- Energy Storage & Decarbonization Pathways

- Project Finance

- Renewable Energy Innovation

- Supply Chain & Trade

- Tax Incentives & Appropriations

- Blog

High Expectations for Renewable Energy Finance Dampened by Commerce Inquiry and Other Headwinds

By: Maheen Ahmad

June 15, 2022

Despite growing momentum for the energy transition, several headwinds have emerged that could impede the rate of renewable growth and sidetrack progress on climate targets.

Industry perspectives on the state of renewable finance are presented in the fifth issue of the American Council on Renewable Energy (ACORE)’s annual Expectations for Renewable Energy Finance report, which tracks the renewable energy sector’s progress toward ACORE’s $1T 2030 campaign and the Biden administration’s power sector decarbonization targets.

The report also conveys the results of new surveys of investors and developers on renewable sector attractiveness over the next three years. ACORE conducted these surveys both before and after the Department of Commerce initiated its solar tariff inquiry. The results show the strong trajectory the sector was on and how it could now recover despite these challenging few months, and the ongoing headwinds posed by supply chains, shifting energy markets, inflation, full interconnection queues and legislative uncertainty.

Notable findings from the report are highlighted below.

Investment in the U.S. renewable energy and grid-enabling technology sectors in 2021 remained steady at $58.5 billion.

Renewable energy sector investment fell six percent as the solar investment tax credit (ITC) continued to phase down and the wind production tax credit (PTC) expired. Notably, energy storage projects attracted $4 billion, a 60 percent increase from 2020, and the offshore wind sector attracted $4.1 billion, nearly a fourteenfold increase over its previous record.

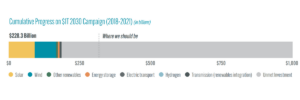

In 2021, the U.S. reached 23% of ACORE’s $1T 2030 campaign goal. Since the $1T 2030 campaign launch in 2018, the U.S. has attracted a total of $228.3 billion in private sector investment for renewable energy, grid-enabling technologies and transmission for renewable integration.

ACORE launched its $1T 2030 campaign in 2018 to achieve $1 trillion in private sector investment in U.S. renewable energy and enabling grid technologies by 2030, while advocating for policy reforms and market drivers to help meet this objective. Achieving the 2030 objective will require an average of $96 billion in annual investment through 2029, a 65 percent increase over the 2021 investment level.

The $1T 2030 objective puts the U.S. in reach of the administration’s carbon pollution-free power sector by 2035.

According to an analysis by BloombergNEF, an estimated $1.1 trillion of investment in U.S. wind and solar projects is needed to achieve President Joe Biden’s power sector decarbonization goal between 2021-2035.

Utility-scale solar and energy storage rank as the most popular preferences for investment among surveyed investors over the next three years, switching places from 2021.

However, respondents indicate the attractiveness of utility-scale solar had dropped post-Commerce inquiry.

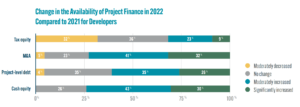

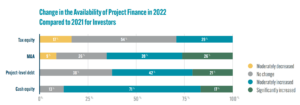

While more developers report experiencing a decrease in the availability of tax equity this year than investors have observed, respondents from both groups report some recovery in the tax equity market.

More developers than investors also have reduced their risk appetites in 2022 compared to 2021.

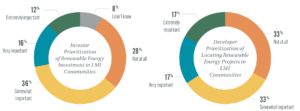

About two-thirds of investors and developers consider renewable energy projects in low- and moderate-income (LMI) communities in their decision-making.

Of the investors who consider investing in LMI regions important, 50 percent have moderately increased their prioritization of renewable energy investment in these communities in 2022 compared to 2021. Of the developers who consider locating renewable energy projects in LMI regions important, 47 percent have moderately or significantly increased their prioritization of development in LMI communities in the past year.

Uncertainty caused by the Commerce inquiry, supply chain issues, and the stalled passage of the Build Back Better Act present headwinds to sector growth.

Prior to the Commerce inquiry, surveyed investors and developers reported, on average, confidence in the renewable energy and energy storage sectors over the next three years.

However, in our follow-up survey about the Commerce inquiry, a high proportion of respondents — 86 percent of investors and 81 percent of developers — indicate the inquiry had either moderately or significantly decreased their outlook on the growth of the solar sector over the next three years.

Reflects survey responses prior to the Commerce inquiry

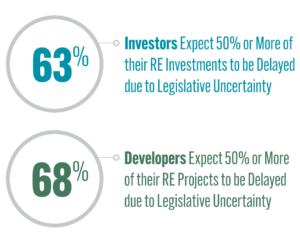

The stalled passage of the renewable energy tax credit package is also causing investors and developers to delay a significant portion of their investment and project pipelines. Nearly two-thirds of investors expect 50 percent or more of their U.S. renewable energy sector investments to be delayed, and more than two-thirds of developers expect 50 percent or more of their pipelines’ U.S. renewable energy sector projects to be postponed because of legislative uncertainty.

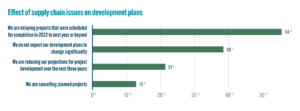

Investors and developers also cite supply chain issues as either causing delays, cancellations, or reduced investment projections or development. More than half of surveyed developers report plans to delay projects that were scheduled for completion in 2022 by a year or more because of supply chain issues unlinked to the Commerce inquiry. Forty percent of surveyed investors report delaying investment plans scheduled for 2022 by at least a year.

ACORE is strategically deploying its resources to promote policy reforms and market drivers that support accelerated sector growth to achieve our $1T 2030 objective and the Biden administration’s decarbonization targets. To learn more, read the full report here.

Join leaders from across the renewable energy sector.

What will our next 20 years look like? Here’s the truth: they’ll be better with ACORE at the forefront of energy policy.

Shannon Kellogg

Amazon Web Services (AWS)