Pathways to Coordination: Proactive, State-Led Transmission Development to Reduce Costs and Achieve Goals in PJM

Prepared by Joe Delosa III and Johannes Pfeifenberger of the Brattle Group for the American Council on Renewable Energy.

Executive SummaryExecutive Summary

In the pursuit of meeting expanding clean energy goals and growing electricity demand, states often face complex challenges of maintaining both grid reliability and reasonable customer costs. Recent developments have highlighted the enabling role that well-designed transmission additions must play in cost-effectively meeting state clean energy and decarbonization goals. Uneconomic generation resources are being retained beyond their anticipated retirement dates, raising customer costs, and resulting in immediate-need, siloed transmission development to maintain local reliability. Reform efforts associated with Federal Energy Regulatory Commission (“FERC” or “Commission”) Order 1920 to improve long-term transmission planning are likely to require nearly a decade of compliance, litigation, implementation, planning, procurement, and permitting before efficient holistic transmission solutions might begin construction. Even with these Order 1920 compliance efforts underway, continued challenges in deploying new resources indicate that large near-term improvements are unlikely under the status quo.

In pursuit of more actionable processes for states to meet short-term transmission needs, this paper identifies and explores seven pathways that states can pursue to identify more cost-effective, coordinated, and proactively planned transmission solutions:

Transmission procured by single states through the PJM State Agreement Approach (“SAA”):

- Focusing on a single-driver to facilitate urgent resource interconnection needs

- Expanding to multi-driver procurements that focus on multiple transmission needs (e.g., reliability, congestion relief, public policy, asset renewal)

Multi-state SAAs coordinated between various interested states agreeing to share costs and benefits of mutually beneficial projects:

- Focusing on a single-driver to capture available benefits of jointly pursing interconnection facilities over a wider geographic area as previously found by PJM

- Expanding to multi-driver procurements that expand the focus on multiple transmission needs across participating states

Voluntary procurements of transmission outside the SAA approach:

- Voluntary procurements outside of PJM’s SAA, both single state and multi-state within PJM, which could present coordination and feasibility challenges

- Voluntary interregional, multi-driver transmission procurements, that can capture additional customer value through projects overlooked by existing interregional coordination processes

PJM Order 1920 regional long-term planning:

- Relying on PJM’s implementation of FERC’s Order 1920 long-term regional planning process

We focus primarily on the PJM Interconnection’s (“PJM”) regional grid, but also evaluate potential options to extend planning collaboration beyond PJM’s regional borders—such as through the ongoing progress of the Northeast States Collaborative on Interregional Transmission, which is considering many of these same issues.

As a key element of implementing the identified pathways, we describe the regulatory framework underlying the states’ ability to act independently from the existing planning processes of the regional transmission organizations (“RTO”). Notably, a wide range of Commission precedent—including a Policy Statement on voluntary transmission planning and cost allocation and approval of various state-led planning processes—comfortably supports independent state action to identify, procure, develop, and agree to costs of transmission facilities. Recent legislative reforms in several Mid-Atlantic states have provided states additional authority to engage in regional collaborations focused on transmission to enable offshore wind.

Finally, we describe and assess each identified pathway through a series of criteria including timing, generator interconnection costs, system-wide costs, ability to address multiple transmission needs (such as upgrades related to generator retirements), and the level of state involvement. We provide only approximate ratings for each identified pathway, designed as a general guide for interested parties in comparing the various options. States will ultimately need to evaluate each option in their ongoing efforts to maximize potential ratepayer benefits, while also considering the timing needs of increasingly pressing state policy targets.

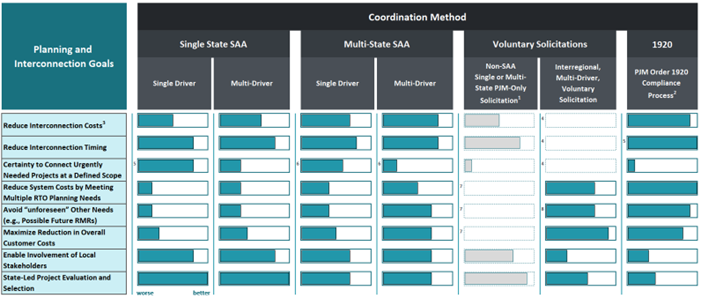

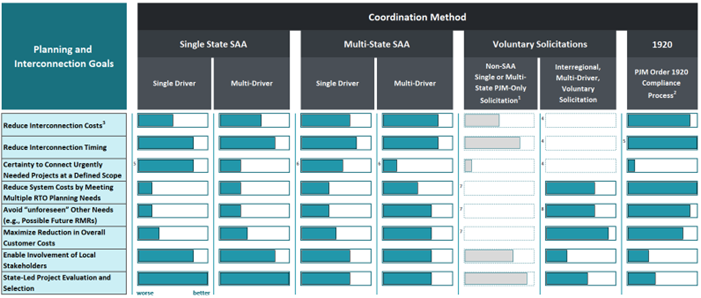

Figure ES-1 lists each of these seven pathways and assesses its effectiveness against a series of metrics representing planning and coordination goals, with longer bars in a specific cell indicating that a pathway fares better in that regard. The table shows that there is an inherent tradeoff between: (1) implementing pathways with more narrow-scope solutions (e.g., addressing only a specific need of an individual state) on a shorter timeframe with more single-state decision-making and (2) pathways with broader-scope solutions (e.g., covering multiple states, multiple needs, and multiple regions) that offer lower-cost outcomes overall but require a higher degree of coordination and multi-state decision making, which tend to be associated with longer implementation timeframes. Given the multi-year timeline of complying and implementing Order 1920 compliant planning processes, this option is unlikely a viable strategy for near-term transmission needs.

Figure ES-1: Pathways for Meeting State Transmission Objectives

Longer bars show a higher likelihood of achieving a given goal, although this may be significantly impacted by, for example, strong state leadership around coordination, timing, and cost sharing.

Notes within the figure are applicable to the cell directly to the right of the superscript.

- Given uncertainty surrounding structure and implementation of this method, ratings are highly approximate. Bars are grey given that this method is not likely to result in a substantial acceleration for finalizing procurements.

- Depends on effective implementation of Order 1920 (including appropriate weighting of public policies and ultimate project selection processes)

- Depends on the overall size of transmission procurement as related to sizes of anticipated/planned resources seeking interconnection

- Despite the potential for significant customer benefits (see row 6), this method likely will not directly focus on interconnecting resources, but on improving efficient transfers of power between regions

- Would require process (entry-fee or similar) to enable resources access to pre-planned headroom created for their use

- Speed is driven by participating states prioritizing speed of process (within state control subject to RTO resource constraints)

- Depends on scope of voluntary external solicitation and ability to coordinate need and solution identification with PJM’s regional plan

- Larger procurement scope has the potential to reduce specified locational need by providing additional sources to alleviate contingency conditions

I. The Importance of State Leadership, Proactive Planning, and Collaboration

A. Current Reform Efforts in the PJM Region

In the pursuit of meeting current and expanding clean energy goals, states often face a variety of complex challenges layered onto the core responsibilities of maintaining reliability and reasonable customer costs. Transmission constraints often require retention of higher-priced and inefficient generation in specific locations, challenging reliability and raising costs. The ongoing need to integrate new generation resources, create the transmission capacity that can move power from generators to load, provide operators with necessary flexibility, and capture available market efficiencies, highlights the unique role that transmission additions must play in meeting state policy goals. Only if these transmission additions are well planned and designed will they maximize customer benefits.

