is terminated. |

| Issuance of Orders | 6/9/2025 | 4/3/2025 | Pending ITC final determination, orders issued and take effect. |

Section 337 (Intellectual Property Protections)

Purpose

Section 337 of the Tariff Act of 193099 gives the USITC broad authority to conduct investigations into unfair practices in import trade. Section 337 investigations most often involve intellectual property violations, including allegations of patent and copyright infringement by imported goods.100 This provision may also be used to address other forms of unfair competition, such as misappropriation of trade secrets, violations of antitrust laws, and other legal theories which feature unfairly imported goods that injure a domestic industry.101

Process

The Section 337 process is a quasi-judicial proceeding administrated by the USITC. Impartial Administrative Law Judges (ALJs) play a key role by overseeing the development of a discovery and trial record much like in a federal court. As with other trade remedies, DHS’s CBP is typically tasked with enforcement of the ITC’s Section 337 orders.

The USITC initiates an investigation upon the receipt of a properly filed complaint. When an investigation is initiated, the Chief ALJ of the USITC assigns an ALJ to preside over the proceedings. The ALJ then has 45 days from publication in the Federal Register of a notice of investigation to set a target date for completion of the investigation. The ALJ then seeks to make an initial determination (ID) on the merits of the case no later than four months prior to the target date. The process is consistent with other impartial legal processes and affords parties to the case the right of adequate notice, cross-examination, presentation of evidence, objection, motion, argument, and other essential rights to a fair hearing.102

After a formal evidentiary hearing on the case, the ALJ issues an Initial Determination (ID) which is then reviewed by the USITC. The USITC can review and adopt, decline to review (in which case the ID takes effect), or reverse the ID. While there is no specific statutory deadline for cases to be completed, the USITC has historically worked to complete most investigations within 15-18 months, depending on the complexity of the case.103 In addition, any remedial orders approved by USITC are sent to the President for a 60-day “Presidential Review Period,” during which the President may disapprove the orders for policy reasons (this is rare).

If the President takes no action, the order is effective. During this period, activities prohibited under the order may continue, provided a bond is posted.104

The law provides two primary remedies: Exclusion orders and cease and desist orders.

- Exclusion orders direct CBP to exclude goods from the U.S. and can be “limited” – i.e. applicable to just the goods from a particular firm that is named as a respondent in the investigation – or “general,” carrying powerfully broad applicability to restrict imports of all infringing goods regardless of source (including goods that were not considered in the litigation at the ITC, but later found by CBP to fall within the order).

- Cease and desist orders direct the party found to be exporting, importing, or selling infringing imported articles to cease its unfair acts, and are enforced by the USITC. Civil penalties may be assessed for failure to comply, including fines of the greater of $100,000 per violation day or twice the domestic value of the violating goods entered each day.105

In addition, petitioners may seek preliminary relief in the form of a “temporary exclusion order/or temporary cease and desist order.” Such temporary proceedings are quite rare as the USITC requires substantial additional proof and other requirements for these requests, but if a complainant makes the required showing, determinations are made by the USITC within 90 days of initiating an investigation (up to 150 days for complex cases).106

Not all Section 337 investigations are adjudicated or resolved using these remedies. Parties to the investigation may also move to terminate an investigation if they reach an agreement, either for appropriate licensing of the items at issue or other settlement. USITC has also engaged in mediation programs to address Section 337 matters. If an alternative resolution is determined to be in the public interest by the ALJ and USITC, the motion may be approved either in whole or in part.107

Recent Actions Related to Clean Energy Technologies

Section 337 relief has been sought in several cases related to clean energy technologies, including wind turbines, electric vehicles and components, and solar panels.

One notable recent Section 337 investigation (337-TA-1159)—Certain Lithium Ion Batteries, Battery Cells, Battery Modules, Battery Packs, Components Thereof, and Processes Therefore)—featured allegations of trade secret misappropriation brought by a Korean battery maker against a rival’s imports of components and battery inputs into a newly established $2.6 billion EV battery plant in Georgia. The USITC ultimately issued exclusion and cease and desist orders that would have effectively shuttered the Georgia plant by cutting off its supply of materials.108 Not long after, the parties entered into a $1.8 billion settlement to resolve the dispute and lift the ITC’s orders.109

UFLPAUyghur Forced Labor Prevention Act (UFLPA)

Purpose

The use of forced and child labor to produce goods has been recognized as a violation of human rights, and U.S. trade law has long included provisions to prohibit the importation of such goods. In 2021, UFLPA was enacted to strengthen existing U.S. prohibitions on the importation of goods mined, produced, or manufactured using forced labor, particularly from the XUAR due to the systemic use of such labor directed by the Chinese Communist Party against the Uyghur population of the region.110

Process

Restrictions imposed under the UFLPA (P.L. 117-78111) are administered by DHS.

