- Energy Storage & Decarbonization Pathways

- Just Transition

- Project Finance

- Sustainable Investing & ESG

- Tax Incentives & Appropriations

- Trade & Supply Chain

- Blog

Expectations for Renewable Energy Finance: The Post-IRA Landscape

The Inflation Reduction Act (IRA) provides the U.S. clean energy sector with an unprecedented opportunity for growth, offering new and extended tax incentives and other policy support. Despite headwinds prompted by grid and supply chain constraints, trade restrictions, financing barriers, and inflation, early analysis indicates that trillions of dollars in private-sector investment could flow into the sector as a result of the IRA.

Recently, the IRS and Treasury provided highly anticipated guidance on the transactional provisions of the tax credits within the IRA, specifically focusing on direct pay and transferability. Direct pay allows tax-exempt and governmental entities to invest in clean energy projects and claim the equivalent amount of tax credit in the form of a direct payment from the IRS. Direct pay is also available for taxable entities who would receive credits for carbon capture, clean hydrogen and the manufacturing of renewable energy components. Transferability enables project owners to monetize tax credits by transferring them to other taxpayers with sufficient tax liabilities (such as corporate off-takers), facilitating new investors and financing for new clean energy projects and addressing constraints in the tax equity market. These guidelines are expected to unlock a massive infusion of new renewable energy investment and broaden participation in the clean energy transition.

In the sixth issue of the American Council on Renewable Energy (ACORE)’s annual Expectations for Renewable Energy Finance report, ACORE surveyed companies that actively develop or finance U.S. renewable energy projects about their companies’ plans for 2023 and their outlooks for growth over the next three years. The survey results represent the near- and mid-term outlooks of some of the most prominent companies in the sector. The report also reflects companies’ expectations for the availability of project financing sources in a post-IRA implementation landscape, including transferability, direct pay, and traditional tax equity.

Below are some of the most significant findings from the report.

Near-Term Outlook

Investment in the U.S. renewable energy and energy storage sectors in 2022 remained steady at $54.8 billion, while still falling short of the annual investment needed (approx. $96 billion) to achieve the administration’s objective for power sector decarbonization by 2035.

- Investment in solar projects decreased by 8%.

- Investment in wind projects fell by 25%.

- Investment in energy storage projects increased to a record $5.3 billion.

The IRA has already increased companies’ participation in the market in 2023.

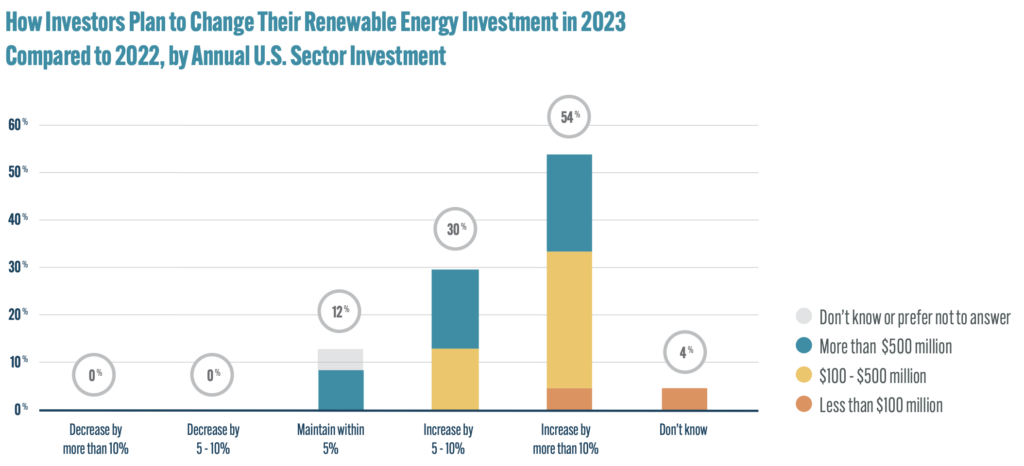

- All investors and most developers plan to increase their activity in the renewable energy sector compared to the previous year.

- 84% of investors plan to increase renewable energy investment by 5% or more.

- Only 4% of investors express uncertainty, down from 16% last year.

- Investors cite the IRA’s long-term tax credit extensions, solar production tax credits, standalone storage investment tax credits, direct pay, and transferability as shaping their investment behavior in 2023.