Despite recent stakeholder efforts, PJM’s transmission planning process has not yet evolved to the point where it is cost-effectively meeting multiple system needs, including the public policy goals of PJM states. This would require a more proactive and holistic planning approach. Over the past several years, PJM has only implicitly acknowledged its ability to plan for public policy needs under its existing process; PJM’s current regional transmission plans do not include public policy needs in their development of reliability or market-efficiency projects.1 To resolve these challenges, PJM and stakeholders developed a Long-Term Regional Transmission Planning (“LTRTP”) process in early 2024. The LTRTP process would have relied on PJM’s existing SAA process to plan transmission projects that could address public policy needs.2

PJM and stakeholders have since paused the LTRTP development in favor of compliance proceedings in response to FERC’s landmark Order 1920.3 This FERC order requires transmission planners to consider a range of plausible scenarios and factors, including public policies and associated generator interconnection needs, in developing long-term transmission plans that cover anticipated needs over at least a 20-year time horizon.4 Order 1920 recognizes (and we discuss further below) that proactively planning for multiple long-term needs in a coordinated fashion will enable the identification of more efficient transmission solutions than is possible under current, reactive, and siloed planning processes that only incrementally address one transmission need at a time.5

Despite the progress offered by the reforms in Order 1920, several challenges remain. As with any landmark Commission rule, implementation will take time, vary between regions, and lead to divergent approaches to meeting the Order’s requirements. In short, relying only on Order 1920 processes is unlikely a viable strategy for achieving near-term goals. This uncertainty is enhanced by ongoing litigation from the Order’s opponents.

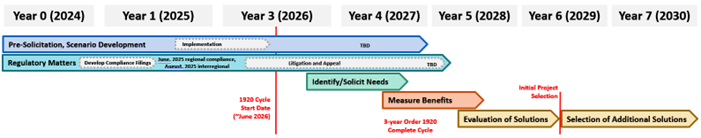

Ultimately, while PJM’s Order 1920 compliance filing is due in June 2025,6 rehearing requests, additional compliance revisions, and federal court appeals processes are likely to extend well beyond this timeframe.7 Once PJM’s compliance filing is finally approved, the long-term planning cycle will likely take three years of scenario development, benefit assessments, and solution evaluation prior to the selection of any transmission projects.8 FERC expects the first long-term planning cycle to begin one year from PJM’s compliance filing, in June 2026, but transmission providers can request further delay to coordinate the reforms with current processes.9 States face a range of pressing transmission needs in the more immediate future and will thus need to make critical clean energy planning decisions before the PJM long-term planning process is fully implemented. Efficiently meeting these near-term needs is likely incompatible with the expected multi-year compliance and implementation timeline of the Order 1920 planning processes.

Yet, these near-term needs remain unaddressed by the status-quo planning processes in PJM, which will largely be unaffected by Order 1920 reforms.10 While the long-term planning reforms in response to Order 1920 will help redefine decades of common planning methods, they will not resolve near-term planning needs and the development of transmission solutions that can reliably and cost-effectively address more urgent state public policy goals.

This near-term urgency is magnified by impending generation retirements (which reduce reserve margins and require transmission upgrades throughout the region) and the continued challenges in deploying new resources in a timely fashion. After the recent ten-fold increase of PJM capacity prices, industry analysts note the potential for worsening price spikes, given the relatively low amount of anticipated capacity additions (caused in part by PJM’s generator interconnection process), the tightness of the supply stack reflected in recent auctions, the compressed timelines of capacity market auctions, and continued demand growth.11 Uneconomic resources are being retained beyond their anticipated retirement dates through expensive reliability-must-run (“RMR”) contracts, raising customer costs and resulting in costly transmission upgrades to retain local reliability.

These challenges, which continue to grow given the reality of achieving aggressive clean energy goals, include:

- Rising energy, congestion, and capacity costs, triggered by the resource adequacy shortages that are exacerbated by recent and likely resource retirements within load pockets;

- Inefficient sequencing of incremental regional transmission upgrades, resulting in the development of “immediate need” transmission facilities in response to generator retirements or local needs rather than the planning of transmission that could proactively and holistically address a broader set of needs;

- Delayed interconnection of new generators to the grid, given potentially high-cost and long timelines of generator interconnection processes, limited points of interconnection (“POI”) with available capacity to access the transmission system, and delays in constructing grid upgrades;

- Community impacts of growing renewable development goals without multi-state coordination, and a desire to minimize disruptions of communities through coordinated strategies for community engagement and shared point of interconnection (“POI”) planning;

- Project permitting and interconnection delays which impede the construction of transmission necessary to interconnect public policy resources;12

- Failure to “right size” the refurbishment or replacement of aging existing facilities to utilize existing rights of way more efficiently, including through advanced transmission technologies such as advanced reconductoring.13

Too often, the design and selection of transmission facilities occurs through siloed, incremental planning processes that do not: (1) consider a holistic set of transmission needs; (2) proactively anticipate long-term needs; (3) sufficiently articulate benefits (cost savings) offered by alternative transmission solutions; nor (4) describe the need for the project to impacted local communities or stakeholders beyond the confines of RTO planning processes. While planning and construction lead times for transmission are significant, cost-effective generation development similarly requires extensive lead times that are impacted by a lack of certainty around the necessary transmission solutions. Generation projects that face significant transmission hurdles also face timing, financing, and project-cost challenges that can derail their path to commercial operation.14 More proactive and holistic transmission planning is uniquely capable of addressing this bottleneck, enabling deployment and interconnection of generation additions in a more timely and cost-effective fashion.

B. Benefits of Proactive Planning

Well-designed proactive planning processes can respond to pressing challenges and better identify transmission facilities that can meet multiple overlapping needs in a more timely and cost-effective fashion. A wide range of studies have identified the significant scale of benefits available from the coordinated development of proactive transmission solutions that reduce community impacts and interconnection costs.15 Among the most relevant examples of the benefits of coordinated planning as applied to the public policy goals of PJM states:16

- PJM’s Offshore Wind (“OSW”) Transmission Study highlights the stark difference in generation interconnection costs if long-term interconnection needs are planned proactively. A previous OSW study showed that under the then-current interconnection process, which relied on individual interconnection studies for each queue request, PJM identified $6.4 billion in required upgrades to the onshore grid for 15.6 gigawatts (“GW”) of individual OSW plants,17 or $413 per kilowatt (“kW”) of renewable generation.18 In contrast, PJM’s 2021 Offshore Wind Transmission Study showed that proactively planning interconnection needs for an estimated 74.5 GW of combined onshore wind, offshore wind, and solar capacity needed to meet the current public policy goals of PJM states would require only $3.2 billion of onshore system upgrades to facilities above 100 kilovolt (“kV”),19 resulting in interconnection costs of only $43 per kW of renewable generation. If implemented, such a proactive planning effort would have yielded a nearly 90% reduction in the cost of major onshore upgrades (before adding the cost of lower-voltage transmission upgrades) to accommodate interconnection of the resources necessary to meet existing clean energy goals of PJM states.