The UFLPA amended existing restrictions on the importation of items produced with forced labor by establishing a “rebuttable presumption” that any goods produced in whole or in part in the XUAR are made with forced labor and thus prohibited unless the importer presents CBP with clear and convincing evidence to the contrary.112

DHS has also established a UFLPA Entity List, which identifies PRC-based firms that have been determined to meet the requirements of the UFLPA, including entities in the XUAR that mine, produce, or manufacture wholly or in part any goods, wares, articles, and merchandise using forced labor, among other concerns consistent with UFLPA.113

Recent Actions Related to Clean Energy Technologies

Prior to enactment of UFLPA, in June 2021, DHS issued a “Withhold Release Order” (WRO) against one of China’s largest producers of silica-based products, which include solar panels, electronics, and other goods, due to concerns related to the use of forced labor in the XUAR for production of the goods.114

A WRO directs U.S. personnel to detain shipments of goods that are suspected of being produced using forced or child labor. Importers of goods subject to a WRO have three months to either prove that the shipment does not violate the law or export the goods to another destination. If no action is taken in that period, DHS will destroy the merchandise.115

UFLPA took effect on June 21, 2022, and items imported on or after that date that were covered by the 2021 WRO and also subject to UFLPA became subject to the law’s “rebuttable presumption” policy.116

Imports of polysilicon-based products have been identified by the FLETF as high-priority sectors for enforcement.117 The FLETF’s 2024 strategy update retained the existing four priority sectors—apparel, cotton and cotton products, silica-based products (including polysilicon), and tomatoes and downstream products—and added three additional sectors: polyvinyl chloride (PVC), aluminum, and seafood.118

While DHS does not provide item-specific disaggregated data, solar products are included under the “electronics” heading, which has been the largest sector for detained shipments not only from China but also from third countries such as Malaysia, Vietnam, and Thailand.119

As of July 2024, there are 68 entities on the UFLPA Entity List, including several that produce polysilicon products and lithium-ion batteries.120 Further additions to the UFLPA Entity List are possible and could impact the clean technology supply chain.

For any inquiries about U.S. trade restrictions on clean energy technology imports, please contact Jeremy Horan, ACORE’s Vice President of Government Affairs, at horan@acore.org.

Author

ACORE Team Member

1 ACORE appreciates the support from Alex Chinoy, William Isasi and Jay Smith of Covington & Burling LLP on this Issue Brief.

2 International Energy Agency, “Securing Clean Energy Technology Supply Chains,” July 2022, https://iea.blob.core.windows.net/assets/0fe16228-521a-43d9-8da6-bbf08cc9f2b4/SecuringCleanEnergyTechnologySupplyChains.pdf.

3 Nectar Gan, “Russia, Chopsticks, Oversupply: Everything You Want to Know about Janet Yellen’s China Visit,” CNN, April 8, 2024, https://edition.cnn.com/2024/04/08/business/janet-yellen-china-visit-takeaways-hnk-intl/index.html.

4 Keith Bradsher, “U.S. Solar Panel Makers Accuse Chinese of Trade Violations,” The New York Times, October 19, 2011, https://www.nytimes.com/2011/10/20/business/global/us-solar-manufacturers-to-ask-for-duties-on-imports.html.

5 Note and Disclaimer: To ensure brevity and focus on provisions that have been applied to the clean technology sector, this brief does not seek to cover all aspects of restrictions applied to steel and aluminum, such as the application of Section 232 national security tariffs, as those matters are well covered by other sources; nor does it seek to provide an exhaustive review of potential provisions of law that address imports, exports, investment, or other matters impacting international trade. This overview does not constitute legal advice, and readers should consult counsel regarding the application of any of the outlined provisions or other trade laws to their business activities.

6 Sections 201 and 301 are under the Trade Act of 1974

7 AD/CVD is under the Tariff Act of 1930

8 United States International Trade Commission, “About Section 337,” 2024, https://www.usitc.gov/intellectual_property/about_section_337.htm#:~:text=Unfair%20import%20%28a.k.a.%2C%20Section%20337%29%20investigations%20conducted%20by.