Mixed Expectations for Tax Equity:

Surveyed investors and developers provided the following insights on the market’s availability of project financing sources and their experiences attracting those sources:

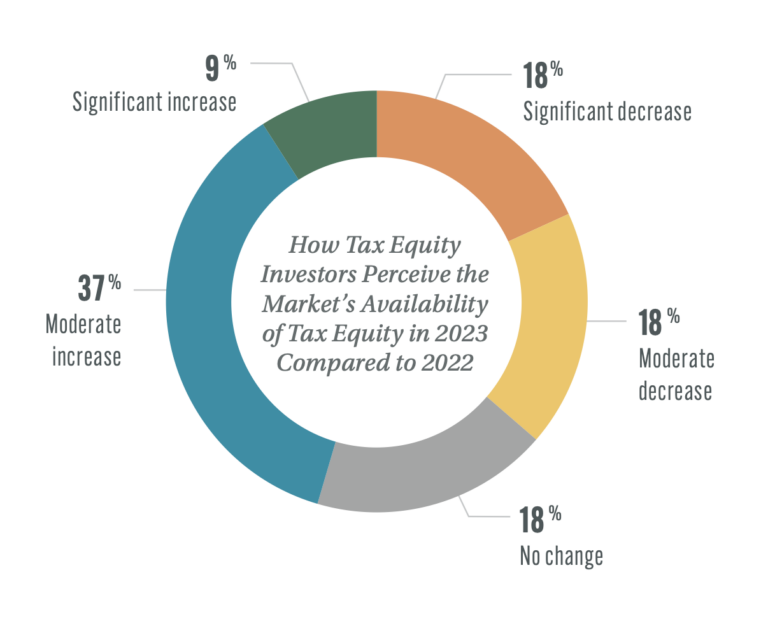

- Of the surveyed investors who specifically invest in tax equity, 36% report a decrease in tax equity this year compared to 2022, while 46% see an increase.

- Investors who report a reduction in tax equity cited the need for Treasury guidance on specific tax-related provisions of the IRA as causing a slowdown.**

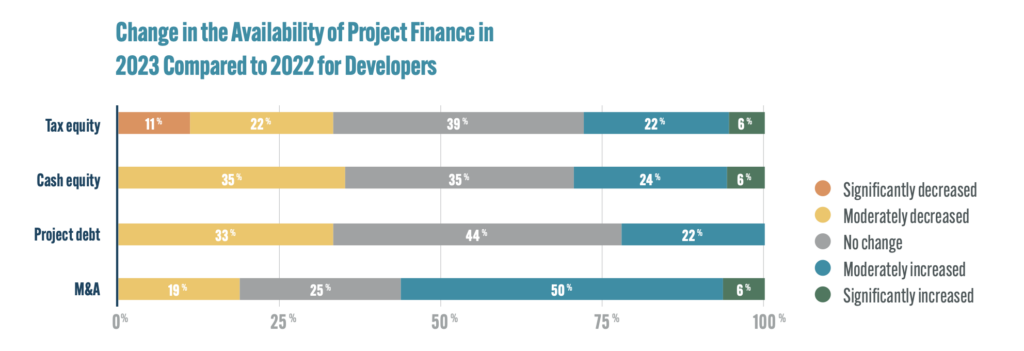

- While 39% of developers observe no change in the availability of tax equity this year, one-third of respondents expect a decrease, expecting a sharp rise in demand for tax equity without additional supply.

- More than half of developers report increased mergers and acquisitions (M&A).

Recent attempts to limit ESG investment have affected one-third of investors and developers.

- 34% of investors report that recent state-level legislation (and other political actions) taken against ESG investment have negatively affected their investment plans in the renewable sector.

- 33% of developers believe that anti-ESG political actions have a slight or moderate negative impact on their ability to attract investment.

Equitable Investment:

Survey responses from both investors and developers indicate that supportive IRA provisions targeting low-income and energy communities are helping to inform investment and development decisions:

- Over 90% of surveyed investors and developers prioritize low-to-moderate income (LMI) communities (or “energy communities”, as defined by the IRA) to some extent in their renewable investment or development decisions.

- Most developers (84%) consider the inclusion of minority or women-owned business enterprises (MWBEs) to some extent when selecting suppliers.

Mid-Term Outlook

Investors unanimously expect the U.S. to increase in attractiveness for renewable energy investment in 2023-2026 compared to other countries.

- For the first time in the six years ACORE has conducted investor surveys, 100% of surveyed investors report an increase in perceived attractiveness of the U.S. as a venue for renewable energy investment compared with other leading countries.