- The recent PJM-New Jersey SAA process which more proactively addressed 6,400 megawatts (“MW”) of additional OSW generation interconnections needed to reach the state’s 7,500 MW OSW goal for 2035, similarly showed substantial savings compared to pursuing generation interconnection incrementally through PJM’s conventional process. This proactive planning effort, conducted under PJM’s never-previously used SAA, was focused only on New Jersey’s OSW interconnection needs through 2035, yet yielded substantially lower-cost solutions for the identified upgrades to the onshore grid. In response to the SAA solicitation that received 80 proposals from 13 bidders, PJM and the New Jersey Board of Public Utilities (“NJBPU”) have now approved onshore transmission upgrades to nine companies that will: (1) reduce the total cost of transmission needed to add an additional 6,400 MW of OSW generation by 2035 by over $900 million; (2) significantly reduce schedule and cost uncertainties; (3) utilize the existing grid more efficiently; (4) develop a shared collector substation with sufficient space for the high-voltage direct current (“HVDC”) converter stations of up to four OSW generators that allows for a significant reduction of transmission-related environmental and community impacts; (5) maximize the availability of approximately $2.2 billion in federal tax credits; and (6) allow the state to more cost-effectively reach its new 11,000 MW by 2040 offshore wind goal through future procurements.20

- The benefits of proactive planning—even if focused solely on generation interconnection needs—are similarly documented in Midcontinent Independent System Operator’s (“MISO”) and Southwest Power Pool’s (“SPP”) Joint Targeted Interconnection Queue (“JTIQ”) Study. By pooling 5-years’ worth of generation interconnection requests on both sides of the MISO-SPP seam, the two RTOs identified $1.6 billion in interregional transmission solutions that facilitate the integration of over 28 GW of generation interconnection at a cost of only $58 per kW of renewable resources, reducing interconnection costs by over 50% (from $117/kW under the system operators’ individual interconnection processes), while additionally reducing the congestion and fuel costs of MISO and SPP customers by approximately $1 billion.21

- With respect to proactive planning for regional offshore wind integration, National Grid’s U.K. OSW study analyzed the impact planning would have on the integration of 60 GW of wind generation between 2025 and 2050. The study estimated that, if planning results are implemented starting in 2025, the U.K. could reduce total transmission-related capital costs by 19%, saving approximately $7.4 billion. The estimated savings drop to half that amount if implementation of planning results is delayed by only 5 years, from 2025 until 2030.22

While the available benefits from proactive planning are significant, the benefits diminish with additional delays. In particular, a coordinated approach to preparing the onshore transmission grid for public policy needs becomes less valuable as increasingly larger shares of public policy resources are interconnected without access to coordinated solutions. This phenomenon has been demonstrated in the context of preplanning transmission for offshore wind in the U.K., where many long-term benefits rely on transmission solutions selected and constructed far enough in advance of OSW project development.23

Notably, the type and locations of transmission facilities selected to address today’s public policy resources will directly impact available POIs to address states’ 2040 and 2050 generator interconnection needs. If transmission technologies, corridors, and grid interconnection points used to address OSW generation interconnection over the next decade do not consider longer-term needs, incremental solutions will increase the total cost of achieving 2040 and 2050 goals and result in increased environmental and community impacts. Proactive, holistic transmission planning pursued today will help create certainty for generation development and reduce the risk of delay in states meeting public policy goals. Further coordinating planning across states and in concert with other transmission needs will increase the potentially available benefits, while introducing additional coordination complexities that we address below.

Options for State Planning CollaborationII. Options for State Planning Collaboration

Given these potential benefits, states have been examining various options to pursue elements of a coordinated transmission strategy. Notable examples within PJM include New Jersey’s ongoing strategic evaluation of transmission options24 and the passage of the Maryland POWER Act, enabling the state to engage PJM in multi-state transmission planning and development discussions under the SAA.25

Ultimately, voluntary transmission development to address the needs of multiple states will require careful regulatory and technical coordination. To identify the available pathways, the following section specifies and highlights key elements of various options available to the states and outlines the timeframes for procuring and developing transmission projects selected through each option.

A. Framing Collaboration Options

Prior to discussing specific options, framing questions can establish a common understanding of the dimensions that must be considered when selecting a pathway for states to pursue. Each collaboration option fits within a framework established by several simple questions: (1) who is at the table; (2) what transmission needs or drivers are being considered; and (3) what is the scope of facilities states need to procure?

Which states are at the table?

Any collaboration of states and PJM is associated with certain challenges depending on the group’s composition. The most straightforward state-sponsored proactive planning efforts involve just one state, as was the case with New Jersey’s SAA, within PJM. Multiple states can coordinate, though doing so is more challenging as each state brings its own priorities and interests into the collaboration. Adding New York would not only introduce an additional state but also the need for interregional technical coordination of the states and PJM with the New York Independent System Operator (“NYISO”). The additional complexities of multi-state and multi-regional planning, however, are offset by the potential for larger benefits and more cost-effective transmission solutions. Adding ISO New England (“ISO-NE”) states to PJM-NYISO planning efforts further increases planning and coordination complexities, but also offers the potential to capture additional benefits by virtue of diversification of system needs across the larger geographic footprint.26 In summary, combining the transmission needs for a larger set of coordinating states and system operators is likely to increase the potential cost savings and reliability benefits while posing additional coordination challenges that require stronger leadership and clearer commitments, efforts, and resources from the states involved.

Which transmission needs are considered in the collaboration?

The participating states will have to determine and clearly articulate the underlying goals of any transmission procurement. The procurement could range in focus from addressing a relatively narrow set of transmission needs to an all-encompassing multi-driver plan. For instance, focusing on only individual drivers, such as the interconnection of policy-driven OSW resources, may forego solutions that can more effectively address multiple other needs—such as generation retirements, congestion relief, the refurbishment of aging transmission infrastructure, resource adequacy needs, and interregional transmission needs. Simultaneously addressing multiple needs (rather than addressing them incrementally and individually) offers potentially significant benefits to lower customer costs but increases complexity and coordination challenges.

What is the scope of facilities States Need to procure?

Lastly, participating states and regional system operators will need to agree on the scope of procurement to meet the identified drivers. When considering OSW integration needs, there are unique challenges associated with extending coordinated transmission procurements beyond the POI.27 For other public policy resource interconnection needs (such as including land-based wind, solar, and battery storage goals), coordinated planning should focus on shared backbone needs, providing flexibility for resources to ultimately determine specific interconnection locations. A broader focus on interregional transmission expansion could also be part of such a coordination effort by, for example, identifying particularly high-value methods of utilizing regionally planned transmission solutions.28

B. Options for State-Led Transmission Planning

In response to the various framing questions described above, several options exist for states to lead transmission development efforts with greater or lesser degrees of collaboration. We provide this survey before a detailed assessment by individual states to help stakeholders identify specific potential options available under today’s rules. This overview will ideally enable future review of state-specific challenges and assessments necessary to underlie pursuit of any of the described collaboration approaches.