9 Congressional Research Service, “Section 307 and Imports Produced by Forced Labor,” October 25, 2023, https://crsreports.congress.gov/product/pdf/IF/IF11360.

10 U.S. Customs and Border Protection, “Uyghur Forced Labor Prevention Act,” U.S. Customs and Border Protection, October 25, 2022, https://www.cbp.gov/trade/forced-labor/UFLPA.

11 United States Trade Representative, “Enforcement,” United States Trade Representative, n.d., https://ustr.gov/issue-areas/enforcement.

12 International Trade Administration, “U.S. Antidumping and Countervailing Duties,” www.trade.gov, n.d., https://www.trade.gov/us-antidumping-and-countervailing-duties.

13 United States International Trade Commission, “About the USITC | USITC,” www.usitc.gov, n.d., https://www.usitc.gov/press_room/about_usitc.htm.

14 United States International Trade Commission. “Section 337 Investigations | Answers to Frequently Asked Questions,” March 2009. https://www.usitc.gov/intellectual_property/documents/337_faqs.pdf.

15 U.S. Customs and Border Protection, “Trade,” U.S. Customs and Border Protection, n.d., https://www.cbp.gov/trade.

16 United States International Trade Commission. “Section 337 Investigations | Answers to Frequently Asked Questions,” March 2009. https://www.usitc.gov/intellectual_property/documents/337_faqs.pdf.

17 U.S. Customs and Border Protection, “Uyghur Forced Labor Prevention Act,” U.S. Customs and Border Protection, October 25, 2022, https://www.cbp.gov/trade/forced-labor/UFLPA.

18 “19 USC Ch. 12: Front Matter,” House.gov, 2018, https://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title19-chapter12-front&num=0&edition=prelim.

19 Vivian C. Jones, Specialist in International Trade and Finance, Congressional Research Service, “Safeguards: Section 201 of the Trade Act of 1974,” December 31, 2018, available at: https://crsreports.congress.gov/product/pdf/IF/IF10786/7

20 United States International Trade Commission, “Understanding Safeguard Investigations | USITC,” Usitc.gov, n.d., https://www.usitc.gov/press_room/us_safeguard.htm.

21 Congressional Research Service, “Section 201 of the Trade Act of 1974,” December 31, 2018, https://crsreports.congress.gov/product/pdf/IF/IF10786/7

22 United States International Trade Commission, “Understanding Safeguard Investigations | USITC,” Usitc.gov, n.d., https://www.usitc.gov/press_room/us_safeguard.htm.

23 Congressional Research Service, “Section 201 of the Trade Act of 1974,” December 31, 2018, https://crsreports.congress.gov/product/pdf/IF/IF10786/7

24 Executive Office of the President, Proclamation 9693, ”To Facilitate Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products) and for Other Purposes, 2018, Proclamation 9693 of January 23, 2018,” published in the Federal Register on January 25, 2018, available at: https://www.federalregister.gov/d/2018-01592

25 U.S. Trade Representative, Notice, ”Exclusion of Particular Products From the Solar Products Safeguard Measure, 2018, Notice of September 19, 2018.” Federal Register. https://www.federalregister.gov/d/2018-20342.

26 U.S. Trade Representative, Notice of Product Exclusion, ”Exclusion of Particular Products From the Solar Products Safeguard Measure, 2019, Notice of June 13, 2019.” Federal Register. https://www.federalregister.gov/d/2019-12476.

27 Executive Office of the President, Proclamation 10101, “To Further Facilitate Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products), 2020, Proclamation 10101 of October 10, 2020,” as published in the Federal Register on October 16, 2020, available at: https://www.federalregister.gov/d/2020-23108

28 As noted in this opinion, “The court has on five occasions addressed ongoing litigation involving efforts by the President to withdraw an exclusion from safeguard duties on imported solar cells, duties which the President had imposed by proclamation to protect the domestic industry from serious injury suffered due to increased imports,” Gary S. Kratzmann, Judge, Solar Energy Industries Association, et al. v. United States, et al. (United States Court of International Trade November 16, 2021). https://www.cit.uscourts.gov/sites/cit/files/21-154.pdf

29 Executive Office of the President, Proclamation 10339 of February 4, 2022, “To Continue Facilitating Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products), 2022, Proclamation 10339 of February 4, 2022,” as published in the Federal Register on February 9, 2022, available at: https://www.federalregister.gov/d/2022-02906.

