Expanding a Circular Renewable Economy and Improving End-of-Life Management for Renewable Technologies

As the U.S. renewable energy economy grows, the question of how to dispose of decommissioned technologies, such as solar panels and wind turbines, is increasingly coming into focus. Additionally, the continued growth of the sector will also lead to a rise in demand for the critical materials used, most of which the U.S. currently imports. These challenges require solutions in the form of circular production, recycling and end-of-life management.

Recycling metals and minerals produced via a circular model could be one cost-effective way to meet a rise in domestic demand and, by extension, support the expansion of a U.S. manufacturing base. Fortunately, with the support of government programs, the U.S. renewable energy sector has begun innovating important solutions.

What Does a Circular Economy Look Like for Renewables?

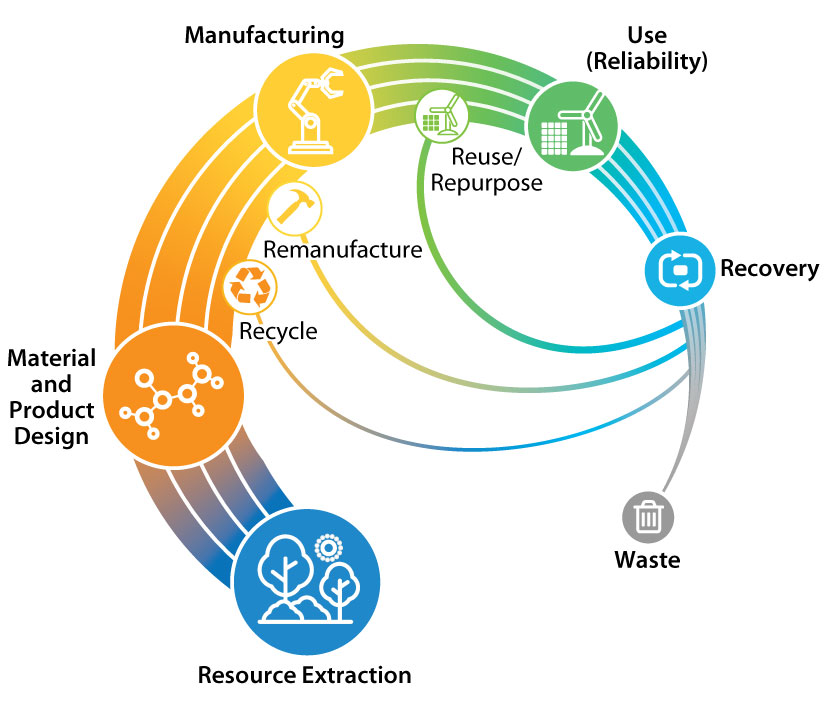

In a circular model of production, materials used for manufacturing consist of recycled and/or recovered materials in conjunction with new designs for recyclability, reducing the need to mine and extract new raw materials. The U.S. Environmental Protection Agency (EPA) describes a circular economy as “an economy that uses a systems-focused approach” to “keep materials, products, and services in circulation for as long as possible.” This reduction in mining and extraction can lead to lower costs, reduced environmental impacts such as water loss and carbon emissions, and reduced reliance on global supply chains.

Implementing a circular economy prompts the question of how to distribute responsibilities and costs among industry stakeholders. Innovation in these areas is occurring under government- and private-sector-led initiatives. Operationally, producers – specifically manufacturers – of renewable technologies could carry out many technical functions of circular production, such as recovering, refurbishing and reusing materials for production inputs and manufacturing more recyclable friendly designs and components. Meanwhile, the government can help reduce the cost burdens for producers by implementing policy incentives for recovering and recycling technology components.

With recent federal policy actions designed to grow U.S. clean energy manufacturing and technology recycling, now is a critical time to start implementing improved circular economy practices throughout the U.S. renewable energy supply chain.

Recent Legislation

Recently enacted federal and state legislation addresses certain aspects of circular production and recycling initiatives in the clean energy sector. Such legislation includes, but is not limited to:

Federal Legislation

- The Inflation Reduction Act (IRA) extends tax credit eligibility (up to 30 percent of investment) to clean energy manufacturing plants built or upgraded for recycling materials.

- The Infrastructure Investment and Job Act (IIJA) allocates grant funding for battery recycling research, development and demonstration; convenes a task force dedicated to developing a framework for producer responsibility for recovering batteries; and launches a $10 million lithium-ion battery recycling competition.

- The Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act allocates grants dedicated to recycling helium, a key component in semiconductors, which are used in renewable technologies such as PV modules.

State Legislation

- Washington was the first state to pass a law in 2017 requiring solar manufacturers to finance and manage takeback programs for used solar units and ensure they are recycled. The law will begin to be implemented in 2025.