In pursuit of more actionable processes for states to meet short-term transmission needs, this paper identifies and explores seven pathways—representing the combinations of single or multiple states, system operators, and transmission needs discussed above—that states can pursue to identify more cost-effective, coordinated, and proactively planned transmission solutions, which will then be reviewed in turn:

Transmission procured by single states through the PJM SAA:

- Focusing on a single-driver to facilitate urgent resource interconnection needs

- Expanding to multi-driver procurements that focus on multiple transmission needs (e.g., reliability, congestion relief, public policy, asset renewal)

Multi-state SAAs coordinated between various interested states agreeing to share costs and benefits of mutually beneficial projects:

- Focusing on a single-driver to capture available benefits of jointly pursing interconnection facilities over a wider geographic area as previously found by PJM

- Expanding to multi-driver procurements that expand the focus on multiple transmission needs across participating states

Voluntary procurements of transmission outside the SAA approach:

- Voluntary procurements outside of PJM’s SAA, both single state and multi-state within PJM, which could present coordination and feasibility challenges

- Voluntary interregional, multi-driver transmission procurements, that can capture additional customer value through projects overlooked by existing interregional coordination processes

PJM Order 1920 regional long-term planning:

- Relying on PJM’s implementation of FERC’s Order 1920 long-term regional planning process

Single-State SAA

As part of the Order No. 1000 compliance process,29 PJM implemented an optional framework for state-led and state-funded transmission planning and procurement. This approach, known as the State Agreement Approach, or SAA, combined the ability for states to direct transmission planning for their “public policy” needs with a formalized process for RTO technical and administrative support.30 The sponsoring state retains the responsibility to define the scope of the need, evaluation criteria, benefits considered, ultimately select the project(s) to meet the identified need, and cover the costs of the project.31 Key features of the SAA include:

- The state’s ability to move faster than would otherwise be possible in PJM’s regional transmission planning or generator interconnection process;32

- The state’s ability to specify the targeted scope and critical project characteristics of the solicitation as well as the evaluation criteria used, allowing for assessment of a wider range of benefits against costs than traditional planning has provided for; and

- The state’s ability to choose the projects that best meet their needs, including whether to select any project at all, by defining their own relevant review criteria (e.g., considering environmental and community benefits where such criteria would not be evaluated in PJM’s project selection process).

In a single-state SAA, there is one state that is setting the relevant scope, defining the criteria proposals must satisfy, working with PJM, and selecting project proposals for award. Among the notable advantages of a single-state SAA is that this single state’s interest drives key solicitation design features and ultimately the state retains the final say as to which project or projects it believes are in its best interest. Only one state working with PJM on any FERC filings also results in only a single state engaging in any negotiation with project developers before or after the project award.

While the provisions governing the SAA is set out in only two paragraphs of PJM’s Operating Agreement, the grid operator enumerated additional SAA-related procedures in subsequent filings, which were developed as part of the first SAA conducted for New Jersey.33 These filings specify the state’s rights and responsibilities associated with the SAA, including establishing a process for project solicitation, evaluation, selection, and coordination with existing regional planning processes.34

While the SAA process extended over several years, a distinct advantage articulated by NJBPU at the time of SAA project selection was that it reduced the timing and cost uncertainty associated with making transmission available for future offshore wind facilities compared to traditional generator interconnection processes.35 While updates to PJM’s generator interconnection process may continue to reduce timelines for resources, the SAA and similar proactive coordination measures offer the unique advantage of enabling the selection and construction of more cost-effective interconnection solutions prior to the resource proceeding through the generator interconnection queue.36

The single-state SAA option also means that the state will be responsible for 100% of the SAA-related costs, even costs associated with out-of-state transmission upgrades that may benefit other states and the PJM region as a whole. However, pursuing a single-state SAA will be attractive even in the presence of SAA-related benefits to other states and the region, if the SAA-related cost savings to the sponsoring state exceed the amount of costs that could reasonably be allocated to other states based on benefits received.

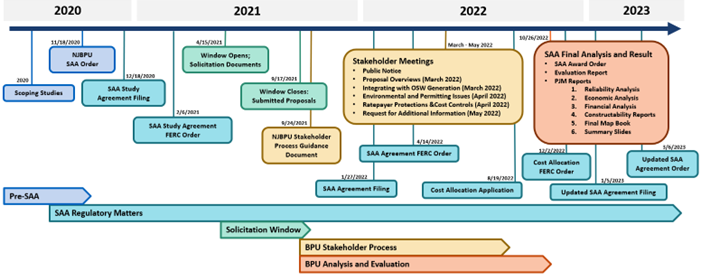

1. Single-Driver

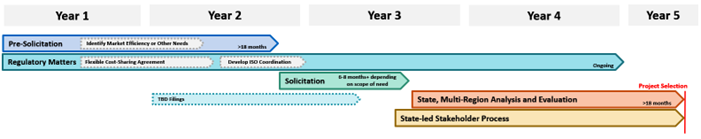

New Jersey’s first SAA for offshore wind transmission shows the timing and process steps that would likely apply to future single-driver SAAs led by a single state. As shown in Figure 1 below, the first SAA process consisted of several carefully-coordinated regulatory filings to appropriately structure all aspects of the procurement. However, state-led transmission procurement is a resource-intensive process even if only involving a single state and category of transmission need. Throughout the process, the NJBPU worked closely with PJM to develop a range of documents specific to the SAA procurement, which ultimately served as the basis for the solicitation, the bid evaluation, and selection of procured transmission solutions, and continues ongoing engagement through the project development phase.

Figure 1: The NJBPU SAA Process

2. Multi-Driver

Single states could also address multiple future transmission needs through an SAA—including known generation retirements, a broader set of public policy needs (e.g., beyond OSW), or the right-sizing of transmission asset replacements or refurbishments. Evaluating future resource retirements together with state public policy interconnection needs may reveal efficiencies and further reduce system costs by identifying transmission facilities that can more-efficiently address each need simultaneously. However, a single-state approach to meeting multiple drivers may identify fewer opportunities as compared to a multi-state, multi-driver approach. Additionally, if large regional projects are identified through a single-state, multi-driver approach, the cost responsibility would be unduly limited to only the state initiating the SAA.

The inclusion of additional needs would likely create challenges in utilizing a multi-driver, single-state process for meeting urgent resource interconnection needs, unless these near-term needs were known and well-specified. Coordinating the procurement with PJM would be a critical aspect of efficiently identifying solutions to multiple drivers.37 Additional time and effort would need to be spent in advance of the opening of a SAA solicitation window to ensure adequate specificity in the scope of needs underlying the procurement, and in ultimately evaluating multi-driver solutions.

Multi-State SAA

Current market rules enable expanding the scope of future SAA procurements by integrating the transmission needs of multiple states. Although this option would require significant, ongoing, and durable collaboration between participating states, there is the potential to identify a broader set of needs, across a wider range of states, and capture efficiencies and other benefits not available through single-state approaches.38 Under this option, multiple states must agree, in advance of a solicitation, on a range of fundamental solicitation elements. Such elements would include: (1) the specific type and amount of resources; (2) the method of calculating benefits associated with proposals; (3) project cost allocation; and (4) the sequence for ultimate project selection, including identifying whether multiple states individually, or jointly, or PJM, will identify successful projects.