30 U.S. Customs and Border Protection, “QB 22-507 Solar Cells and Modules 2022 ,” www.cbp.gov, n.d., https://www.cbp.gov/trade/quota/bulletins/qb-22-507-solar-cells-and-modules-2022.

31 The White House, “FACT SHEET: Biden-Harris Administration Takes Action to Strengthen American Solar Manufacturing and Protect Manufacturers and Workers from China’s Unfair Trade Practices,” The White House (The White House, May 16, 2024), https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/16/fact-sheet-biden-harris-administration-takes-action-to-strengthen-american-solar-manufacturing-and-protect-manufacturers-and-workers-from-chinas-unfair-trade-practices/.

32 Executive Office of the President, Proclamation 10779 of June 21, 2024, “To Further Facilitate Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products), 2024, Proclamation 10779 of June 21, 2024,” published in the Federal Register on June 26, 2024 available at: https://www.federalregister.gov/d/2024-14143

33 Ibid.

34 Executive Office of the President, Proclamation 10790 of August 12, 2024, “To Further Facilitate Positive Adjustment to Competition from Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into Other Products,” as published in the Federal Register on August 15, 2024 and available at: https://www.federalregister.gov/documents/2024/08/15/2024-18444/to-further-facilitate-positive-adjustment-to-competition-from-imports-of-certain-crystalline-silicon

35 Congressional Research Service, “Section 301 of the Trade Act of 1974,” December 6, 2021, https://crsreports.congress.gov/product/pdf/IF/IF11346/14 14 (congress.gov)

36 Ibid.

37 U.S. Trade Representative, “Update Concerning China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property, and Innovation,” November 20, 2018, https://ustr.gov/sites/default/files/enforcement/301Investigations/301%20Report%20Update.pdf.

38 U.S. Trade Representative, “China Section 301-Tariff Actions and Exclusion Process,” ustr.gov, n.d., https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions.

39 Ibid.

40 U.S. International Trade Commission, “Trade Shifts Timeline,” usitc.gov, n.d., usitc.gov/research_and_analysis/tradeshifts/2018/tradeshiftstimeline.html

41 The White House, “FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices,” The White House, May 14, 2024, https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/.

42 U.S. Trade Representative, “Four-Year Review of Actions Taken in the Section 301 Investigation: China’s Acts, Polices, and Practices Related to Technology Transfer, Intellectual Property, and Innovation,” ustr.gov, n.d., https://ustr.gov/sites/default/files/USTR%20Report%20Four%20Year%20Review%20of%20China%20Tech%20Transfer%20Section%20301.pdf

43 The White House, “FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices,” The White House, May 14, 2024, https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/.

44 United States Trade Representative, “U.S. Trade Representative Katherine Tai to Take Further Action on China Tariffs after Releasing Statutory Four-Year Review,” United States Trade Representative, May 20, 2014, https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/may/us-trade-representative-katherine-tai-take-further-action-china-tariffs-after-releasing-statutory.

45 Office of the U.S. Trade Representative, Statement, “Office of the U.S. Trade Representative Continues to Review Public Comments for Proposed Modifications to China 301 Actions,” July 30, 2024 available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/july/office-us-trade-representative-continues-review-public-comments-proposed-modifications-china-301

46 Office of the U.S. Trade Representative, Statement, “USTR Update on Final Determination in Section 301 Investigation,” August 30, 2024, available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/august/ustr-update-final-determination-section-301-investigation

47Office of the U.S. Trade Representative, Final Determination, “Notice of Modification: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation,” released September 13, 2024. Press release available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/september/ustr-finalizes-action-china-tariffs-following-statutory-four-year-review and notice text in the Federal Register available at: https://www.federalregister.gov/documents/2024/09/18/2024-21217/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer

48 Office of the U.S. Trade Representative, “Notice of Modification: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation,” as published in the Federal Register, September 18, 2024, available at: https://www.federalregister.gov/documents/2024/09/18/2024-21217/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer

49 Office of the U.S. Trade Representative, Press Release, “USTR Increases Tariffs Under Section 301 on Tungsten Products, Wafers, and Polysilicon, Concluding the Statutory Four-Year Review,” December 11, 2024, available online at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/december/ustr-increases-tariffs-under-section-301-tungsten-products-wafers-and-polysilicon-concluding

50 Office of the U.S. Trade Representative, “Notice of Modification: China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation,” as published in the Federal Register, December 16, 2024, available at: https://www.federalregister.gov/documents/2024/12/16/2024-29462/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer.

