ACORE Survey: Pandemic Brings Uncertainty to Project Completion Timelines and Financing

By: Lesley Hunter

The rapid spread of COVID-19 is upending the health and livelihoods of workers throughout America’s renewable energy industry, numbering over 450,000 employees across all 50 states.

Economically, the pandemic is putting significant dollars at risk for U.S. renewable energy businesses this year, ranging up to $5 billion per company. Project delays caused by workforce availability and supply chain issues, coupled with a weakened economy, are challenging companies’ confidence in their ability to secure financing, qualify for tax credits, and meet deadlines for power purchase agreements.

These are findings from an anonymous ACORE survey, conducted the week of March 16, of utility-scale renewable developers and financial institutions to assess the initial impacts of the virus.

Survey respondents identified exposures for project delays ranging up to 1 GW due to force majeure and general notices of delay from equipment suppliers, workforce availability, constraints in the tax equity market, concerns about qualifying for the PTC and ITC, and other difficulties closing financing.

-

-

-

-

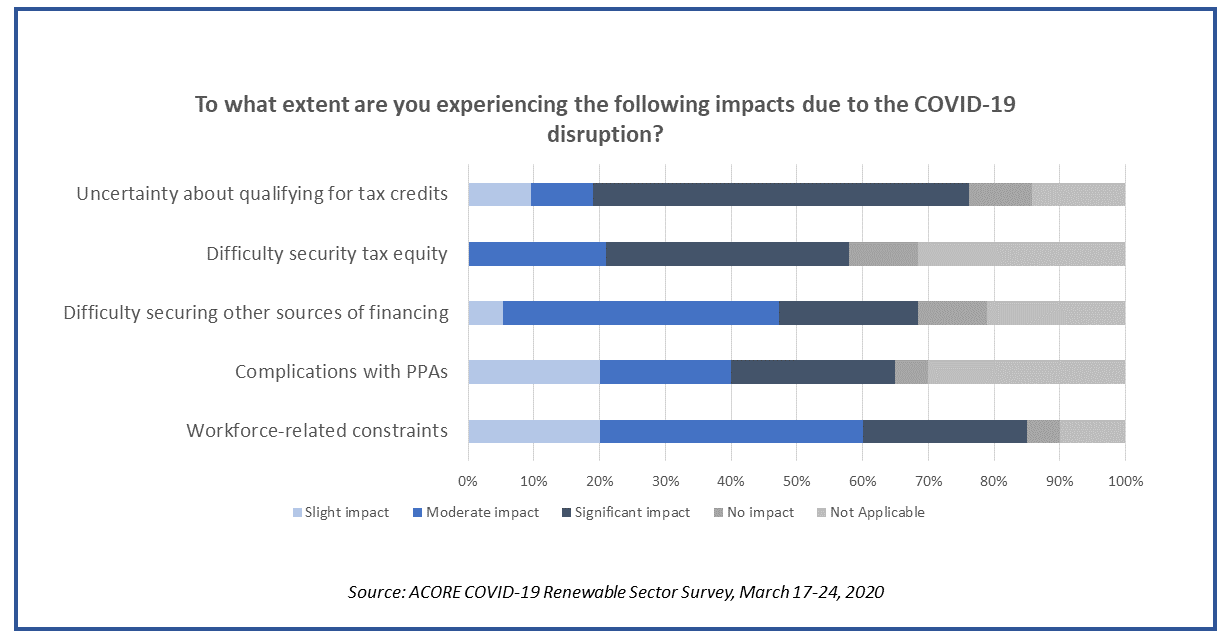

- 57% of survey respondents estimated that COVID-19-related uncertainty about qualifying for tax credits could pose a “significant impact” to their businesses, and a total of 76% estimated there could be some level of impact.

- 58% of respondents indicated that the pandemic poses a moderate or significant impact on securing tax equity financing, and 63% reported a moderate or significant impact on securing other financing sources.

- Supply chain and project construction delays could cause developers to miss meeting deadlines for power purchase agreements, with 2/3 of respondents expecting some impact on these agreements.

- Estimated dollars at risk to companies’ U.S. renewable energy businesses over the year ranged as high as $5 billion per company.

-

While broader market impacts remain unclear as this situation evolves, AWEA projects that up to 35,000 wind jobs could be at risk and $43 billion in investments and payments to rural communities, and SEIA estimates up to 120,000 solar jobs at risk.

These concerns stand in sharp contrast to the record year for U.S. renewable investment in 2019, and bullish views for near-term growth cited by the sector in a separate ACORE survey conducted just a week prior. In that survey, open the week of March 9, 60% of polled financial institutions indicated they were expecting to increase their investments in the U.S. renewable sector by more than 10% in 2020 compared to 2019, and both developers and investors cited high overall confidence in renewable energy sector growth over the next three years, with an average confidence level of 85/100.

ACORE is undertaking extensive outreach to help policymakers better understand COVID-19 impacts on the renewable sector and key policies to address these challenges. That effort includes a joint-renewable energy association letter sent to Congress last week on COVID-19 impacts and the requested legislative response. We have a series of webinars scheduled to provide further clarity on market repercussions and potential policy solutions.

We will also continue surveying our members on COVID-19 effects and market attractiveness as part of our $1T 2030 campaign. Please contact ACORE if you would like to discuss your company’s experience dealing with the virus and learn more about what we’re doing.

-

-

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)