3. Single-Driver

Given the similarities between the interconnection needs of the various coastal states in PJM, several states may seek to pursue a policy-focused SAA over a wider geographic area.39 Such an effort would build on recent notable transmission expansions in response to PJM’s queue transition cycle, evolving data center needs, and resource retirements.40 While each participating state must agree on the ultimate cost allocation approach for a multi-state SAA, several voluntary cost allocation approaches have been suggested for such single-driver, multi-state solicitations.41 Despite the importance of quantifying the benefits offered by different transmission solutions, using detailed benefit calculations to formulaically support a specific cost allocation approach may lead to needless disputes.

Instead, given the necessary uncertainty in future market conditions and the ultimate design and benefits of facilities in advance of a multi-state solicitation, a simple cost-allocation approach that allocates costs in a way that is roughly commensurate with estimated benefits may prove to be more practical, particularly for single-driver approaches. For example, if states were seeking interconnection of public policy resources, states could agree to split the cost of identified facilities in accordance with states’ load ratio shares or the share of resource capability (or generation output) developed for their state.42 Other approaches to ultimately agreeing on cost sharing could rely on one or more specific benefits sought by a particular state, including, for example, the ability to access landfall routes or specific POIs in neighboring states.

4. Multi-Driver

A multi-state SAA could also range in scope from a focused procurement based on a specific need (such as OSW transmission) to a broad solicitation seeking to address multiple transmission needs. A multi-driver, multi-state procurement would enable the broadest evaluation of potential transmission needs among the participating states, offer the greatest potential for cost savings and other benefits, yet create the largest coordination challenges. This coordination would not only extend between states, but also with PJM and PJM’s existing regional planning efforts, as both processes would seek to resolve transmission needs beyond public policy (e.g., reliability including resource retirements, market-efficiency). Effectively addressing the complexity of developing selection criteria and cost-sharing approaches between states would require careful advance definition of the needs underlying the solicitation and how the cost of SAA-driven projects and, for example, PJM reliability-driven projects would be allocated. States could potentially reduce these coordination challenges by developing with PJM detailed project designs and other procurement elements in advance.

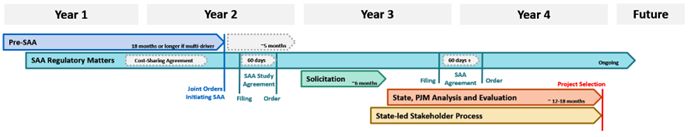

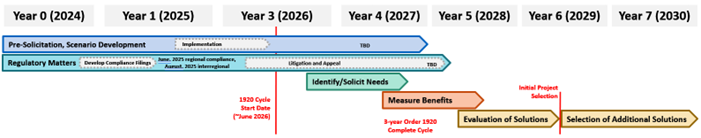

This additional coordination is likely to extend timelines for the pre-solicitation phase. States could reduce the time required for this pre-solicitation period if only a single-driver were pursued using previously recommended cost-allocation approaches. In contrast, if the multi-state coordination seeks to address multiple transmission drivers using a complex allocation approach it would likely further extend the timelines associated with pre-SAA activities and ultimate project selection. Considering these factors, we anticipate a slightly longer timeline underlying a multi-state procurement, as shown in Figure 2 below.

Figure 2: Potential Multi-State SAA Process Diagram

Voluntary procurements

5. Non-SAA Single or Multi-state Intraregional Solicitation

States acting individually or in collaboration may choose to procure transmission outside of the SAA process. As the Regulatory Framework section discusses in greater detail below, states have broad latitude to procure transmission through their own solicitations, a common practice seen with bundled generation and transmission facilities. Under this approach, a state or states may decide that a procurement outside of the SAA process is desirable. States can base this determination on a finding, for example, that RTO resource limitations impacting an RTO-administered solicitation (such as the SAA) result in timelines that do not align with state goals.

As with any single or multi-state SAA approach, state law must enable this option. Where such authority exists, for example in New Jersey, Delaware, and Maryland, states could design a transmission solicitation and determine how to administer it. We would advise that any such effort involve early and on-going coordination with PJM to ensure understanding of how transmission interconnections would be studied and capacity reserved. Notably, states would face additional challenges associated with attempting to develop a solicitation outside of PJM processes, including the need for an even larger commitment of state staff time and resources towards managing a solicitation. Such a non-SAA approach would require the states to take on many additional analytical and modeling responsibilities led by PJM in the SAA 1.0 process. Any such solicitation would lack the benefit of being a part of PJM’s planning process, while still requiring a larger commitment of state time and effort to closely integrate the solicitation with PJM, which must ensure that integration of new transmission will comport with NERC and PJM standards. Given this need for coordination with PJM, and the beneficial coordination already built into the SAA process, it is not clear that a non-SAA approach to state-led transmission procurement would result in a substantial acceleration for finalizing procurements solely within the PJM footprint.

6. Interregional, Multi-Driver, Voluntary Transmission Procurement

An additional option exists to enable coordination between states over a broader (interregional) geographic scope, potentially unlocking even larger benefits but presenting additional coordination challenges. Similar to the authority that exists for non-SAA single or multi-sate procurements in PJM, states could initiate an independent interregional transmission planning and procurement effort. Under a state-led voluntary procurement, states across several regions could coordinate to address specifically identified needs best addressed in an interregional manner outside the confines of PJM’s SAA and other RTO-led planning processes.43

A more limited implementation of this framework would enable identification or procurement of already-planned or shovel-ready interregional facilities that could increase interregional transfer capability.44 Pursuit of these “low-hanging fruit” projects would be well-suited to a procurement structure that could identify specific projects with discrete benefit assessments and associated cost allocation agreements. In the future, a similar coordination structure may also prove useful for pursuing additional interregional links, including by interconnecting (network-ready) offshore collector stations. Figure 4 below shows likely timeframes and coordination steps associated with each of these potential use-cases.

Figure 3: Potential Interregional Voluntary Procurement Timelines

Near-Term

Long-Term

Order 1920

7. PJM Order 1920 Compliance Process

Order 1920 requires transmission providers to implement a multi-value long-term planning process to consider a wide range of transmission needs, including generator interconnection needs driven by public policy requirements. In the long term, compliance with Order 1920 (if implemented well) will move transmission planning forward toward yielding greater efficiency and consumer benefits. However, as with any landmark Commission order, its effectiveness relies largely on additional choices made during the compliance process, including the methods used to account for state public policies, future resource interconnection needs, and allowing insights from the holistic long-term planning process to inform and modify the transmission solutions necessary for addressing near- and intermediate-term needs.

Use of long-term planning processes will exhibit a higher degree of PJM-led guidance and control when compared to the SAA process. While states retain some flexibility under the SAA to accelerate the process,45 long-term planning under Order 1920 will proceed on schedules determined by PJM. Further, the governing documents underlying the Order 1920 long-term planning process will be set by PJM’s compliance process and manual revisions, in contrast to the comparatively more adaptable and flexible agreements, crafted together by PJM and the states (and approved by FERC), which govern the SAA process. Finally, while PJM may serve as the selection entity in a multi-state SAA process at the states’ election, an Order 1920 process would necessarily place PJM in the role of selecting projects to meet identified transmission needs. Ideally, states would retain the ability to meaningfully engage in the Order 1920 process, given the requirement for long-term plans to consider state public policy requirements.46

The timeline associated with identifying projects under PJM’s Order 1920 planning process remains highly uncertain and is likely to extend towards 2030. PJM’s regional compliance filing is not due until June 2025,47 with rehearing requests, additional compliance revisions, and federal court appeals processes likely to extend well beyond this timeframe. There are a wide range of potential regulatory and legal outcomes that could delay further implementation, despite the Commission envisioning Order 1920 planning beginning by transmission providers within one year from making a compliance filing.48 Even after states will know which transmission solutions are developed through this new process (e.g., by 2029), several additional years would be required for ultimate permitting and project development ahead of construction and project completion by the mid-2030s. Accordingly, as shown in Figure 3 below,49 Order 1920 planning processes are unlikely to meet pressing needs, even under a best-case timing scenario.