51 Office of the U.S. Trade Representative, “Notice of Modification: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation,” as published in the Federal Register, September 18, 2024, available at: https://www.federalregister.gov/documents/2024/09/18/2024-21217/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer.

52 Office of the U.S. Trade Representative, “Notice of Modification: China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation,” as published in the Federal Register, December 16, 2024, available at: https://www.federalregister.gov/documents/2024/12/16/2024-29462/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer.

53 International Trade Administration, “U.S. Antidumping and Countervailing Duties,” www.trade.gov, n.d., https://www.trade.gov/us-antidumping-and-countervailing-duties.

54 International Trade Administration, “Antidumping and Countervailing Duty Frequently Asked Questions,” International Trade Administration | Trade.gov, accessed August 8, 2024, https://www.trade.gov/antidumping-and-countervailing-duty-frequently-asked-questions.

55 Ibid.

56 U.S. Department of Commerce, “Department of Commerce Issues Final Determination of Circumvention Inquiries of Solar Cells and Modules from China,” U.S. Department of Commerce, August 18, 2023, https://www.commerce.gov/news/press-releases/2023/08/department-commerce-issues-final-determination-circumvention-inquiries.

57 “19 USC Ch. 4: TARIFF ACT of 1930,” House.gov § (n.d.), https://uscode.house.gov/view.xhtml?req=granuleid%3AUSC-prelim-title19-chapter4&saved=%7CZ3JhbnVsZWlkOlVTQy1wcmVsaW0tdGl0bGUxOS1jaGFwdGVyNC1ub2RlNTQ0LWZyb250%7C%7C%7C0%7Cfalse%7Cprelim&edition=prelim.

58 International Trade Administration, “Antidumping and Countervailing Duty Frequently Asked Questions,” International Trade Administration | Trade.gov, accessed August 8, 2024, https://www.trade.gov/antidumping-and-countervailing-duty-frequently-asked-questions.

59 United States International Trade Commission, “Understanding Antidumping & Countervailing Duty Investigations | USITC,” www.usitc.gov, n.d., https://www.usitc.gov/press_room/usad.htm.

60 “19 USC Ch. 4: TARIFF ACT of 1930,” Sec. 1675 (a) House.gov § (n.d.), https://uscode.house.gov/view.xhtml?req=granuleid%3AUSC-prelim-title19-chapter4&saved=%7CZ3JhbnVsZWlkOlVTQy1wcmVsaW0tdGl0bGUxOS1jaGFwdGVyNC1ub2RlNTQ0LWZyb250%7C%7C%7C0%7Cfalse%7Cprelim&edition=prelim.

61 International Trade Administration and Department of Commerce, “Code of Federal Regulations,” 19 CFR 351.213 Ecfr.gov § (n.d.), https://www.ecfr.gov/current/title-19/chapter-III/part-351/subpart-B/section-351.213.

62 Ibid.

63 International Trade Administration and Department of Commerce, “Code of Federal Regulations,” 19 CFR 351 Subpart B Ecfr.gov § (2024), https://www.ecfr.gov/current/title-19/chapter-III/part-351/subpart-B.

64 International Trade Administration and Department of Commerce, “Code of Federal Regulations,” 19 CFR 351.218 Ecfr.gov § (n.d.), https://www.ecfr.gov/current/title-19/chapter-III/part-351/subpart-B/section-351.218.

65 Ibid.

66 United States International Trade Commission, “Understanding Five-Year (Sunset) Reviews,” Usitc.gov, n.d., https://www.usitc.gov/press_room/us_sunset.htm.

67 International Trade Administration and Department of Commerce, “Code of Federal Regulations,” 19 CFR 351 – Antidumping and Countervailing Duties Ecfr.gov § (n.d.), https://www.ecfr.gov/current/title-19/chapter-III/part-351/subpart-B/section-351.213.

68 International Trade Administration, “Antidumping and Countervailing Duty Frequently Asked Questions,” International Trade Administration | Trade.gov, accessed August 8, 2024, https://www.trade.gov/antidumping-and-countervailing-duty-frequently-asked-questions.

69 Ibid.

70 International Trade Administration, “Statutory Time Frame for AD/CVD Investigations,” www.trade.gov, n.d., https://www.trade.gov/statutory-time-frame-adcvd-investigations.