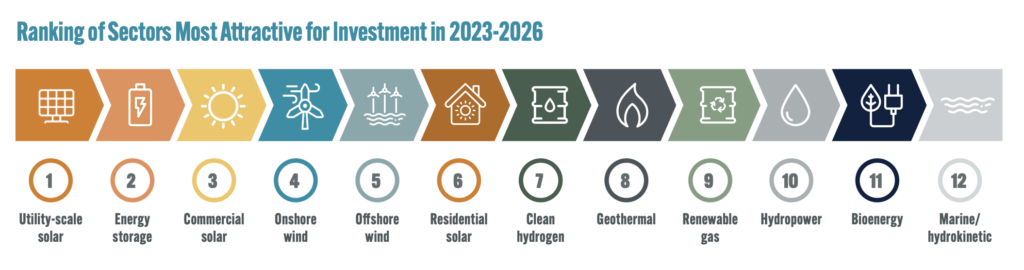

Investors collectively rank utility-scale solar, energy storage, and commercial solar as the top three most attractive clean energy sectors for investment over 2023-2026.

- The top three most attractive technologies for investment have remained constant since ACORE’s 2022 surveys.

- Multiple investors also expressed optimism about the growth of the offshore wind sector as an area of future investment.

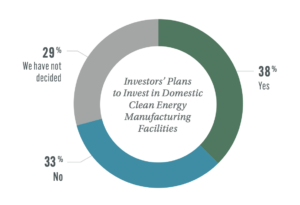

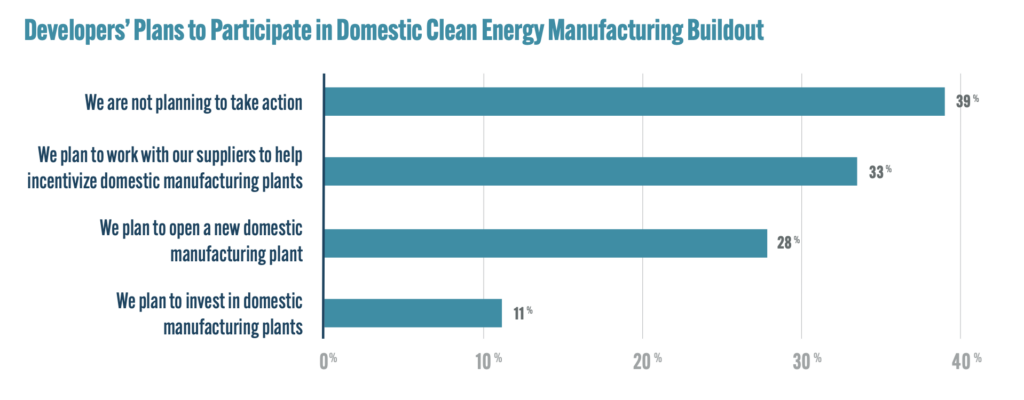

In response to government incentives designed to reduce reliance on imported solar, wind, and energy storage equipment, many investors and developers plan to participate in domestic efforts to expand clean energy manufacturing:

- Over one-third (38%) of investors plan to invest in domestic clean energy manufacturing facilities in the U.S.

- 28% of developers report plans to open a new manufacturing plant.

- 33% plan to incentivize their suppliers to open domestic facilities.

- 11% intend to invest in domestic manufacturing plants.

- Developers expect tax equity to be the most available financing source over the next three years, while investors rank tax equity in fourth place:

- Both groups expect transferability to play a significant role in the market.

Outlook for Project Finance

Investors warn the tax equity market must nearly triple in size to meet heightened post-IRA demand.

- New investors and expanded commitments from existing investors are needed to address the lack of supply in the tax equity market.

- The most consequential constraints in the tax equity market are non-economic:

- Surveyed companies describe the administrative process of undergoing tax equity transactions as complex, slow, and bureaucratic.

- Looming policy and regulatory issues also present challenges.

Transferability and Direct Pay:

- Over 80% of surveyed investors plan to utilize either transferability or direct pay.

- Most investors (61%) intend to utilize both transferability and direct pay.

- Corporations and banks—including existing tax equity investors—are perceived as the most likely entities to purchase transferable tax credits.

- Other potential purchasers include insurance companies, equity firms, and oil and gas companies.

- There is concern among investors that transferring tax credits might pass on risks to the transferee, limiting the available pool of tax credit buyers.

Conclusion

In light of the IRA’s provisions and recently issued guidance from the IRS and Treasury, the renewable energy sector is poised for significant growth and increased private-sector investment. While the industry faces challenges such as supply chain issues, grid constraints, and uncertainties surrounding tax credit monetization, recent guidance on direct pay and transferability provide a solid foundation for unlocking new opportunities and broadening investor participation in the clean energy transition.

By strategically deploying its resources to promote policy reforms and market drivers, ACORE is working to maximize the impact of the IRA and further propel the renewable energy industry toward a more sustainable future.

The full report can be accessed here.

**Note: The guidance mentioned in this article on direct pay and transferability was not available at the time the American Council on Renewable Energy (ACORE) conducted its survey. The subsequent release of the guidance by the IRS and Treasury has since provided important clarifications and enhanced the understanding of tax credit monetization within the renewable energy sector.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)