Figure 4: Potential PJM Order 1920 Process Diagram

C. Regulatory Framework for State-Led Transmission Planning

Despite PJM’s inclusion of brief enabling language underlying the SAA in its operating agreement, states do not require specific federal approval under the Federal Power Act or RTO tariffs to conduct transmission solicitations outside FERC-approved regional planning processes. Massachusetts50 and Maine,51 for example, have conducted direct requests for proposals (“RFP”) for transmission assets associated with enabling renewable energy assets. Similarly, New York, New Jersey, Maryland, Connecticut, Rhode Island, Virginia, and Massachusetts have also directly procured high-voltage alternating current (“HVAC”) and HVDC transmission facilities bundled with offshore wind generation resources.52 Nor are states limited to the SAA arrangement in PJM, or similarly structured state-RTO coordination processes recently filed with FERC and approved for New England.53

On June 17, 2021, the Commission issued its policy statement on state planning and funding of transmission.54 FERC explained that “Voluntary Agreements” include “agreements among: (1) two or more states; (2) one or more states and one or more public utility transmission providers; or (3) two or more public utility transmission providers.”55 The Policy Statement explains that such planning and procurement could:

provid[e] states with a way to prioritize, plan, and pay for transmission facilities that, for whatever reason, are not being developed pursuant to the regional transmission planning processes required by Order No. 1000. In addition, in some cases, Voluntary Agreements may allow state-prioritized transmission facilities to be planned and built more quickly than would comparable facilities that are planned through the regional transmission planning process(es).56

While FERC noted that arrangements like the SAA are examples of Voluntary Agreements, the range of possibilities extend beyond examples specifically articulated in RTO tariffs. Notably, the Commission expressed concern “that confusion regarding the relationship between Voluntary Agreements and Commission rules and regulations may be deterring such agreements.”57

The Policy Statement makes clear that states retain latitude in developing arrangements to plan, procure, and pay for transmission.58 While a single or multi-state SAA may present a more direct path for states to procure transmission, one or more states or states in one or more planning regions, for example, might also choose to issue their own RFP and seek RTO/ISO technical support under a study agreement underlying a voluntary transmission procurement. In addition to transmission bundled with renewable generation, this could, for example, provide an alternate path forward for states acting under Northeast State Collaborative on Interregional Transmission to discuss transmission solutions that capture the benefits of coordination and scale.59

Several states have enabling legislation to pursue elements of independent transmission coordination. In the example of the first SAA, New Jersey relied on language in its enabling offshore wind legislation that provided authority to procure transmission independently of offshore wind generation.60 In the case of Maryland, the state has authorized two paths forward for the state procurement of transmission for offshore wind, stating in Senate Bill 781:61

(c) (1) On or before July 1, 2025, the Commission shall issue, or request that PJM Interconnection issue, one or more competitive solicitations for proposals for open access offshore wind transmission facilities and complementary onshore transmission upgrades and expansions.

(2) The Commission may issue, or request that PJM Interconnection issue, further solicitations for proposals after this date if determined necessary by the commission. (emphasis added)

Delaware also has authority to participate in transmission planning activities with a range of other entities, including the RTO as well as other states, and authority to engage in offshore wind solicitations for offshore generating and associated transmission facilities either on its own or with other states.62

With the appropriate enabling authority, states can move independently or in coordination to secure cost-effective enabling transmission that incorporates benefits to meet state energy and related economic development goals, such as supply chain development. Where states have existing authority, additional state analysis and assessment, and ultimately state-led pursuit of specific procurement processes, is required. Realizing the potential time, scope, and other benefits of state-led transmission procurement whether through an SAA or an alternative state-defined structure, will lie with state leadership.

Comparing OptionsIII. Comparing Options for State-Led Planning

Each option takes a unique approach to achieve the potential benefits of coordinated planning. While we address the various benefits and drawbacks associated with each of these options below, we emphasize that additional review and study, specific to each state’s unique and specific circumstances, is ultimately required. Experience indicates that the largest potential benefits are available from addressing the widest potential scope of (multiple) near and long-term transmission needs. However, larger scope often requires larger coordination efforts which introduce timing uncertainty and coordination challenges. These coordination efforts are less challenging with more narrow approaches such as a single-state SAA or by addressing a narrower set of transmission needs. Each state will need to make these policy trade-offs for themselves, in light of their unique enabling legislation, and as part of their efforts to achieve stated public policy goals.

Targeted coordination (whether single or multi-state) may be needed to prepare transmission systems to meet a state’s near-term energy policy and reliability needs, while achieving a portion of the benefits associated with longer-term multi-value planning. Larger, coordinated multi-state procurements within PJM could enable states to identify preferred technology standards and requirements for expandability and avoid the suboptimal scale of upgrades and inefficient results of legacy generator interconnection and grid planning approaches. State-led planning further enables the evaluation of solutions with benefits that align with the states’ policy objectives and power system needs, beyond the more limited benefits assessments considered to date in typical regional assessments. Relying on Order 1920 processes can risky because, in addition to Order 1920’s timing challenges, there is no guarantee that PJM’s ultimately approved long-term planning processes will resolve persistent challenges associated with the status quo.63

To compare these various coordination options, Figure 5 roughly assesses the benefits and drawbacks associated with each approach. We emphasize that these ratings are approximate. They are designed as a general guide for interested parties to use in comparing various available approaches to transmission coordination. We assess each method against a series of notable planning and interconnection goals, with longer bars in a specific cell representing that the specific method fares better in that aspect. Because each approach has distinct benefits and drawbacks which will vary across applications, we do not ultimately recommend any one approach to coordinating state-led transmission development. We do however note the high likelihood of an extended timeframe associated with Order 1920 compliance and implementation, and the associated challenge with relying on this process for implementation of states’ near-term policy goals. We further note the inherent tradeoff between: (1) implementing pathways with more narrow-scope solutions (e.g., addressing only a specific need of an individual state) on a shorter timeframe with more single-state decision-making; and (2) pathways with broader-scope solutions (e.g., covering multiple states, multiple needs, and multiple regions) that offer lower-cost outcomes overall but require a higher degree of coordination and multi-state decision-making, which tend to be associated with longer implementation timeframes.

Figure 5: Pathways for Meeting State Transmission Objectives

Longer bars show a higher likelihood of achieving a given goal, although this may be significantly impacted by, for example, strong state leadership around coordination, timing, and cost sharing

Notes within the figure are applicable to the cell directly to the right of the superscript.

- Given uncertainty surrounding structure and implementation of this method, ratings are highly approximate. Bars are grey given that this method is not likely to result in a substantial acceleration for finalizing procurements.