71 International Trade Administration and Department of Commerce, “Commerce Initiates Antidumping Duty (AD) and Countervailing Duty (CVD) Investigations of Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules (Solar Cells) from the People’s Republic of China (China),” n.d., https://enforcement.trade.gov/download/factsheets/factsheet_prc-solar-cells-ad-cvd-init.pdf.

72 International Trade Administration and Department of Commerce, “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from the People’s Republic of China: Amended Final Determination of Sales at Less than Fair Value, and Antidumping Duty Order,” 77 FR 73018 Federalregister.gov § (2012), https://www.federalregister.gov/d/2012-29668.

73 IInternational Trade Administration and Department of Commerce, “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from the People’s Republic of China: Countervailing Duty Order,” 77 FR 73017 § (2012), https://www.federalregister.gov/d/2012-29669.

74 International Trade Agency and Department of Commerce, “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules from the People’s Republic of China: Final Results of the Expedited Second Sunset Review of the Countervailing Duty Order,” Federalregister.gov § (2024), https://www.federalregister.gov/d/2024-12531.

75 International Trade Administration, “FACT SHEET Commerce Finds Dumping of Imports of Certain Crystalline Silicon Photovoltaic Products from China and Taiwan and Countervailable Subsidization of Imports of Certain Crystalline Silicon Photovoltaic Products from China,” n.d., https://enforcement.trade.gov/download/factsheets/factsheet-multiple-certain-crystalline-silicon-photovoltaic-products-ad-cvd-final-121614.pdf.

76 International Trade Administration and Department of Commerce, “Certain Crystalline Silicon Photovoltaic Products from Taiwan: Antidumping Duty Order,” 80 FR 8596 Federalregister.gov § (2015), https://www.federalregister.gov/d/2015-03179.

77 International Trade Administration and Department of Commerce, “Certain Crystalline Silicon Photovoltaic Products from the People’s Republic of China: Antidumping Duty Order; and Amended Final Affirmative Countervailing Duty Determination and Countervailing Duty Order,” 80 FR 8592 Federalregister.gov § (2015), https://www.federalregister.gov/d/2015-03183.

78 Thomas Beline to Secretary Gina Raimondo, “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules from the People’s Republic of China: Auxin Solar’s Request for an Anti-Circumvention Ruling pursuant to Section 781(B) of the Tariff Act of 1930, as Amended,” February 8, 2022, https://www.seia.org/sites/default/files/2022-02/Circumvention%20Petition%20Filed%202.8.22.pdf.

79 Executive Office of the President, Proclamation 10414, “Declaration of Emergency and Authorization for Temporary ExtU.S. Department of Commerce, “Department of Commerce Issues Final Determination of Circumvention Inquiries of Solar Cells and Modules from China,” U.S. Department of Commerce, August 18, 2023, https://www.commerce.gov/news/press-releases/2023/08/department-commerce-issues-final-determination-circumvention-inquiries. ensions of Time and Duty-Free Importation of Solar Cells and Modules From Southeast Asia, 2022, Proclamation 10414 of June 6, 2022,” published in the Federal Register on June 9, 2022, available at: https://www.federalregister.gov/d/2022-12578

80 U.S. Department of Commerce, “Department of Commerce Issues Final Determination of Circumvention Inquiries of Solar Cells and Modules from China,” U.S. Department of Commerce, August 18, 2023, https://www.commerce.gov/news/press-releases/2023/08/department-commerce-issues-final-determination-circumvention-inquiries.

81 International Trade Administration and Department of Commerce, “Antidumping and Countervailing Duty Orders on Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from the People’s Republic of China: Final Scope Determination and Final Affirmative Determinations of Circumvention with Respect to Cambodia, Malaysia, Thailand, and Vietnam,” 88 FR 57419 unblock.federalregister.gov § (2023), https://www.federalregister.gov/d/2023-18161.

82 International Trade Administration, “Reminder on Utilization Requirements for Solar Cells and Modules Imported from Cambodia, Malaysia, Thailand, and Vietnam,” International Trade Administration | Trade.gov, August 23, 2023, https://www.trade.gov/reminder-utilization-requirements-solar-cells-and-modules-imported-cambodia-malaysia-thailand-and.