- New Jersey and North Carolina both enacted legislation in 2020 requiring the study of end-of-life management options for PV modules. These states have also created advisory groups to recommend policies supporting EV battery recycling.

- Illinois enacted Public Act 102-1025 in May 2022 establishing a task force dedicated to research opportunities for recycling renewable energy and energy storage components, on which they are to publish a formal report by 2025.

- California also enacted universal waste regulations in 2021 addressing end-of-life management for discarded PV modules.

Government Programs

While there are no national recycling laws or mandates exclusively governing clean energy technologies or e-waste, two regulations under the EPA – the Resource Conservation and Recovery Act and the Pollution Prevention Act – govern all industrial recycling, including clean energy technologies. However, the Department of Energy (DOE) is expanding its programs dedicated to recycling renewable technologies, some of which is supported by funding from the IIJA. Examples of DOE programs include:

- On August 3, 2022, the DOE’s Office of Manufacturing and Energy Supply Chains announced a Request for Information (RFI) seeking public input for a new $750 million Advanced Energy Manufacturing and Recycling Grant Program funded by the IIJA. This program will support the expansion and creation of manufacturing and recycling facilities that produce and recycle clean energy products.

- On March 18, 2022, the DOE Solar Energy Technologies Office (SETO) released an action plan to enable the safe and responsible handling of PV end-of-life materials. The plan entails stakeholder outreach activities, data gathering, research, and analysis, including the development of a database that tracks characteristics of modules, hardware research to reduce the environmental impacts, and a target to reduce the cost of recycling solar panels to about $3 per panel by 2030.

- DOE’s Wind Energy Tech Recycling Research & Development program, funded by the IIJA and housed under the Office of Energy Efficiency and Renewable Energy (EERE), provides financial support to eligible entities carrying out research, development and demonstration projects for recycling wind energy technologies. The program recently awarded $40 million to various institutions carrying out this research.

- DOE leads a national research collaboration among industry, academia and national laboratories called ReCell, which is working to advance recycling technologies for the entire battery lifecycle.

- A team of National Renewable Energy Laboratory (NREL) analysts is researching best practices for recycling and implementing a circular model for manufacturing energy materials.

For batteries, a recent White House report titled “100-Day Reviews under Executive Order 14017: Building Resilient Supply Chains, Revitalizing American Manufacturing, And Fostering Broad-Based Growth” outlines the federal administration’s long-term intentions to develop a circular economy for advanced battery materials and battery recycling infrastructure to recover nickel and cobalt used for manufacturing, reducing the need for new mining and supply chain-related price fluctuations of the materials. The report indicates that achieving this objective will require both executive and legislative policy support.

Private Sector Initiatives Led by Renewable Energy Manufacturers and Developers

Manufacturers and developers in the renewables sector are experimenting with circular business functions in the form of takeback programs, recovering and reusing renewable technology materials and innovating recyclable products. Examples of private sector programs include:

Circular Economy /Recycling Initiative |

Companies |

| Takeback programs

Programs in which a company accepts the return of used products from the consumer to recycle, reuse or refurbish.

| First Solar offers a recycling service agreement with two-year termed renewable pricing or an on-demand service for single-event or consolidated module recycling requests.

|

| Recovering and/or repurposing materials

This function includes the extraction or separation of reusable materials from technologies to reuse as inputs in the production process. | SolarCycle and We Recycle Solar resell modules and extract their components for secondary uses.

GE and Veolia North America, Enel and Makeen Power are developing procedures to repurpose existing spent wind turbines and blades into transmission towers and cement, respectively. TPI Composites provides decommissioning services for wind blades.

Retriev Technologies, Nth Cycle, Umicore and Ascend Elements work to dismantle and recover valuable components of lithium-ion batteries and repurpose them into other valuable battery components like cathodes. |

| Producing recyclable technologies or technologies that enable recycling

These initiatives focus on manufacturing more recyclable renewable technologies and equipment for recycling infrastructure.

| First Solar designs modules to maximize material recovery and the end-of-life for reuse and redistribution.

Vestas, GE, Siemens Gamesa and ENGIE are looking to innovate wind turbines made of easy-to-recycle materials that will break down easily at their end of life.

Redwood Materials uses recycling materials to produce anodes and cathodes, while KULR Technology Group invented a fireproof casing designed to safely transport used batteries for recycling. |

The circular model can potentially support the growth of domestic manufacturing by expanding facilities dedicated to clean technology recycling and increasing the availability of recovered resources in the U.S supply chain. Ultimately, the U.S. will need to strengthen its regulatory instruments and expand private-sector programs to support a circular renewable economy. Doing so would allow the U.S. renewable energy industry to become a leader for other industries in technology recycling and sustainable manufacturing, and continue to grow in the most effective and sustainable way.

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)