- Depends on effective implementation of Order 1920 (including appropriate weighting of public policies and ultimate project selection processes)

- Depends on the overall size of transmission procurement as related to sizes of anticipated/planned resources seeking interconnection

- Despite the potential for significant customer benefits (see row 6), this method likely will not directly focus on interconnecting resources, but on improving efficient transfers of power between regions

- Would require process (entry-fee or similar) to enable resources access to pre-planned headroom created for their use

- Speed is driven by participating states prioritizing speed of process (within state control subject to RTO resource constraints)

- Depends on scope of voluntary external solicitation and ability to coordinate need and solution identification with PJM’s regional plan

- Larger procurement scope has the potential to reduce specified locational need by providing additional sources to alleviate contingency conditions

List of Acronyms

ESO: Electricity System Operator

FERC: Federal Energy Regulatory Commission

GW: Gigawatt

HVAC: High-Voltage Alternating Current

HVDC: High-Voltage Direct Current

ISO: Independent System Operator

ISO-NE: Independent System Operator of New England

JTIQ: Joint Targeted Interconnection Queue study

kV: Kilovolt

kW: Kilowatt

LBNL: Lawrence Berkley National Laboratory

LTRTP: Long-Term Regional Transmission Planning Process

MISO: Midcontinent Independent System Operator

MW: Megawatt

NJBPU: New Jersey Board of Public Utilities

NYISO: New York Independent System Operator

OSW: Offshore Wind

PJM: PJM Interconnection

POI: Point of Interconnection

RFP: Request for Proposal

RMR: Reliability-Must-Run

RTO: Regional Transmission Organization

SAA: State Agreement Approach

SPP: Southwest Power Pool

TEAC: Transmission Expansion Advisory Committee

1 PJM, Consideration of Federal and State Public Policy Initiatives Through PJM’s Long-Term Regional Transmission Planning Process (December 15, 2023) at 4, 6–10. PJM explains this position paper is “informational only.”

2 PJM presentation to the Planning Committee, Long-Term Regional Transmission Planning (LTRTP) Manual M14B and M14F Update (January 9, 2024) at 4, 15. Note that the base case reliability studies proposed under the LTRTP would have considered resource retirements driven by public policy needs, but not resource additions driven by public policy, see Id. at 15. As discussed further below, the SAA features state-led development of transmission drivers and project selection, with the sponsoring state(s) bearing responsibility for the costs of all projects identified to meet identified needs.

3 PJM presentation to the Planning Committee, Long-Term Regional Transmission Planning: FERC Order No. 1920 Update (June 4, 2024).

4 See FERC, Fact Sheet: Building for the Future Through Electric Regional Transmission Planning and Cost Allocation (May 13, 2024); PJM presentation to the Special TEAC—Order 1920, Education on FERC Order No. 1920 Section III: Long-Term Regional Transmission Planning (August 27, 2024).

5 Building for the Future Through Electric Regional Transmission Planning and Cost Allocation, Order No. 1920, 187 FERC ¶ 61,068 at P 85 (2024) (“Specifically, we find that the absence of sufficiently long-term, forward-looking, and comprehensive transmission planning requirements is causing transmission providers to fail to adequately anticipate and plan for future system conditions. It causes transmission providers to fail to appropriately evaluate the benefits of transmission infrastructure, and results in piecemeal transmission expansion to address relatively near-term transmission needs. We find that this status quo causes transmission providers to undertake relatively inefficient investments in transmission infrastructure, the costs of which are ultimately recovered through Commission-jurisdictional rates. This dynamic results in, among other things, transmission customers paying more than necessary or appropriate to meet their transmission needs and forgoing benefits that outweigh their costs, which results in less efficient or cost-effective transmission investments”)(“Order 1920”).

6 PJM presentation to Special Transmission Expansion Advisory Committee (TEAC)—Order 1920, PJM’s FERC Order No. 1920 Activities Plan (August 8, 2024) at 5.

7 Eleven appeals across various federal circuit courts were consolidated into the 4th Circuit by order on August 8, 2024.

8 PJM presentation to the Special TEAC—Order 1920, Education on FERC Order No. 1920 Section III: Long-Term Regional Transmission Planning (August 27, 2024) at 3.

9 Order 1920 at P 1072 (requiring transmission providers to begin long-term regional planning cycles within one year from initial compliance filings, with the ability for transmission providers to request a later initiation of the first planning cycle “only to the extent needed” to align long-term planning with existing transmission planning processes).

10 Note that PJM is only forecasting minor changes to existing local transparency requirements to comply with the requirements of Order 1920, given the existing PJM Tariff Attachment M-3 process. Order 1920 does require Transmission Owners to consider “right-sizing” replacement facilities and requires maintenance of a “10 year facility outlook for facilities expected to be eligible for replacement in kind.” See PJM presentation to the Special TEAC—Order 1920, Order 1920—Part VII, VIII and IX Review (August 27, 2024) at 12. Apart from these transparency and right-sizing requirements, much of the existing regional planning processes are unaffected by Order 1920, see Order 1920 at P 241 (“Except as set forth in this final rule, we do not require that any transmission provider replace or otherwise make changes to its existing Order No. 1000-compliant regional transmission planning processes that plan for reliability or economic transmission needs…”).

11 Ethan Howland, UtilityDive, PJM Capacity Prices Could Jump 157% in Next Auction: Morgan Stanley (August 29, 2024).

12 Note there is a possibility for resources to connect on an interim basis where applicable under PJM rules.

13 See E. Chojkiewicz, U. Paliwal, N. Abhyankar, C. Baker, R. O’Connell, D. Callaway, and A. Phadke, Accelerating Transmission Capacity Expansion by Using Advanced Conductors in Existing Right-of-Way Proceedings of the National Academies of Sciences (September 23, 2024).

14 See R. Gramlich, J. Wilson, J. M. Hagerty, J. DeLosa III et al., Unlocking America’s Energy (August 27, 2024).

15 J. P. Pfeifenberger, J. DeLosa III, et al., The Benefit and Urgency of Planned Offshore Transmission (January 24, 2023) at § II.

16 Bullets reproduced (with permission) from Id. at 31–33.

17 Business Network for Offshore Wind and Grid Strategies LLC, Offshore Wind Transmission Whitepaper (2020) at 11.

18 See also J. Seel, et al., Berkeley Lab, Interconnection Cost Analysis in the PJM Territory (January 2023). Figure 5 of this study similarly shows approximately $400/kW in average cost for OSW generation in PJM’s interconnection queue currently—higher than the interconnection costs of any other resource type and with an uncertainty range of $200/kW to over $500/kW.

19 PJM, Offshore Wind Transmission Study: Phase 1 Results (2021) at 14, 18.

20 See J. P. Pfeifenberger, J. M. Hagerty, J. DeLosa III New Jersey State Agreement Approach for Offshore Wind Transmission: Evaluation Report (October 26, 2022). (“BPU SAA Evaluation Report”) The SAA process identified $575 million in upgrades to the existing grid for 6,400 MW, or $90 per kW of OSW generation. This is approximately 60% less than the $1.5 billion ($234/kW) cost of grid upgrades estimated based on PJM’s most recent individual OSW interconnection studies.

21 T. B. Tsuchida, Proactive Planning for Generation Interconnection A Case Study of SPP and MISO (August 17, 2022) at 9.