83 American Alliance for Solar Manufacturing Trade Committee, “Leading U.S. Solar Manufacturers File Trade Petitions to Combat China’s Illegal & Harmful Trade Practices in Vietnam, Malaysia, Cambodia, and Thailand, Wiley Rein LLP Reports – American Alliance for Solar Manufacturing Trade Committee,” April 24, 2024, https://americansolartradecmte.org/leading-u-s-solar-manufacturers-file-trade-petitions-to-combat-chinas-illegal-amp-harmful-trade-practices-in-vietnam-malaysia-cambodia-and-thailand-wiley-rein-llp-reports/.

84 819498-2163476.pdf (usitc.gov)

85 International Trade Administration and Department of Commerce, “Regulations Improving and Strengthening the Enforcement of Trade Remedies through the Administration of the Antidumping and Countervailing Duty Laws,” 89 FR 20766 unblock.federalregister.gov § (2024), https://www.federalregister.gov/d/2024-05509.

International Trade Administration, “Webinar on Updated Antidumping and Countervailing Duty Regulations,” May 9, 2024, https://www.trade.gov/sites/default/files/2024-05/May%209%2C%202024%20Webinar.pdf.

Federal Register :: Regulations Improving and Strengthening the Enforcement of Trade Remedies Through the Administration of the Antidumping and Countervailing Duty Laws; PowerPoint Presentation (trade.gov)

86 U.S. International Trade Administration, “Commerce Initiates Antidumping and Countervailing Duty Investigations of Crystalline Silicon Photovoltaic Cells from Cambodia, Malaysia, Thailand, and the Socialist Republic of Vietnam,” www.trade.gov, n.d., https://www.trade.gov/commerce-initiates-antidumping-and-countervailing-duty-investigations-crystalline-silicon.

87 United States International Trade Commission, “USITC VOTES to CONTINUE INVESTIGATIONS on CRYSTALLINE SILICON PHOTOVOLTAIC CELLS, WHETHER or NOT ASSEMBLED into MODULES from CAMBODIA, MALAYSIA, THAILAND, and VIETNAM,” www.usitc.gov, June 7, 2024, https://www.usitc.gov/press_room/news_release/2024/er0607_65269.htm.

88 Wiley Rein LLP, press release, “Wiley Files Critical Circumstances Allegations Against Solar Imports from Vietnam and Thailand,” August 15, 2024, available at: https://www.wiley.law/pressrelease-Wiley-Files-Critical-Circumstances-Allegations-Against-Solar-Imports-from-Vietnam-and-Thailand

89 U.S. International Trade Administration, “AD/CVD Initiation FAQs,” available online at: https://www.trade.gov/faq/faqs-initiation-antidumping-duty-andor-countervailing-duty-investigation.

90 U.S. International Trade Administration, “Preliminary Affirmative Determinations in the Countervailing Duty Investigations of Crystalline Photovoltaic Cells Whether or Not Assembled into Modules from Cambodia, Malaysia, Thailand, and Vietnam,” released October 1, 2024 and available online at: https://www.trade.gov/commerce-preliminary-countervailing-duty-investigation-crystalline-photovoltaic-cells-cambodia

91 U.S. Department of Commerce, International Trade Administration, Federal Register Notice, October 4, 2024, ”Antidumping or Countervailing Duty Investigations, Orders, or Reviews: Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled into Modules, from Malaysia,” available online at: https://www.federalregister.gov/public-inspection/2024-22997/antidumping-or-countervailing-duty-investigations-orders-or-reviews-crystalline-silicon-photovoltaic (See also notices for Thailand: https://www.federalregister.gov/public-inspection/2024-22993/antidumping-or-countervailing-duty-investigations-orders-or-reviews-crystalline-silicon-photovoltaic; Notice for Cambodia: https://www.federalregister.gov/public-inspection/2024-22999/antidumping-or-countervailing-duty-investigations-orders-or-reviews-crystalline-silicon-photovoltaic and Notice for Vietnam: https://www.federalregister.gov/public-inspection/2024-22994/antidumping-or-countervailing-duty-investigations-orders-or-reviews-crystalline-silicon-photovoltaic)

92 Ibid.

93 Ibid.

94 U.S. International Trade Administration, Fact Sheet, “Preliminary Affirmative Determinationas in the Antidumping Duty Investigations of Crystalline Photovoltaic Cells Whether or Not Assembled into Modules from Cambodia, Malaysia, Thailand, and the Socialist Republic of Vietnam (Vietnam),” November 29, 2024, available online at: https://www.trade.gov/preliminary-determinations-antidumping-duty-duty-investigations-crystalline-photovoltaic-cells

95 U.S. International Trade Administration, “Crystalline Silicone Photovoltaic Cellse, Whether or Not Assembled Into Modules From the Socialist Republic of Vietnam: Preliminary Affirmative Determination of Sales at Less Than Fair Value, Preliminary Affirmative Determination of Critical Circumstances, in Part, and Postponement of Final Determination and Extension of Provisional Measures,” Federal Register Notice, December 4, 2024, available online at: https://www.federalregister.gov/documents/2024/12/04/2024-28403/crystalline-silicon-photovoltaic-cells-whether-or-not-assembled-into-modules-from-the-socialist

96 U.S. International Trade Administration, “Crystalline Silicone Photovoltaic Cells, Whether or Not Assembled Into Modules, From Thailand: Preliminary Affirmative Determination of Sales at Less-Than-Fair-Value, Affirmative Determination of Critical Circumstances, Postponement of Final Determination, and Extension of Provisional Measures,” Federal Register Notice, December 4, 2024, available online at: https://www.federalregister.gov/documents/2024/12/04/2024-28404/crystalline-silicon-photovoltaic-cells-whether-or-not-assembled-into-modules-from-thailand

97 U.S. International Trade Administration, Fact Sheet, “Preliminary Affirmative Determinations in the Antidumping Investigations of Crystalline Silicon Photovoltaic Cells Whether or Not Assembled into Modules from Cambodia, Malaysia, Thailand and the Socialist Republic of Vietnam (Vietnam),” November 29, 2024, available online at: https://www.trade.gov/preliminary-determinations-antidumping-duty-duty-investigations-crystalline-photovoltaic-cells

99 “19 USC Ch. 4: Tariff Act of 1930,” Sec. 1337 House.gov § (n.d.), https://uscode.house.gov/view.xhtml?path=/prelim@title19/chapter4&edition=prelim.

100 United States International Trade Commission, “About Section 337 | United States International Trade Commission,” Usitc.gov, 2024, https://www.usitc.gov/intellectual_property/about_section_337.htm#:~:text=Unfair%20import%20%28a.k.a.%2C%20Section%20337%29%20investigations%20conducted%20by.

101 United States International Trade Commission. “Section 337 Investigations | Answers to Frequently Asked Questions,” March 2009. https://www.usitc.gov/intellectual_property/documents/337_faqs.pdf.

102 Ibid.

103 Ibid.

104 Ibid.

105 Civil penalties are outlined at 19 USC § 1337(f)(2).

106 United States International Trade Commission. “Section 337 Investigations | Answers to Frequently Asked Questions,” March 2009. https://www.usitc.gov/intellectual_property/documents/337_faqs.pdf.

107 Ibid.

108 Lisa R. Barton, Certain Lithium Ion Batteries, Battery Cells, Battery Modules, Battery Packs, Components Thereof, and Processes Therefor (U.S. International Trade Commission February 10, 2021) https://www.usitc.gov/system/files/secretary/fed_reg_notices/337/337_1159_notice_02102021sgl.pdf

109 Hyunjoo Jin, Heekyong Yang, and David Shepardson, “S.Korean Battery Makers Agree $1.8 Bln Settlement, Aiding Biden’s EV Push,” Reuters, April 11, 2021, sec. Technology, https://www.reuters.com/technology/skorean-battery-makers-agree-18-bln-settlement-aiding-bidens-ev-push-2021-04-11/.

110 Homeland Security, “UFLPA Strategy ,” www.dhs.gov, n.d., https://www.dhs.gov/uflpa-strategy.

111 Rep. James McGovern, “H.R.6256 – to Ensure That Goods Made with Forced Labor in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China Do Not Enter the United States Market, and for Other Purposes.” (2021), https://www.congress.gov/bill/117th-congress/house-bill/6256/titles.

112 U.S. Customs and Border Protection, “Uyghur Forced Labor Prevention Act (UFLPA) Public Law No. 117-78 December 23, 2021,” June 2022, https://www.cbp.gov/sites/default/files/assets/documents/2022-Jun/UFLPA%20CBP%20Importer%20Overview%20Final%20PBRB%20Approved_0.pdf.

113 Homeland Security, “UFLPA Entity List,” www.dhs.gov, n.d., https://www.dhs.gov/uflpa-entity-list.