22 National Grid ESO, Offshore Coordination Phase 1 Final Report (December 16, 2020) at 31. National Grid’s U.K. OSW study found that without proactive planning, the best POIs for connecting offshore wind to the U.K. electric transmission network quickly became saturated, and that additional POIs developed to supplement them were not as ideal, requiring extensive upgrades to the onshore transmission network.

23 BPU SAA Evaluation Report. These study results have been similarly demonstrated around the world and in areas with more developed offshore wind transmission interconnection regimes and confirm the impacts of proactive planning and the loss of benefits that can result with delay and continuation of the status quo, see B. Stojkovska, UK’s Analysis In Planning for Offshore Network to Meet Clean Energy Goals. NationalGrid ESO (February 2, 2021) at 5. See also Ibid.

24 Press Release, Murphy Administration Announces Developments in Offshore Wind Industry (May 28, 2024).

25 See MD Department of Legislative Services, Fiscal and Policy Note SB 781 revised (accessed August 29, 2024) at 9.

26 See, e.g. U.S. Department of Energy, Atlantic Offshore Wind Transmission Study (March, 2024), identifying interregional offshore transmission links across all three system operators that are cost effective (at least) by 2050.

27 BPU SAA Evaluation Report at 29–30, 56–57.

28 Including, for instance, linking regionally-planned transmission solutions for OSW generation, which would require OSW generator lead-lines to be created network-ready.

29 See PJM Order 1000 Compliance Filing, Docket No. ER13-198 (October 25, 2012) at 48; Order on Compliance Filings, 142 FERC ¶ 61,214 (2013) at PP 142–148. The SAA was proposed by PJM in response to Order 1000, it was not required for compliance with the Order.

30 PJM provides a high level overview of the State Agreement Approach in PJM, Factsheet: The State Agreement Approach (May 8, 2024).

31 Given the ability to select the ultimate project, the state also retains the ability to select no project or terminate the process at any time.

32 Subject to RTO resource constraints.

33 PJM Operating Agreement Sch. 6 § 1.5.9; See FERC Docket No. ER22-902, Order Accepting Agreement, 179 FERC ¶ 61,024 (2022).

34 Note that given the ongoing engagement with the RTOs, existing resource constraint concerns are not alleviated by a single-state SAA and may be exacerbated by a requirement to conduct multiple parallel planning processes.

35 I.M.O. Declaring Transmission to Support Offshore Wind a Public Policy of the State of New Jersey, Docket No. QO20100630 (October 26, 2022) at 51 (“SAA Award Order”).

36 Ibid.

37 Note that while a multi-driver SAA could select projects that could for example partially alleviate future known resource retirement needs, such a project identification or selection would not replace PJM’s ultimate generator deactivation study.

38 See PJM OSW Study Phase 1, described above.

39 See Ibid.

40 See, e.g., PJM 2023 Regional Transmission Expansion Plan (March 7, 2024) at 1 (“The PJM Board approved baseline projects in 2023 totaling over $5 billion to address reliability criteria violations as part of 2022 RTEP Window No. 3. This includes transmission enhancements driven by 7,500 MW of data center load growth…”); PJM presentation to Transmission Expansion Advisory Committee, Generator Deactivation Notification Update (June 6, 2023). Note that additional transmission to meet the needs of two large transition generator interconnection clusters are also likely to be identified by the end of 2024, see TC 1—Phase II Analysis Update, PJM Presentation to the Interconnection Process Subcommittee (August 26, 2024) at 3-4.

41 J. P. Pfeifenberger, J. DeLosa III et al., RENEW Energy, Boreas Renewables, The Brattle Group, A Transmission Blueprint for New England (May 23, 2022).

42 See Id. at 16.

43 The initial work of this type of larger coordination is currently underway among ten mid-Atlantic and northeastern states through the Northeast States Collaborative on Interregional Transmission.

44 Recent studies from Lawrence Berkley National Laboratory (“LBNL”) have shown significant value to additional regional capabilities, and demonstrating this value to grow over time, see LBNL, Empirical Estimates of Tx. Value (August, 2022) at 18; D. Millstein, R. Wiser, et al., The Latest Market Data Show that the Potential Savings of New Electric Transmission was Higher Last Year than at Any Point in the Last Decade. LBNL Fact Sheet (February, 2023) at 2. Note that for customers to fully realize the benefits of expanded intertie capability will require revisions to rules governing interregional transactions, including intertie optimization, as discussed in J. P. Pfeifenberger, J. DeLosa III, N. C. Bay, et al., The Need for Intertie Optimization. The Brattle Group, Willkie Farr & Gallagher (October, 2023).

45 Subject to RTO resource constraints.

46 See Order 1920 at PP 387–484.

47 PJM presentation to Special TEAC—Order 1920, PJM’s FERC Order No. 1920 Activities Plan (August 8, 2024) at 5.

48 Order 1920 at P 1072 (requiring transmission providers to begin long-term regional planning cycles within one year from initial compliance filings, with the ability for transmission providers to request a later initiation of the first planning cycle “only to the extent needed” to align long-term planning with existing transmission planning).

49 Adapted in part from PJM presentation to Special TEAC—Order 1920, PJM’s FERC Order No. 1920 Activities Plan (August 8, 2024) at 5; PJM presentation to Special TEAC—Order 1920, Education on FERC Order No. 1920 Section III: Long-Term Regional Transmission Planning (August 27, 2024) at 3.

50 See Massachusetts Department of Energy Resources Update on Section 83D Clean Energy Solicitation (Accessed October 9, 2024)

51 See Maine Public Utilities Commission, Request for Proposals for Renewable Energy Generation and Transmission Projects Pursuant to the Northern Maine Renewable Energy Development Program (Accessed September 19, 2024).

52 See e.g., American Clean Power, Offshore Wind Market Report (2024) at pp. 24–38 regarding examples of operational projects, projects under construction, and expected state contract solicitation rounds, all of which include direct state procurement of transmission facilities.

53 ISO New England, et al., 188 FERC ¶ 61,010 (2024). The planning process additions recently approved in that docket provide the states involved with significantly less control over procurement scope, project review, and project selection than states have under the SAA approach in PJM.

54 State Voluntary Agreements to Plan and Pay for Transmission, 175 FERC ¶ 61,225 (2021) (“Policy Statement”).

55 Policy Statement at P 1.

56 Id. at P 2, footnotes omitted.

57 Id. at P 3.

58 State led planning must conform to grid reliability requirements, e.g. NERC standards, address the system impacts of any grid additions, and have any final transmission rate recovery filed with FERC.

59 See Memorandum of Understanding, Northeast States Collaborative on Interregional Transmission (July 9, 2024).

60 L. 2019, c. 440 (January 21, 2020); N.J.S.A. 48:3–87.1(e).

61 See Maryland Senate Bill 781, MD Public Utilities Law § 7-704.3(c).

62 See Delaware Senate Bill 265 (as amended), 29 Del. C. § 8053, 8056.

63 Additional challenges have been noted by several states in the context of ongoing changes to PJM’s governing documents underlying the planning process, see, e.g., Limited Protest and Motion to Lodge of the Organization of PJM States, Docket Nos. EL24-119, ER24-2338, ER24-2336 (July 22, 2024).

Join leaders from across the clean energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)